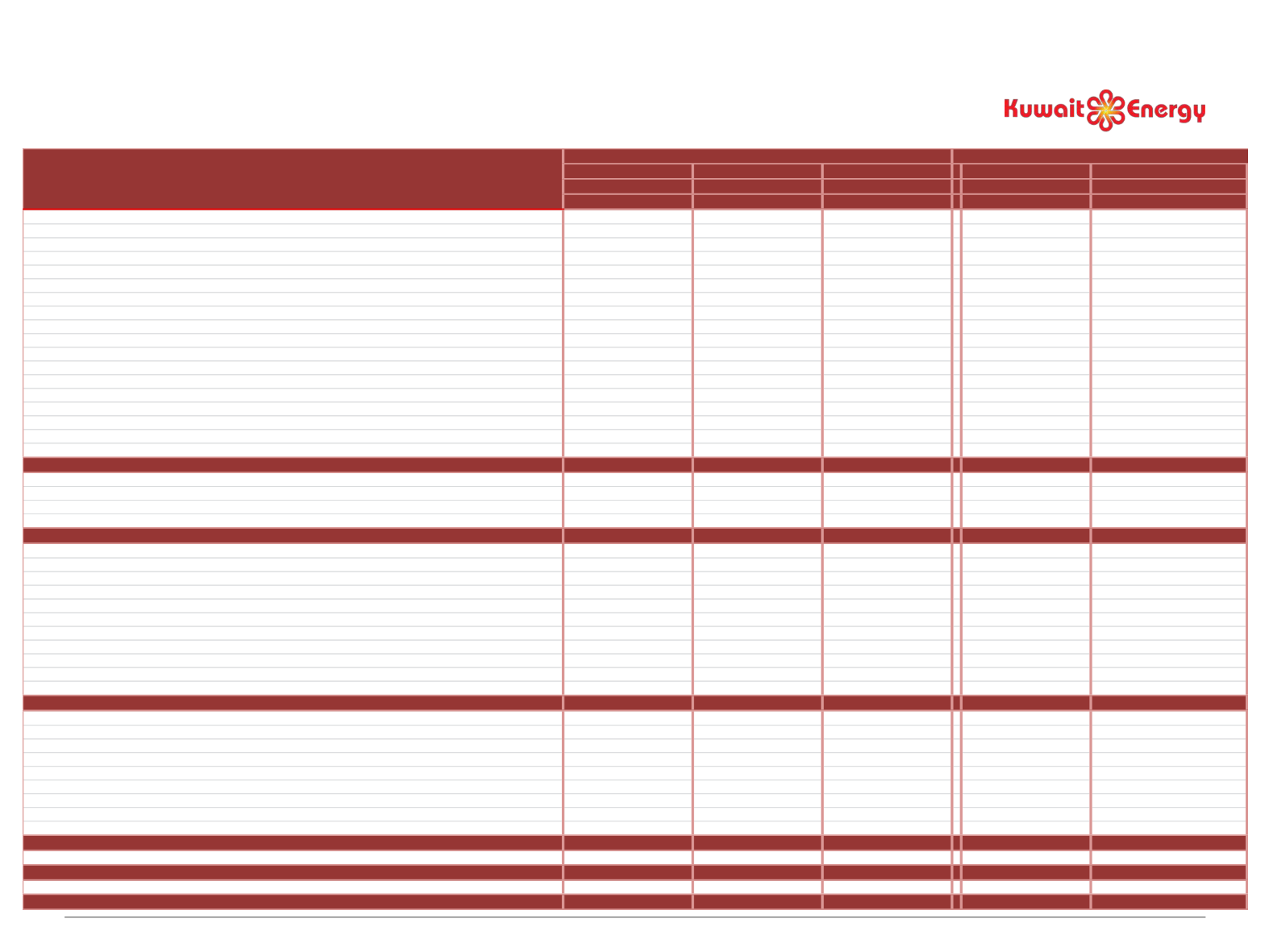

Cash Flow Statement

32

2011

2012

2013

2013

2014

(Restated) (Restated) (Restated)

