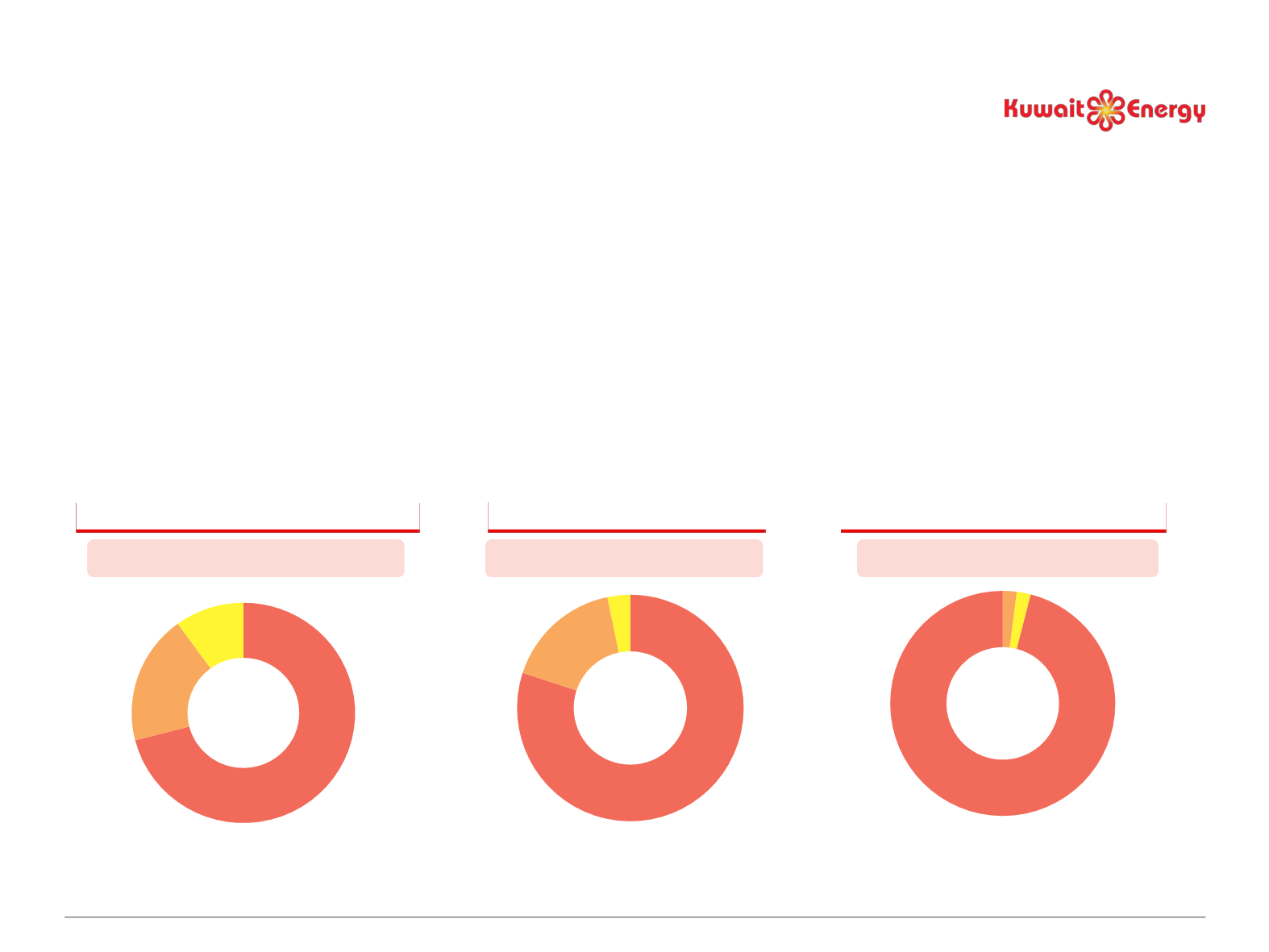

Egypt

71%

Yemen

19%

Oman

10%

Corporate Snapshot

Established in 2005, Kuwait Energy (“KE”) is a leading independent Oil & Gas company with regional knowledge and

technical expertise, set up to exploit untapped reserves and resources in the MENA region

KE leverages its technical excellence, experience and business relationships in the region to successfully explore, develop

and operate upstream oil and gas assets in Egypt, Yemen, Iraq and Oman

Current production in Egypt, Yemen and Oman

Current development in Iraq with Siba project expected to come on-stream in Q4 2015

KE has raised more than $1bn in equity and debt since 2005, supported by diversified regional and US investors, including

the IFC

Source: Kuwait Energy, GCA Report 31 May 2014.

Notes: Gas and condensate volumes were converted to oil equivalent volumes using conversion factors of 6.0 Mscf/boe and 1.0 bbl/boe. Estimates above exclude Karim Small Fields (Oman) where activities are carried out

pursuant to a service agreement whose terms do not allow external reporting of reserves volumes.Reserve and resources are Kuwait Energy Working Interest. Reserves and resources as at 31 May 2014 audited by

Gaffney Cline & Associates (“GCA”).

