KUWAIT ENERGY PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2016

27

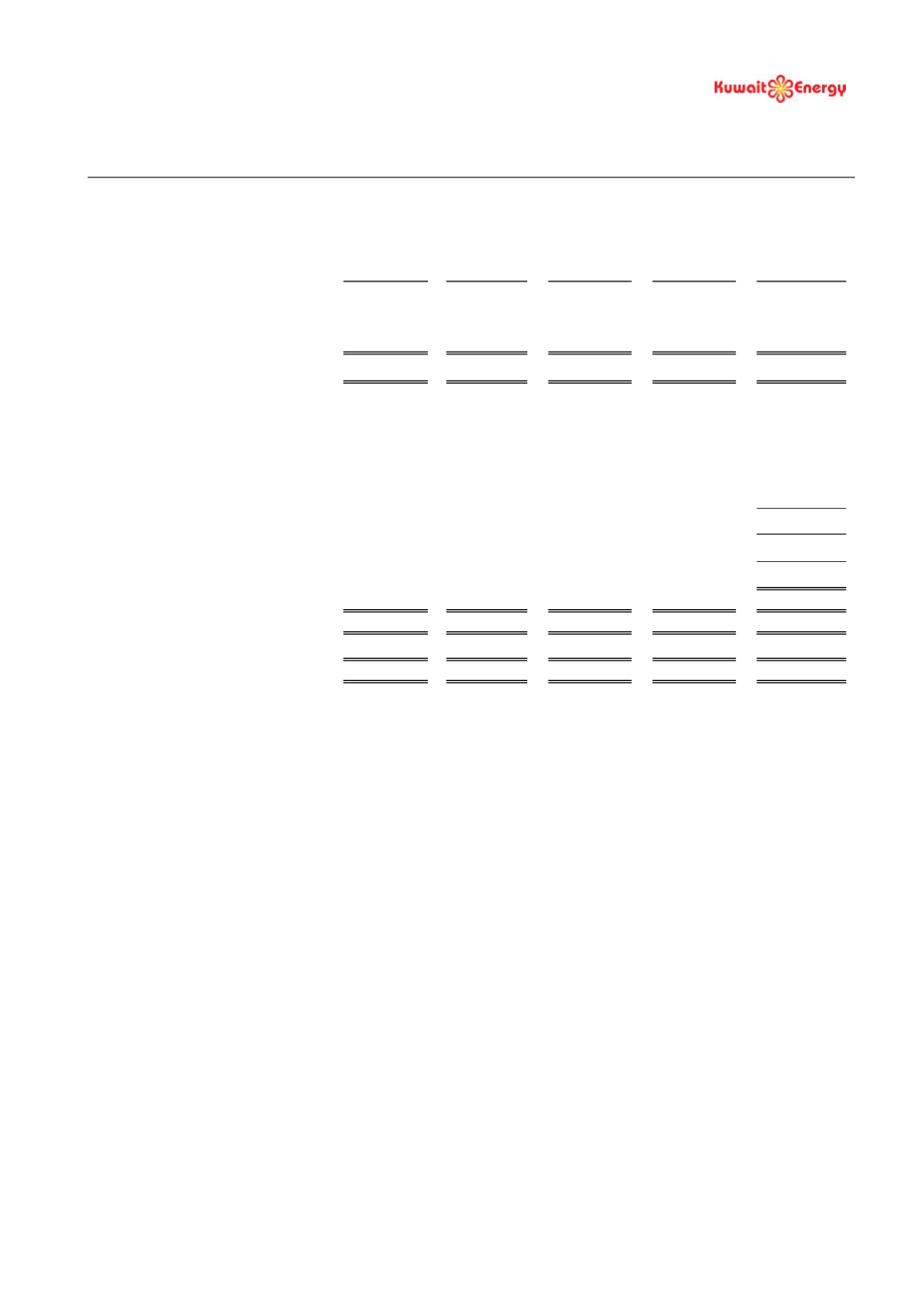

5. SEGMENTAL INFORMATION (CONTINUED)

The following is an analysis of the Group’s revenue and results by reportable segments:

Egypt

Iraq

Yemen

Others

Total

US$ 000’s US$ 000’s

US$ 000’s

US$ 000’s

US$ 000’s

30 June 2016 (Audited)

Segment revenues

50,455

14,364

-

-

64,819

Segment operating profit/(loss)

1,856

4,332

(2,722)

(3,015)

451

Share of results of Joint Venture

-

-

-

(628)

(628)

Fair value loss on convertible loans

(7,362)

Other income

835

Foreign exchange loss

(57)

Finance costs

(4,650)

Loss before tax

(11,411)

Taxation credit

222

Loss for the period

(11,189)

Segment assets

266,235

457,015

79,368

49,380

851,998

E&E assets

10,710

-

21,583

-

32,293

PP&E

186,214

435,642

45,762

1,160

668,778

Segment liabilities

36,707

63,435

22,372

385,587

508,101

Other information:

Additions to E&E

1,451

-

712

-

2,163

Additions to PP&E

7,328

71,244

(3)

-

78,569

Depreciation, Depletion and

Amortisation

26,391

7,069

-

375

33,835