KUWAIT ENERGY PLC

NOTES TO THE CONDENSED SET OF FINANCIAL STATEMENTS

For the nine month period ended 30 September 2017

13

7.

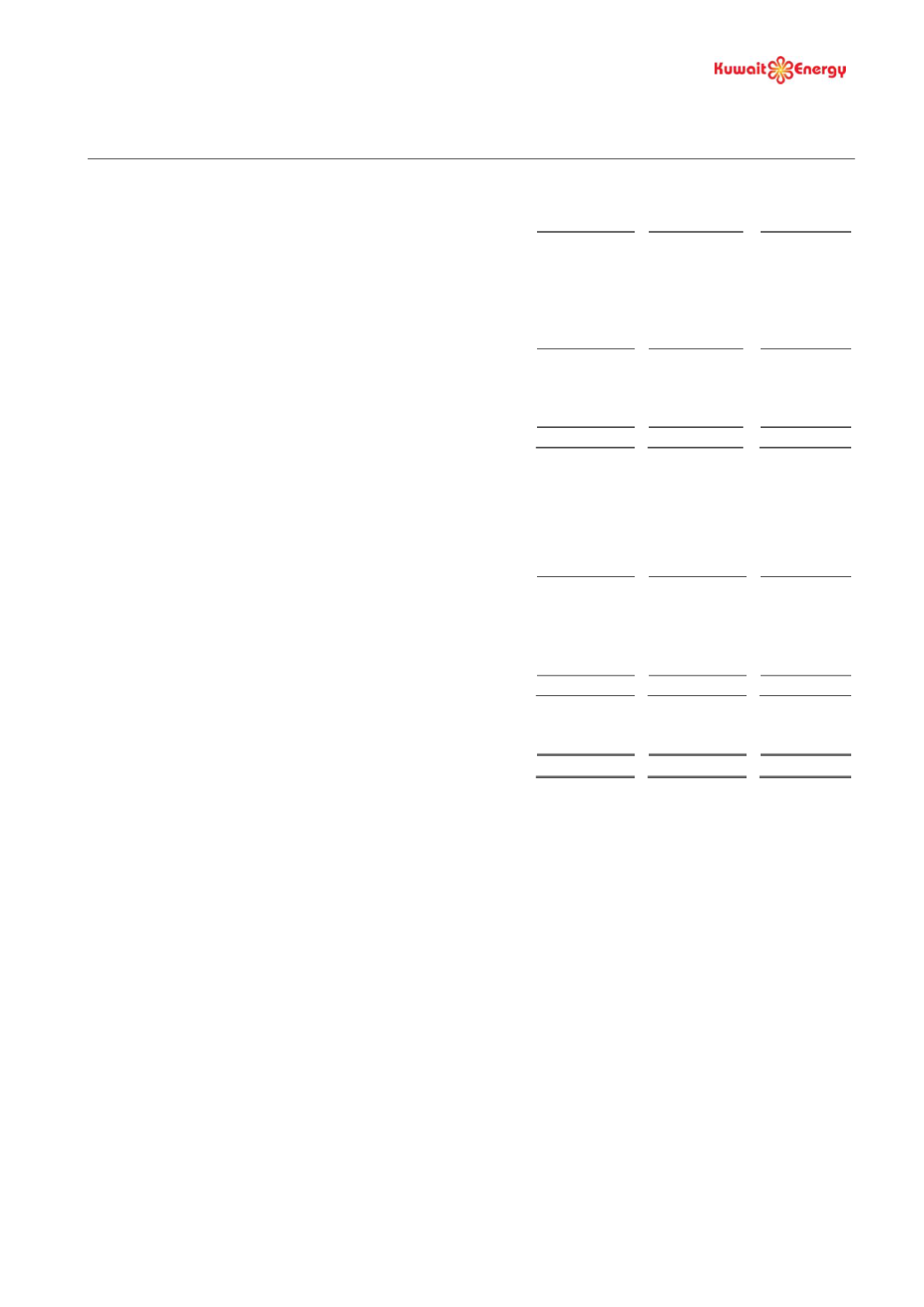

PROPERTY PLANT AND EQUIPMENT

Other fixed assets include a carrying amount of US$ 6.2 million (31 December 2016: US$ 6.8 million) in respect of assets

held under finance leases.

The additions to oil and gas assets mainly relate to Siba and Block 9 in Iraq, and include US$ 12.8 million (31 December

2016: US$ 17.0 million) of finance costs on qualifying assets capitalised during the period and US$ 2.8 million (31

December 2016: US$ 2.4 million) of fair value loss on convertible loans capitalised.

The Group has undertaken a review of the recoverable amount of its assets in accordance with IAS 36

Impairment of

assets,

primarily because the increase in commercial reserve of certain impaired assets represents an indicator of

reversal of impairment recognised in prior periods. Based on this review, the Group has reversed impairment of US$29.9

million recognised in prior periods on the Siba field in Iraq. The recoverable amount of Siba field based on a value in use

basis calculation is US$260.9 million.

During the period ended 30 September 2017, the Group recognised an impairment loss of US$33.8 million on the

Mansuriya field in Iraq. Due to security situation at Mansuriya field which is situated north-west Baghdad, development

activity has been delayed and no activity in the field has been possible since mid-2014. Now, this has resulted in

insufficient time remaining before the expiry of the contract to make the development economically attractive for the

partners of the field under existing terms of the contract, and/or an extension to its duration, before committing to the

development. Therefore, the Group’s reserve at Mansuriya have been re-classified as contingent resources at 30

September 2017. As there are currently no proved plus probable reserve assigned to Mansuriya, the net present value

of the reserve has been assigned a nil valuation, and the net book value of the asset has been impaired in full. The Group

has recognised net impairment loss of US$3.9 million including US$33.8 million impairment loss on Mansuriya field and

US$29.9 million impairment reversal on Siba field in Iraq, in the consolidated income statement.

Oil and

gas assets

Other fixed

assets

Total

Cost

US$ 000’s

US$ 000’s

US$ 000’s

As at 1 January 2016

1,067,280

23,661

1,090,941

Additions

160,957

142

161,099

Disposal

-

(622)

(622)

Transfer from Intangible exploration and evaluation assets

1,485

-

1,485

Transfer to assets held for sale

(194,962)

(103)

(195,065)

As at 31 December 2016

1,034,760

23,078

1,057,838

Additions

78,880

22

78,902

Disposal

-

(47)

(47)

Transfer from Intangible exploration and evaluation assets

1,785

-

1,785

As at 30 September 2017

1,115,425

23,053

1,138,478

Accumulated Depreciation, depletion, amortisation and impairment

As at 1 January 2016

459,657

9,713

469,370

Charge for the year

60,257

2,137

62,394

Impairment

94,337

-

94,337

Disposal

-

(562)

(562)

Transfer to assets held for sale

(77,070)

-

(77,070)

As at 31 December 2016

537,181

11,288

548,469

Charge for the period

41,898

1,329

43,227

Impairment

33,825

-

33,825

Impairment reversal

(29,949)

-

(29,949)

Disposal

-

(47)

(47)

As at 30 September 2017

582,955

12,570

595,525

Carrying amount

As at 30 September 2017

532,470

10,483

542,953

As at 31 December 2016

497,579

11,790

509,369