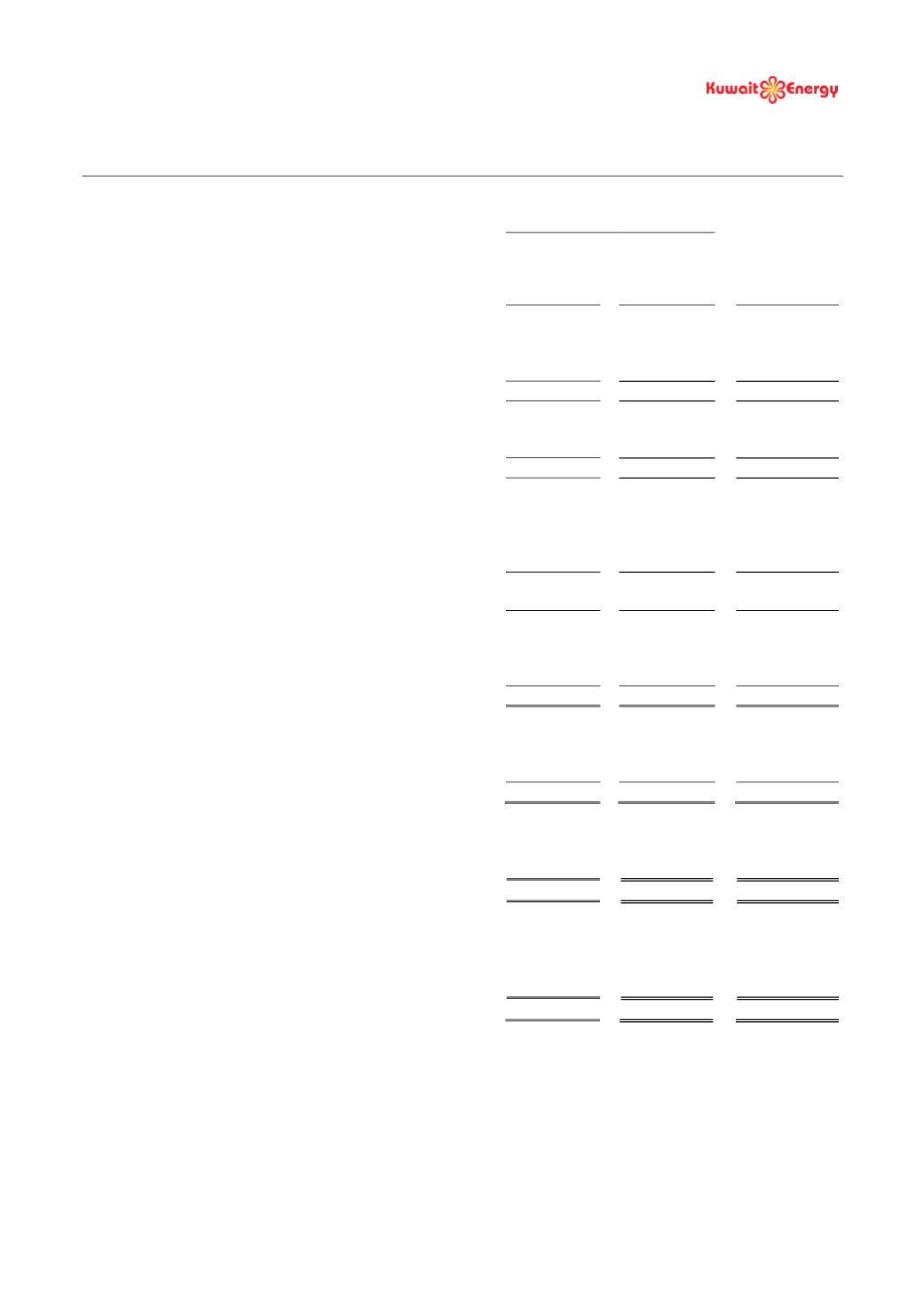

KUWAIT ENERGY PLC

CONDENSED CONSOLIDATED INCOME STATEMENT

Six months ended 30 June 2015

5

Six months ended 30 June

Year ended

2015

Unaudited

2014

Unaudited

(Restated see

note 17)

31 December

2014

Audited

Notes USD 000’s USD 000’s

USD 000’s

Continuing Operations

Revenue

89,103

131,004

270,759

Cost of sales

(73,517)

(53,803)

(140,504)

Gross profit

15,586

77,201

130,255

Exploration expenditure written off

7

(2,519)

-

(1,513)

Impairment of oil and gas assets

8

-

-

(19,247)

General and administrative expenses

(9,170)

(11,883)

(32,669)

Operating profit

3,897

65,318

76,826

Share of results of Joint Venture

9

1,731

2,571

1,040

Fair value loss on convertible loans

13

(8,730)

(6,712)

(9,931)

Other income

818

269

653

Foreign exchange loss

(1,663)

(41)

(273)

Finance costs

(4,750)

(3,552)

(12,773)

(Loss)/profit before tax

(8,697)

57,853

55,542

Taxation charge

4

(1,168)

(5,455)

(8,800)

(Loss)/profit for the period from continuing

operations

(9,865)

52,398

46,742

Discontinued operations

Loss for the period from discontinued operations

5

-

(2,600)

(4,039)

(Loss)/profit for the period

(9,865)

49,798

42,703

Attributable to:

Owners of the Company

(9,863)

49,798

42,711

Non-controlling interests

(2)

-

(8)

(9,865)

49,798

42,703

Earnings/(loss) per share from continuing operations

attributable to owners of the Company

-

Basic (cents)

6

(3.0)

16.0

14.2

-

Diluted (cents)

6

(3.0)

16.0

14.2

Earnings/(loss) per share from continuing and

discontinued operations attributable to owners of the

Company

-

Basic (cents)

6

(3.0)

15.2

13.0

-

Diluted (cents)

6

(3.0)

15.2

13.0