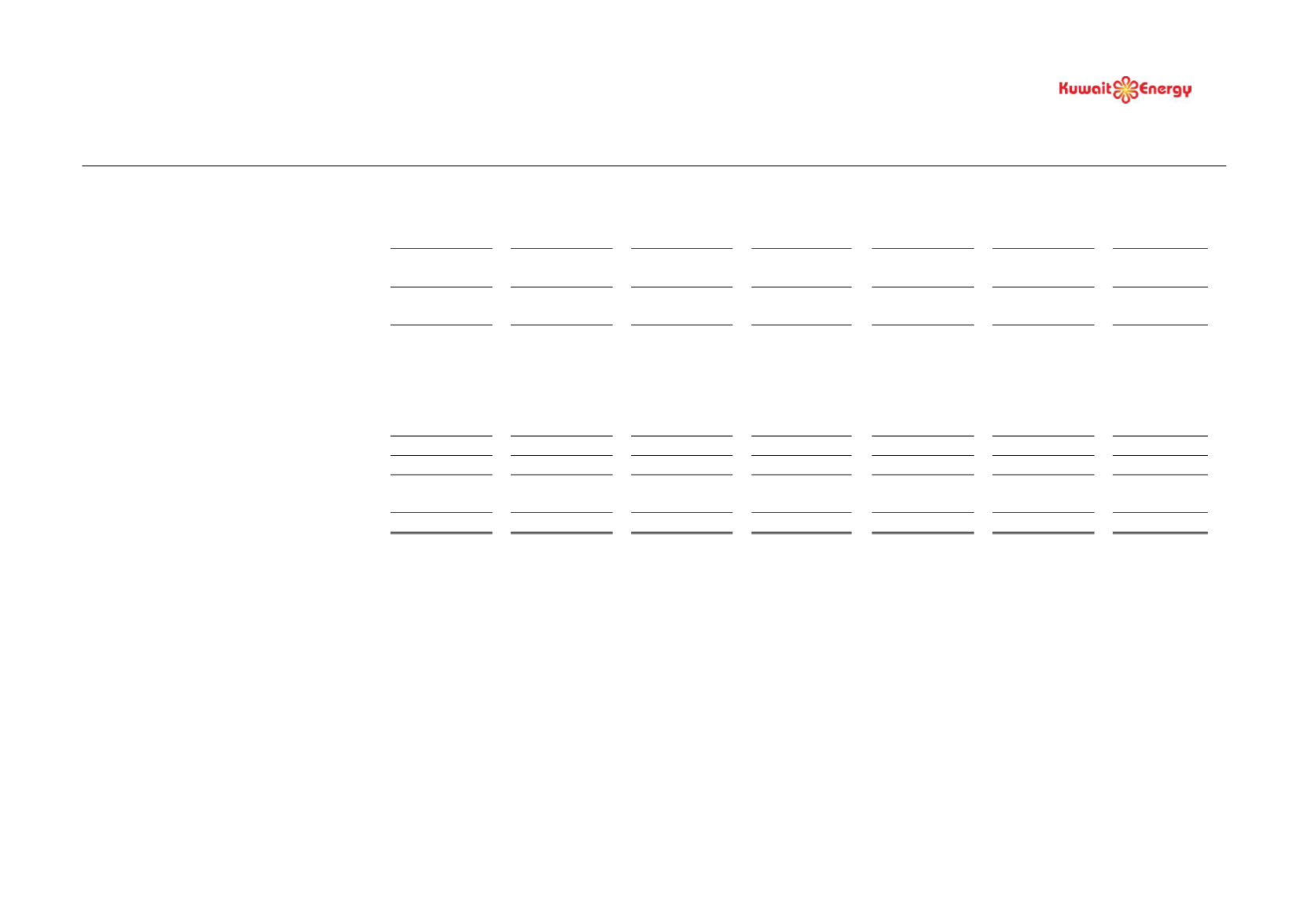

KUWAIT ENERGY PLC

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Six months ended 30 June 2015

8

* The issue of shares in the period relates to the 2014 restructuring of the Group and acquisition of Kuwait Energy Company K.S.C (Closed) (“KEC”) shares, as set out in detail in

note 15 of the 31 December 2014 Group financial statements, available on the Group’s website. At December 2014, 87.8% of the shares in KEC had been exchanged for shares in the

Company. In the period, a further 4.1% of KEC shares have been exchanged and accounted for in line with year end.

Share

capital

Share

premium

Other

reserves

Retained

deficit

Total

Non-

controlling

interest

Total

equity

USD 000’s

USD 000’s

USD 000’s

USD 000’s

USD 000’s

USD 000’s

USD 000’s

Balance at 1 January 2014 (Audited)

507,832

189,309

(36,003)

(290,928)

370,210

-

370,210

Profit/(loss) for the year

-

-

-

42,711

42,711

(8)

42,703

Other comprehensive income for the year

-

-

812

-

812

-

812

Total comprehensive income for the year

-

-

812

42,711

43,523

(8)

43,515

Acquisition of subsidiary

46,785

14,057

(69,669)

-

(8,827)

8,778

(49)

Purchase of treasury shares

-

-

(1,749)

-

(1,749)

-

(1,749)

Issue of shares for prior year business

combination

822

604

-

-

1,426

-

1,426

Issue of shares under incentive scheme

2,369

790

-

-

3,159

-

3,159

Balance at 31 December 2014 (Audited)

557,808

204,760

(106,609)

(248,217)

407,742

8,770

416,512

Loss for the period

-

-

-

(9,863)

(9,863)

(2)

(9,865)

Total comprehensive loss for the period

-

-

-

(9,863)

(9,863)

(2)

(9,865)

Issue of shares*

2,027

731

220

-

2,978

(2,978)

-

Balance at 30 June 2015 (Unaudited)

559,835

205,491

(106,389)

(258,080)

400,857

5,790

406,647