KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2014

59

33.

FINANCIAL INSTRUMENTS (CONTINUED)

Fair value measurement (continued)

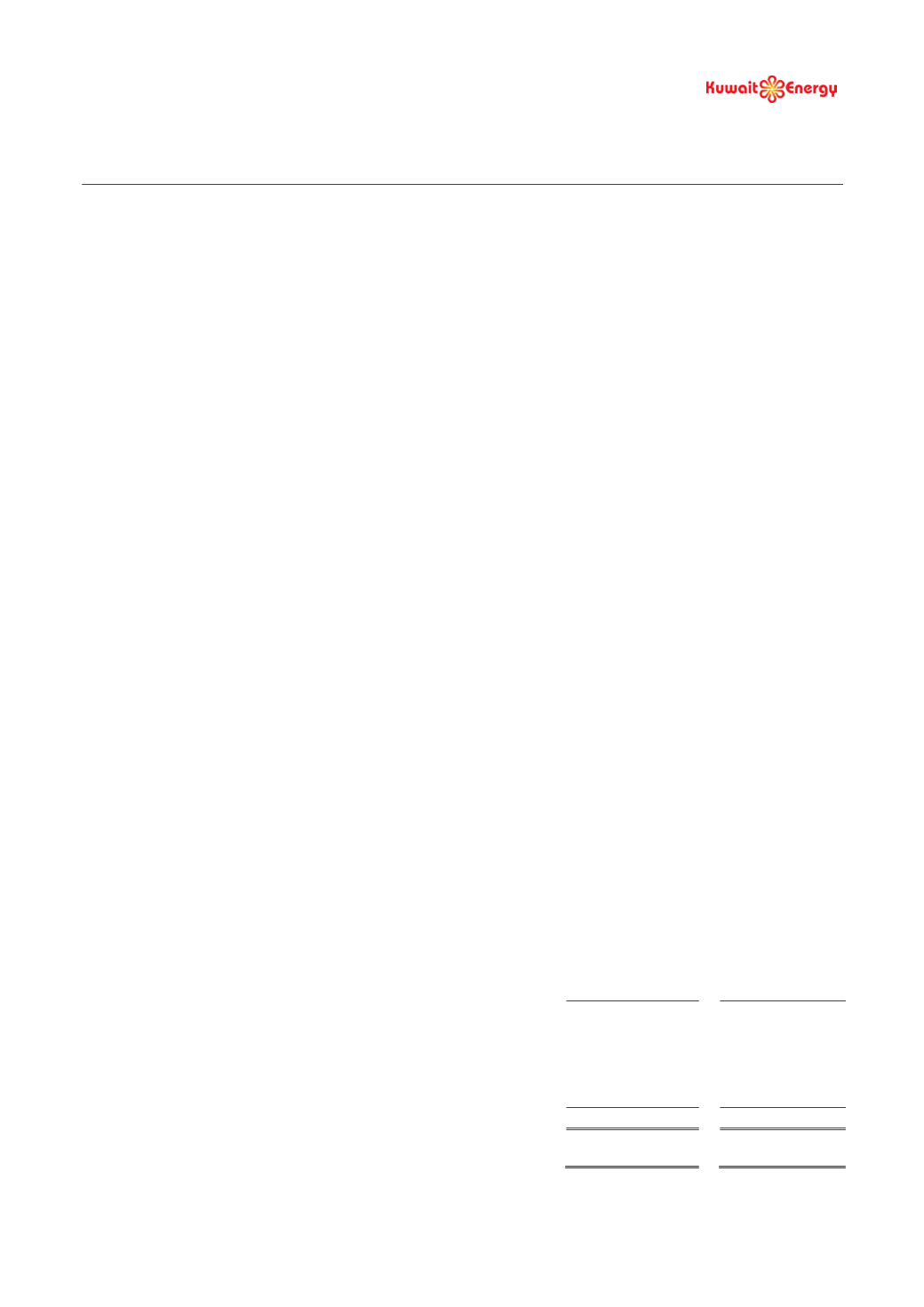

30 June 2013

Level 1

Level 2

Level 3

Total

USD 000’s

USD 000’s

USD 000’s

USD 000’s

Financial liabilities measured at fair value

Financial liabilities at fair value

through profit and loss account (FVTPL):

- Convertible loans

-

-

108,542

108,542

- Derivative financial instruments

-

327

-

327

31 December 2013

Financial assets measured at fair value

Assets classified as held for sale

-

-

51,274

51,274

Financial liabilities measured at fair value

Liabilities directly associated with assets

classified as held for sale

-

-

36,274

36,274

Financial liabilities at fair value

through profit and loss account (FVTPL):

- Convertible loans

-

-

112,551

112,551

- Derivative financial instruments

-

162

-

162

31 December 2012

Financial liabilities measured at fair value

Financial liabilities at fair value

through profit and loss account (FVTPL):

- Convertible loans

-

-

87,244

87,244

- Derivative financial instruments

-

484

-

484

31 December 2011

Financial liabilities measured at fair value

Financial liabilities at fair value

through profit and loss account (FVTPL):

- Derivative financial instruments

-

750

-

750

There were no transfers between Level 1, Level 2 and Level 3 fair value measurements during the period/year.

The following table shows a reconciliation of all movements in the fair value of financial instruments categorised

within Level 3 between the beginning and the end of the reporting period.

Asset classified as

held for sale (net)

Convertible

loans

USD 000’s

USD 000’s

Opening asset/(liability) balance as at 1 January 2014

15,000

(112,551)

Losses arising in the period

(2,600)

(8,593)

Proceeds from disposal

(5,000)

-

Payment

900

4,022

Closing balance as at 30 June 2014

8,300

(117,122)

Total losses for the period included in profit or loss for assets held at

the end of the reporting period

2,600

6,712*

*Net of amounts capitalised within finance costs of USD 1,881 thousand (see note 25).