(1) Average YTD Nov 2014 working interest daily production including Oman. (2) Based on GCA Report 31 May 2014. (3) Oil includes condensate and crude oil. (4) The company has a signed SPA with conditions precedent for

the farm out of 10% WI of Block 9. Post farm out Contingent Resources (2C) would decrease in proportion to the farm out.

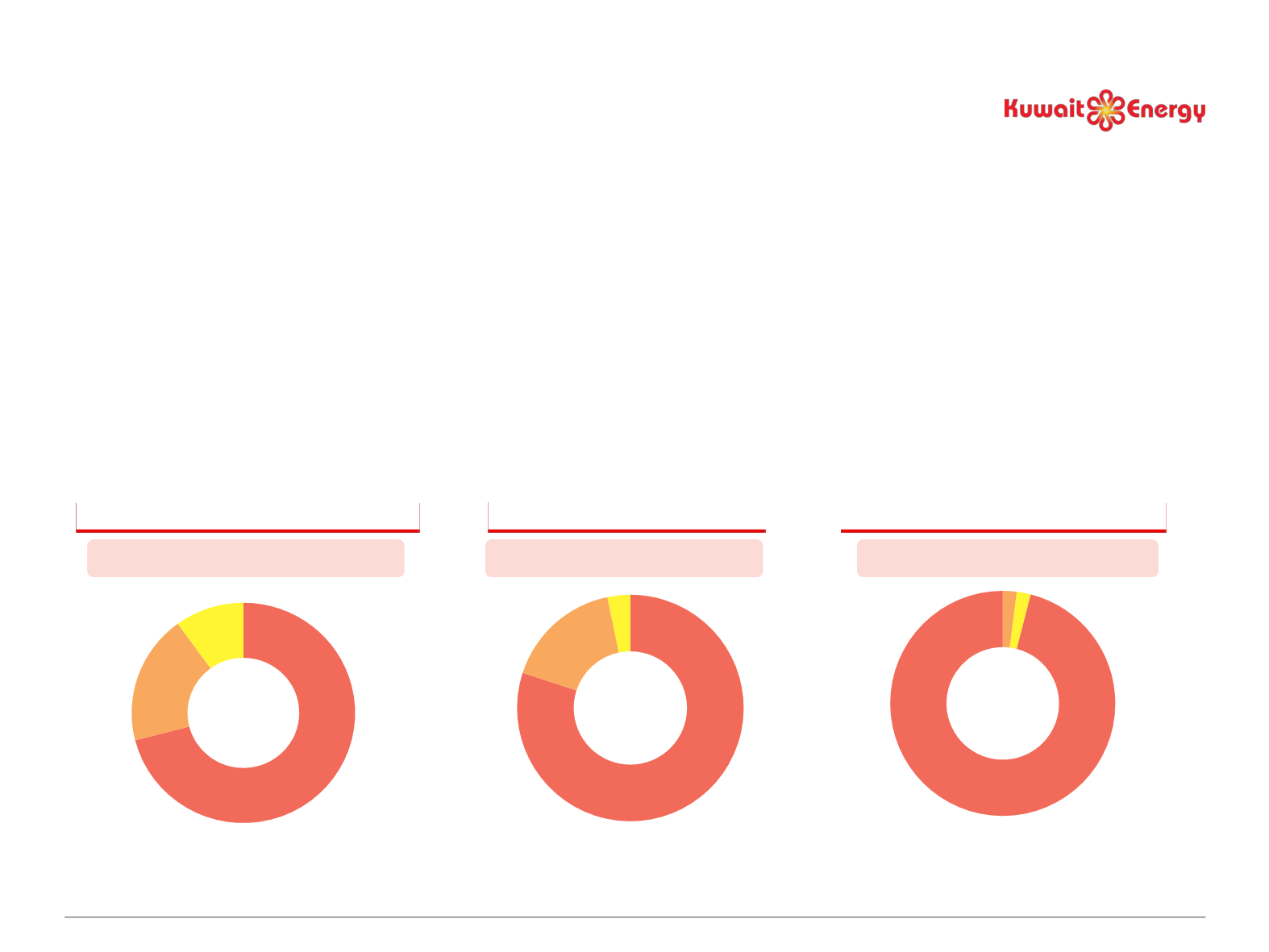

Yemen

2%

Egypt

2%

Iraq

96%

850 mmboe (86% oil)

(3)(4)

165.7 mmboe (38% oil)

(3)

Iraq

80%

Egypt

17%

Yemen

3%

5

24.3 kboepd (100% oil)

(3)

YTD Nov 2014 WI Production

(1)

2P WI Reserves

(2)

WI Contingent Resources (2C)

(2)