KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2014

64

33.

FINANCIAL INSTRUMENTS (CONTINUED)

Liquidity risk management (continued)

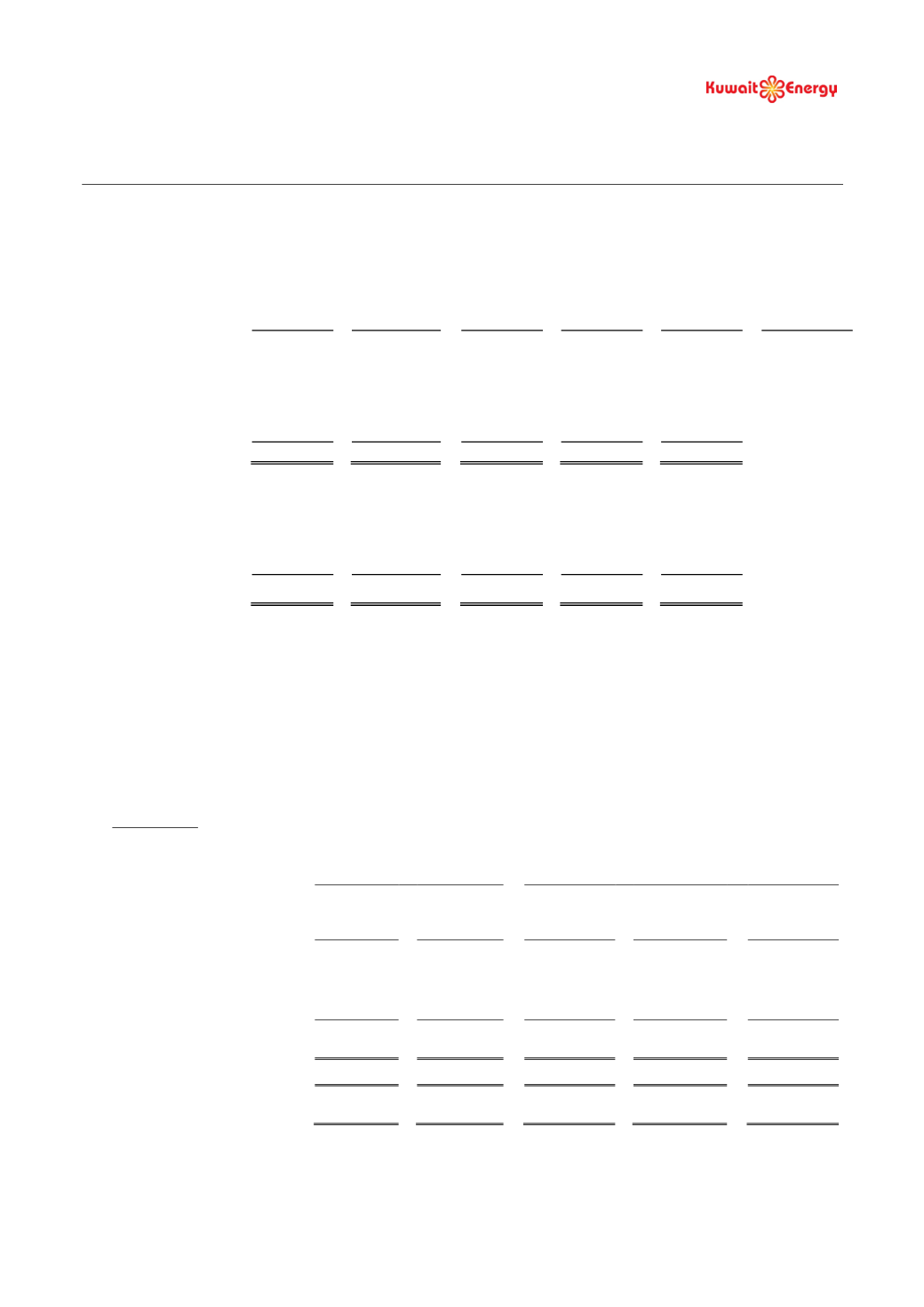

Financial liabilities

Less than

1 year

Between

1 and 3

years

Between

3 and 5

years

More than

5 years

Total

Weighted

average

effective

interest rate

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

%

At 31 December 2012

Long-term loans

3,306

6,654

66,600

-

76,560

6.62%

Convertible loans

7,359

16,000

16,000

89,967

129,326

16%

Trade and other

payables (restated)

47,228

-

-

-

47,228

-

57,893

22,654

82,600

89,967

253,114

At 31 December 2011

Long-term loans

8,000

40,667

7,721

-

56,388

10.11%

Convertible loans

-

-

-

-

0

-

Trade and other

payables (restated)

44,718

-

-

-

44,718

52,718

40,667

7,721

0

101,106

The group has access to financial facilities as described in notes 24 and 25. The group expects to meet its other

obligations from operating cash flows.

Capital risk management

The Group manages its capital to ensure that it will be able to continue as a going concern while maximising the

return to the shareholders through the optimisation of debt and equity balance. The Group’s overall strategy remains

unchanged from 2011 through to 30 June 2014.

The capital structure of the Group consists of equity comprising issued share capital, share premium and merger

reserve (see note 22), other reserves (see note 23) and retained earnings.

Gearing ratio

The gearing ratio at period/year end was as follows:

As at 30 June

As at 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

(Restated)

Audited

(Restated)

Audited

(Restated)

Audited

(Restated)

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

Debt (i)

271,008

233,542

277,067

147,244

53,000

Less: Cash and bank balances

and liquid investments

(125,349)

(29,049)

(127,594)

(46,766)

(38,762)

Net debt

145,659

204,493

149,473

100,478

14,238

Equity

499,809

669,010

448,252

717,942

702,687

Net debt to equity ratio (%)

29.1

30.6

33.3

14.0

2.0

(i) Debt is defined as long-term and short term loans as detailed in note 24 and convertible loans as detailed in note

25.