(Restated)

US$million US$million US$million US$million US$million

OPERATING ACTIVITIES

Profit for the year

18.5

37.6

(281.4)

(50.5)

48.3

Adjustment for:

Share in results of joint venture

(1.1)

(3.1)

(1.5)

(0.7)

(2.6)

Depreciation, depletion and amortization

27.6

45.4

80.0

41.9

38.5

Exploration expenditure written off

18.1

14.3

73.3

43.9

-

Net impairment losses

-

-

1.8

0.8

-

Impairment charge on discontinued operations

-

-

18.6

11.1

-

Other non cash items included in discontinued operations

8.5

26.0

236.9

16.2

1.7

Tax charge

5.6

(3.9)

32.0

(2.3)

-

(Gain) / Loss on held for trading derivative

8.7

8.3

8.1

3.9

5.5

Fair value loss on convertible loans

0.1

(0.3)

(0.3)

(0.2)

-

Loss on sale of other assets

-

4.5

12.1

5.8

6.7

Loss on disposal of oil & gas assets

-

0.3

-

-

-

Net finance costs

0.1

0.1

-

-

-

Share-based compensation expense

7.6

1.0

9.5

4.3

3.3

Reversal of account payable

1.2

0.7

-

-

-

Provision for retirement benefit obligation

0.4

0.4

0.8

0.3

0.3

Operating cash flow before movement in working capital

95.3

131.3

189.9

74.5

101.7

Decrease / (Increase) in trade and other receivables

(86.1)

(38.6)

36.4

12.0

(24.1)

(Decrease)/ Increase in trade and other payables

2.3

5.3

17.9

15.4

54.0

Decrease / (Increase) in inventories

-

(0.4)

3.0

(0.8)

(7.9)

Tax paid

(0.5)

(8.6)

(7.5)

(3.4)

(4.2)

