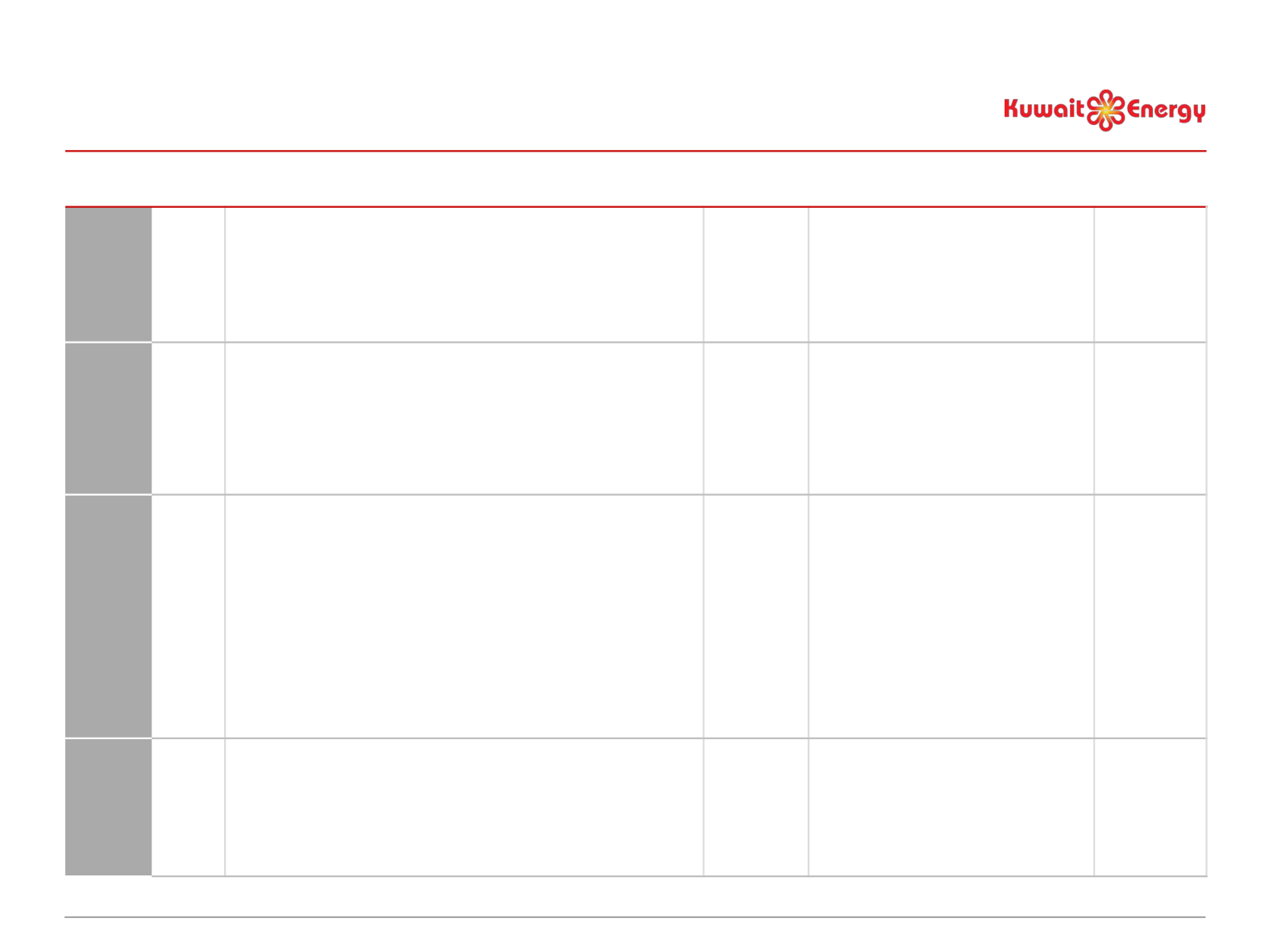

Summary of Licences: Egypt

Field

Licence

Type

Key Licence Terms

Licence Expiry

Fiscal Regime

Historical

Funding

Arrangements

ERQ

PSC with

EGPC

•

Development leases for20-year term over 9 fields discovered

•

7 year exploration period outside these 9 fields expired in September 2011

•

Minimum work obligations required:

