KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2014

65

34.

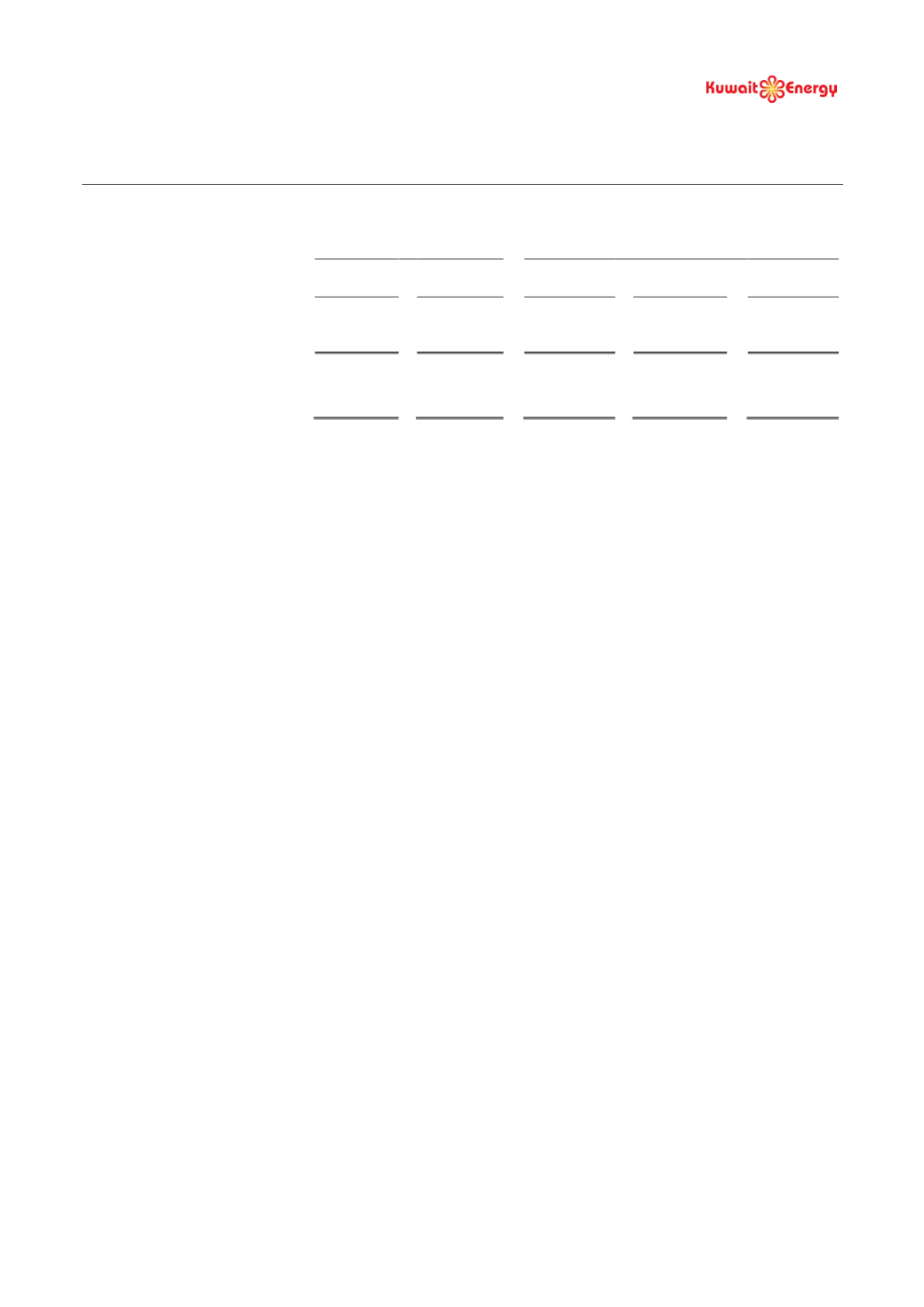

CONTINGENT LIABILITIES AND CAPITAL COMMITMENTS

As at 30 June

As at 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

Audited

Audited

Audited

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

a)

Contingent liabilities -

letters of guarantee

-

2,674

1,628

2,423

16,466

b)

Capital commitments

(other than covered by

letters of guarantee)

106,970

136,700

116,400

114,200

84,952

Capital commitment includes committed exploration drilling and seismic expenditures as specified in the licence.

35.

SUBSEQUENT EVENTS

1)

Subsequent to the period ended 30 June 2014, the Group has issued USD 250 million aggregate principal amount

of its 9.5% Senior Guaranteed Notes due 2019 (the “Notes”). Interest on the Notes will be paid semi-annually in

arrears on 4 February and 4 August of each year, commencing on 4 February 2015. The Notes have been admitted

by the board of the Irish Stock Exchange for listing on the official list and trading on the Global Exchange

Market. Proceeds of the Notes have been used to repay in full amounts outstanding under the Reserve Based

Facilities and the Arab Bank Facility (see note 24). Remaining proceeds, after fees, will be used to partially fund

capital expenditure of the Group, particularly in respect of the Group’s assets in Iraq and for general corporate

purposes.

2)

Subsequent to the period ended 30 June 2014, a restructuring of the Group was undertaken in July 2014 to bring

KEC into the Group. After this restructuring, KEC along with another intermediary holding company called

Kuwait Energy International Limited (Jersey) hold the various Group assets, mainly through a number of BVI

based holding companies.

Following the restructuring, there are a number of ‘associated’ shareholders (holding approximately 26 per cent.

of KEC) still to transfer to ownership of the Company by the end of 2014. However, it is expected that these

shareholders will hold less than 5 per cent of KEC.

KEC is also a 9 per cent shareholder in the Company, however, it is intended to remove this cross-holding.

3)

On 16 July 2014, KEC Kuwait signed a farm out agreement to assign to EGPC a 10% working interest share in

the Block 9 exploration, development and production service contract in Iraq, with an effective date of 1 July

2013. This assignment is subject to final EGPC board approval and certain conditions precedent, including KEC

Kuwait providing a written waiver or other evidence of non-exercise of any preferential rights (including a right

of first refusal to acquire the working interest subject to this proposed farm out) by other parties to the service

contract and written approval of the assignment by the Iraqi government.