KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2014

13

2.

ADOPTION OF NEW AND REVISED STANDARDS (CONTINUED)

Standards affecting the financial statements (continued)

IAS 28 (revised 2011) Investment in Associates and Joint Ventures

As a consequences of the new IFRS 11 Joint Arrangements and IFRS 12 Disclosure of Interests in Other Entities, IAS

28 Investments in Associates, has been renamed IAS 28 Investment in Associates and Joint Ventures, and describes

the application of the equity method to investments in Joint ventures in additions to associates.

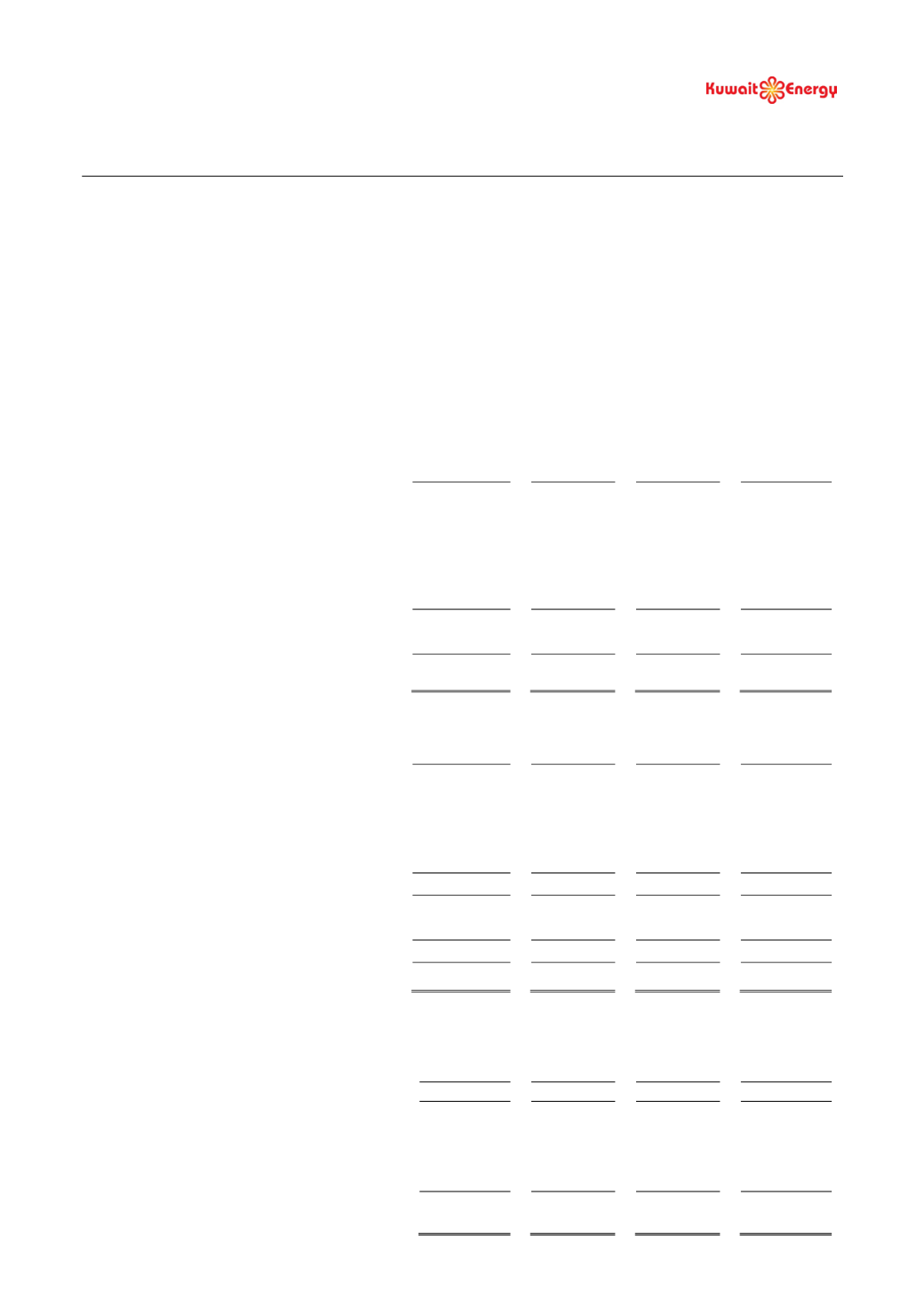

The table below shows the effect of adopting IFRS 11 on the consolidated income statement, consolidated balance

sheet and consolidated statement of cash flows. There was no impact on the reported profit for the year/period, net

assets or the basic and diluted earnings per share.

Impact

on

consolidated

income

statement:

6 months

ended

30.06.13

Unaudited

Year

ended

31.12.13

Audited

Year

ended

31.12.12

Audited

Year

ended

31.12.11

Audited

USD 000’s

USD 000’s USD 000’s USD 000’s

Continuing Operations

Decrease in revenue

(9,901)

(21,898)

(20,607)

(20,029)

Decrease in cost of sales

8,552

20,065

17,667

18,700

Decrease/(increase) in impairment loss

418

-

(540)

-

Increase in share in results of joint venture

728

1,543

3,052

1,119

Decrease in profit before tax

(203)

(290)

(428)

(210)

Decrease in taxation charge

203

290

428

210

Net impact on profit for the period/year

from continuing operations

-

-

-

-

Impact on consolidated balance sheet:

30.06.13

Unaudited

31.12.13

Audited

31.12.12

Audited

31.12.11

Audited

USD 000’s

USD 000’s USD 000’s USD 000’s

Decrease in property, plant and equipment

(5,250)

(5,115)

(6,359)

(7,125)

Increase in investment in joint venture

9,783

10,598

9,055

11,003

Decrease in trade and other receivables

(5,404)

(6,418)

(6,184)

(6,102)

Decrease in cash and bank balances

(2,447)

(3,969)

(1,618)

(1,716)

Net decrease in assets

(3,318)

(4,904)

(5,106)

(3,940)

Decrease in trade and other payables

3,115

4,614

4,678

3,747

Decrease in current tax payable

203

290

428

193

Net decrease in liabilities

3,318

4,904

5,106

3,940

Net impact on equity

-

-

-

-

Impact on consolidated statement of cash

flows:

6 months

ended

30.06.13

Unaudited

Year

ended

31.12.13

Audited

Year

ended

31.12.12

Audited

Year

ended

31.12.11

Audited

USD 000’s USD 000’s USD 000’s USD 000’s

Net decrease in cash generated by operating

activities

(7,139)

(13,563)

(17,891)

(15,394)

Net decrease in cash used in investing

activities

6,310

11,212

17,988

16,026

Net (decrease)/increase in cash generated

during the year/period

(829)

(2,351)

97

632