•

conducting surface sampling and field work

•

acquisition of seismic surveys and

•

drilling of exploration wells, with minimum expenditure commitments

between $7.5m and $27m, currently no outstanding commitments

•

Various dates

between

2027-2031,

with a 5 year

extension

option

(1)

•

Cost oil entitlement cap: 35%

•

Capital cost recovered over 5 years

•

Profit oil percentage: 25-30%

•

Profit gas / condensate percentage: 30%

•

Annual training fee during exploration and

development: $50,000

•

Bonus paid to EPG upon reaching various

production milestones: $200,000-$600,000

RBL Agreement

OCF

Equity

Burg El

Arab

PSC with

EGPC

•

Development leases for20-year term over the oil field discovered in the PSC

area in 1996

•

Minimum work obligations required:

•

conducting surface sampling and field work

•

acquisition of seismic surveys and

•

drilling of exploration wells, with minimum expenditure commitments

between $7.5m and $27m, currently no outstanding commitments

•

December

2016, with a

5 year

extension

option

(1)

•

Cost oil entitlement cap: 35%

•

Capital cost recovered over 5 years

•

Profit oil percentage: 15- 22%

•

Profit gas / condensate percentage: 20%

•

Annual training fee during exploration and

development: $50,000

•

Bonus paid to EPG upon reaching various

production milestones: $1m-$2m

•

Extension lease bonus: $500,000

RBL Agreement

OCF

Equity

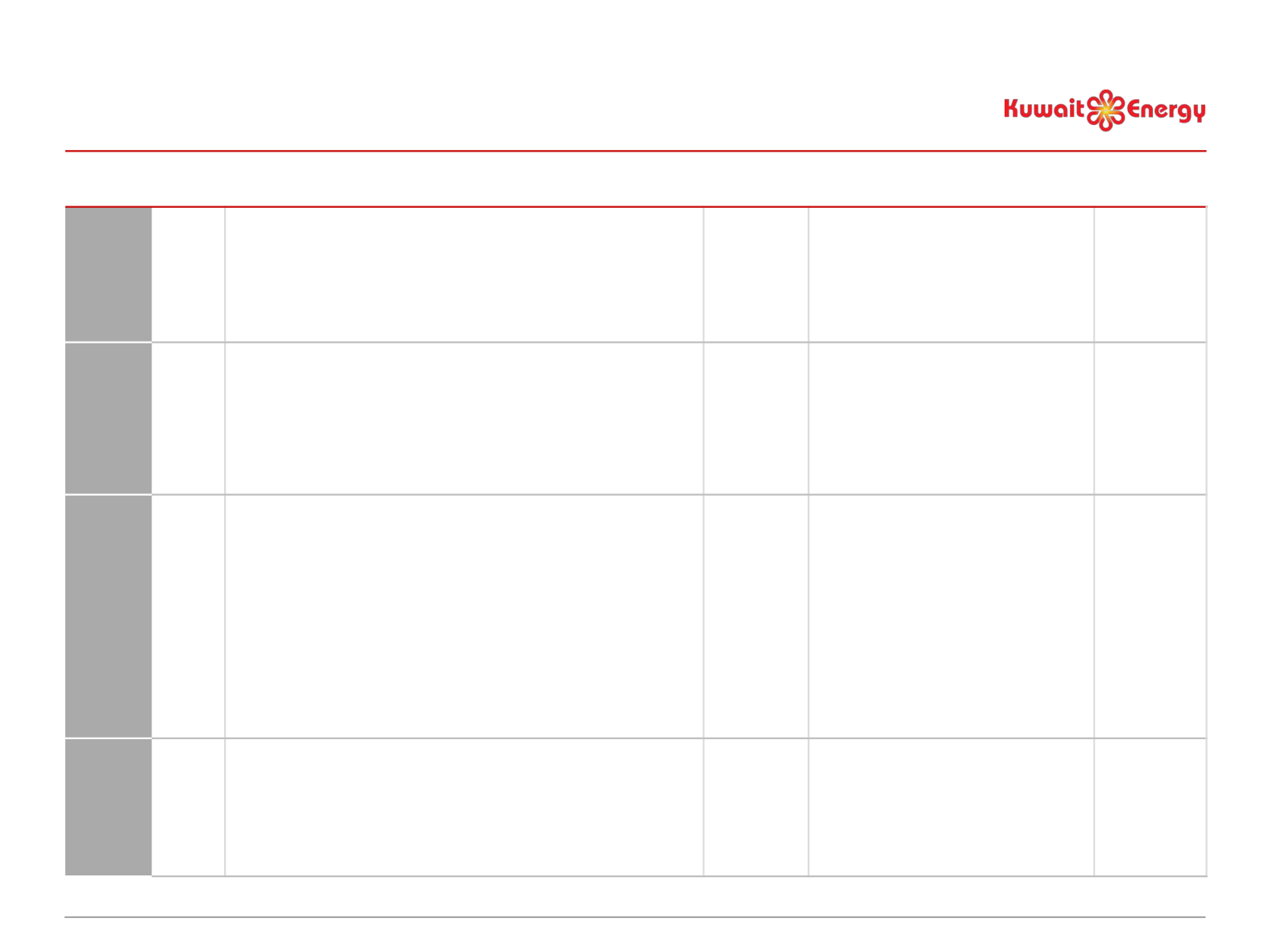

Abu

Sennan

PSC with

EGPC

•

Development leases for20-year term over the three producing fields in the PSC

area

•

Minimum work obligations required:

•

building a treatment facility for oil produced from the site

•

evaluating gas reserves for possible construction of gas facilities

•

drilling of exploration wells, with minimum expenditure commitments

between $7.5m and $27m, currently no outstanding commitments

