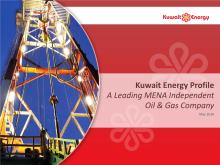

Energy House

14%

Global Investment

House

13%

Zahra Group

13%

Blue Ridge

8%

IFC

8%

Equity Group

8%

Other

36%

2005:

$3.4m

by Founders

2007:

$169.4m

by Equity Group, Global Investment, Energy House,

existing shareholders

2008:

$310.4m

by Blue Ridge, Van Eck Global, Valiant Partners,

existing shareholders

2009:

$23.6m

by Millennium Private Equity

2010:

$33.4m

by existing shareholders

2011:

$73.6m

by existing shareholders, IFC, QFB

Diversified and Supportive Shareholder Base

Has Raised Over $1.25bn Capital Since 2005

Equity Raised

Shareholder Structure Q1 2016

Debt Issued

2007:

$50m

by BNP Paribas

(1)

2009:

$50m

by IFC

(1)

2010:

$8m

by EBRD

(1)

2012:

$150m

by Abraaj Capital

(2)

,

$150m

by QFB

(2)

,

$165m

RBL

(1)

2013:

$25m

by Kuwait International Bank

(1)

,

$15m

by QFB

(1)

,

$60m

by Arab Bank

(1)

2014:

$250m

by Bonds listed on Irish Stock Exchange

2015:

$8m

by Emirates NBD for Cairo office building sales & lease

back transaction

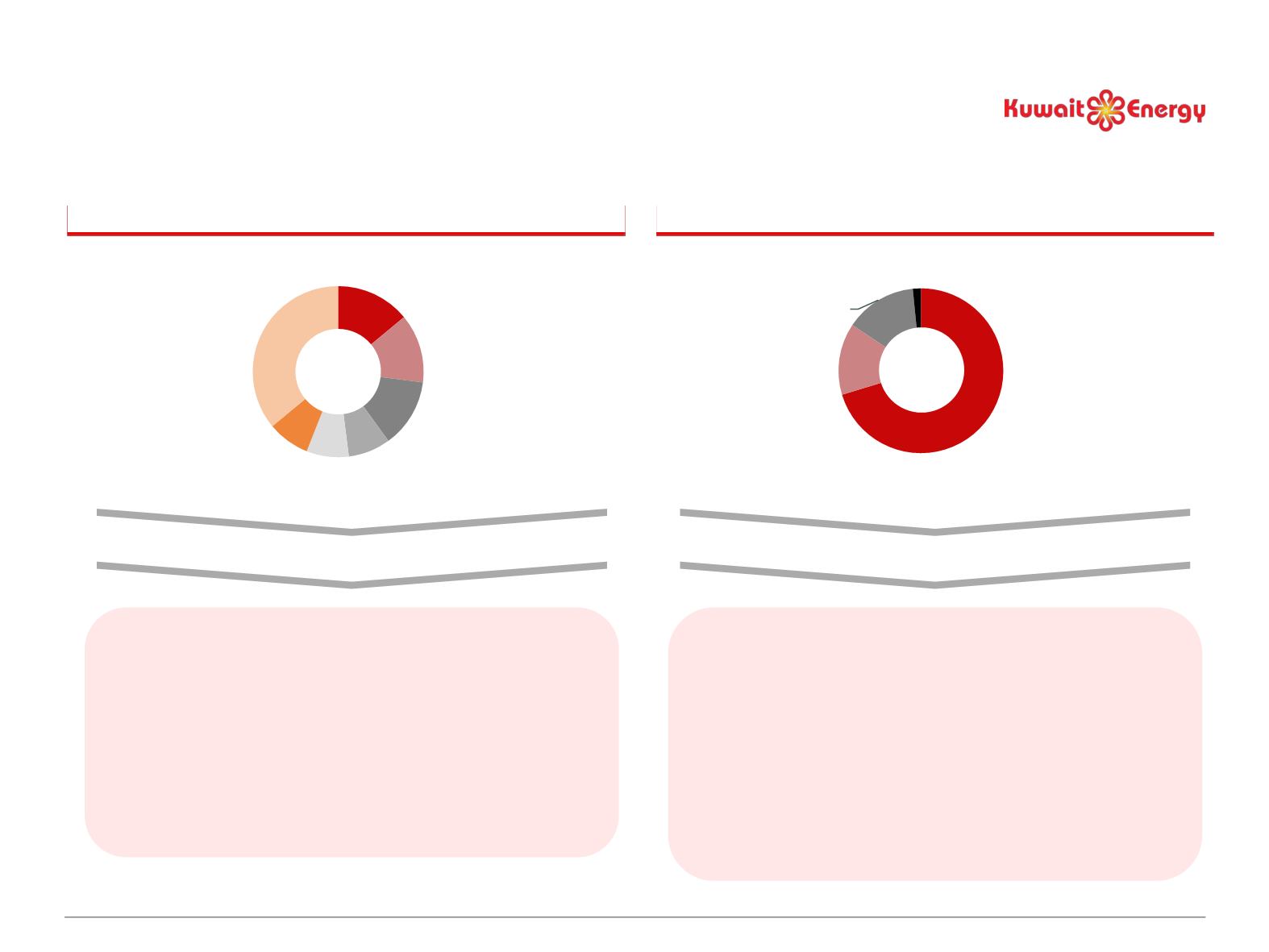

Debt Composition Q1 2016

Bond

70.3%

Abraaj

14.1%

QFB

14.1%

Lease financing

1.6%

$356m

(1) Debt Facility has been repaid.

(2) Abraaj Capital and QFB $50m drawdown each

15