Net cash generated by operating activities

11.0

89.0

239.7

97.7

119.5

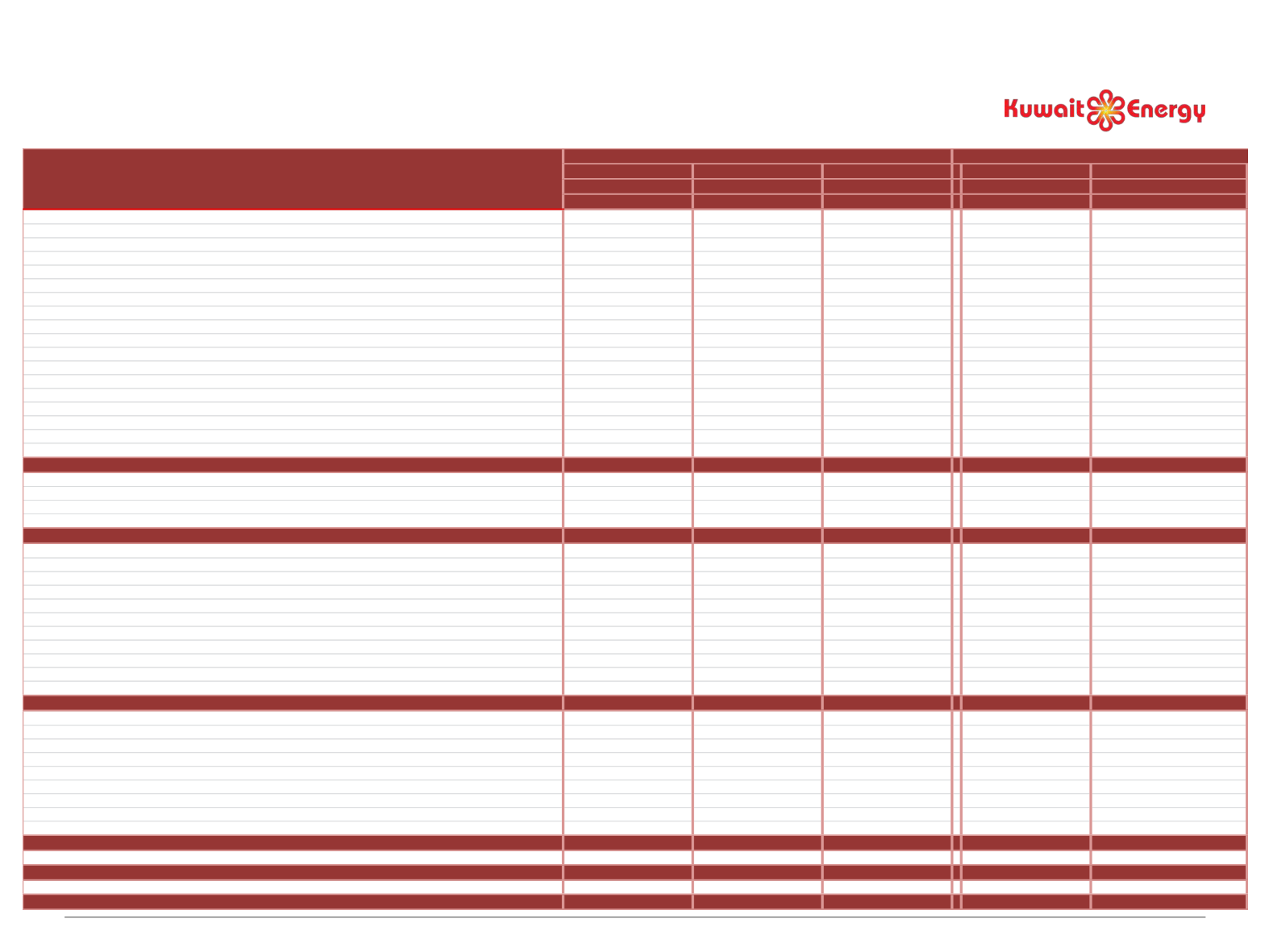

INVESTING ACTIVITIES

Purchase of intangible exploration and evaluation assets

(31.7)

(35.2)

(78.4)

(46.9)

(33.9)

Purchase of property, plant and equipment

(52.4)

(62.3)

(83.7)

(42.2)

(75.5)

Purchase of other fixed assets

(2.9)

(3.3)

(2.8)

(0.9)

(0.6)

Increase/(decrease) in capital inventory stores

1.4

(3.3)

0.8

4.1

(1.0)

Proceeds from farm out of working interests

19.5

-

-

-

-

Proceeds from sale of held to sale

-

-

-

-

5.0

Acquisition of subsidiary, net of cash acquired

-

(30.0)

(102.4)

(102.8)

-

Prepayment for capital expenditure

-

(5.0)

-

-

-

Dividend received from joint venture

-

5.0

-

-

3.5

Interest received

0.2

0.1

0.5

0.4

0.2

Net cash used in investing activities

(65.9)

(134.0)

(266.0)

(188.3)

(102.3)

FINANCING ACTIVITIES

Proceeds from issue of share capital

73.7

-

-

-

-

Proceeds from short term loans

-

-

40.0

40.0

-

Repayment of short term loans

-

-

(40.0)

(25.0)

-

Proceeds from long term loans

-

57.4

110.0

50.0

15.0

Repayment of long term loans

-

(58.0)

(5.5)

-

(25.6)

Proceeds from Convertible loan

-

83.0

17.0

17.0

-

Dividend paid

(22.8)

(23.3)

-

-

-

Finance costs paid

(12.8)

(6.1)

(14.4)

(9.2)

(8.9)

Net cash generated by financing activities

38.1

53.0

107.1

72.8

(19.5)

Effect of foreign currency translation

(0.1)

-

-

-

-

Net increase (decrease) in cash and bank balances

(16.9)

8.0

80.8

(17.8)

(2.3)

Cash and bank balances at beginning of the year

55.7

38.8

46.8

46.8

127.6

Cash and bank balances at end of the period

38.8

46.8

127.6

29.0

125.3

For the year ended 31 December

For the period ended 30 June

Audited Consolidated Statement of Cash Flows