•

Carries Dover Investments’ costs for Dover’s share of the cost oil recovery

entitlement +7.5% of Dover Investments’ share of the profit oil

•

Initial exploration period for the areas outside the 3 fields expired in May 2012

•

2 year extension with commitment to drill 3 wells with total expenditure

of $6.6m

•

Option additional 2 year extension with comment to drill 2 wells with

exploration and appraisal expenditure of $4.4m

•

2032 -2033,

with a 5 year

extension

option

(1)

•

Cost oil entitlement cap: 30%

•

Capital cost recovered over 5 years

•

Profit oil percentage: 17.9%

•

Profit gas / condensate percentage: 17.9%

•

Annual training fee: $50,000

•

Bonus paid to EPG upon reaching various

production milestones: $0.5m-$2m

•

Bonus paid to EPG upon the approval of each

development: $500,000

•

Extension lease bonus: $1,000,000

RBL Agreement

OCF

Equity

Area A

Service

Contract

with

GPC

(2)

•

Service comprising

•

an exploration services agreement governing the non-producing fields

•

a production services agreement governing the five producing fields

•

Minimum work obligations required:

•

exploration phase: drilling 1 exploration well before Sept2014

•

production services extension: drilling 6 development wells and conduct

of a Yusr Waterflood study

•

exploration

services:

February

2019

•

Production,

development

services: June

2023-2028

•

Service fee of $0.61 per barrel for

maintaining the baseline production and a

share of any incremental production where

gross production is above 500 bopd

•

for Shukheir North West: 49-57%

•

For all other fields: 49.0- 51.5%

•

No cost recovery applicable

RBL Agreement

OCF

Equity

Source: Kuwait Energy.

(1) Subject to approval from the Egyptian Ministry of Petroleum. (2) The licence holder, General Petroleum Company (“GPC”), under which the Group and Petrogas.

37