KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2014

54

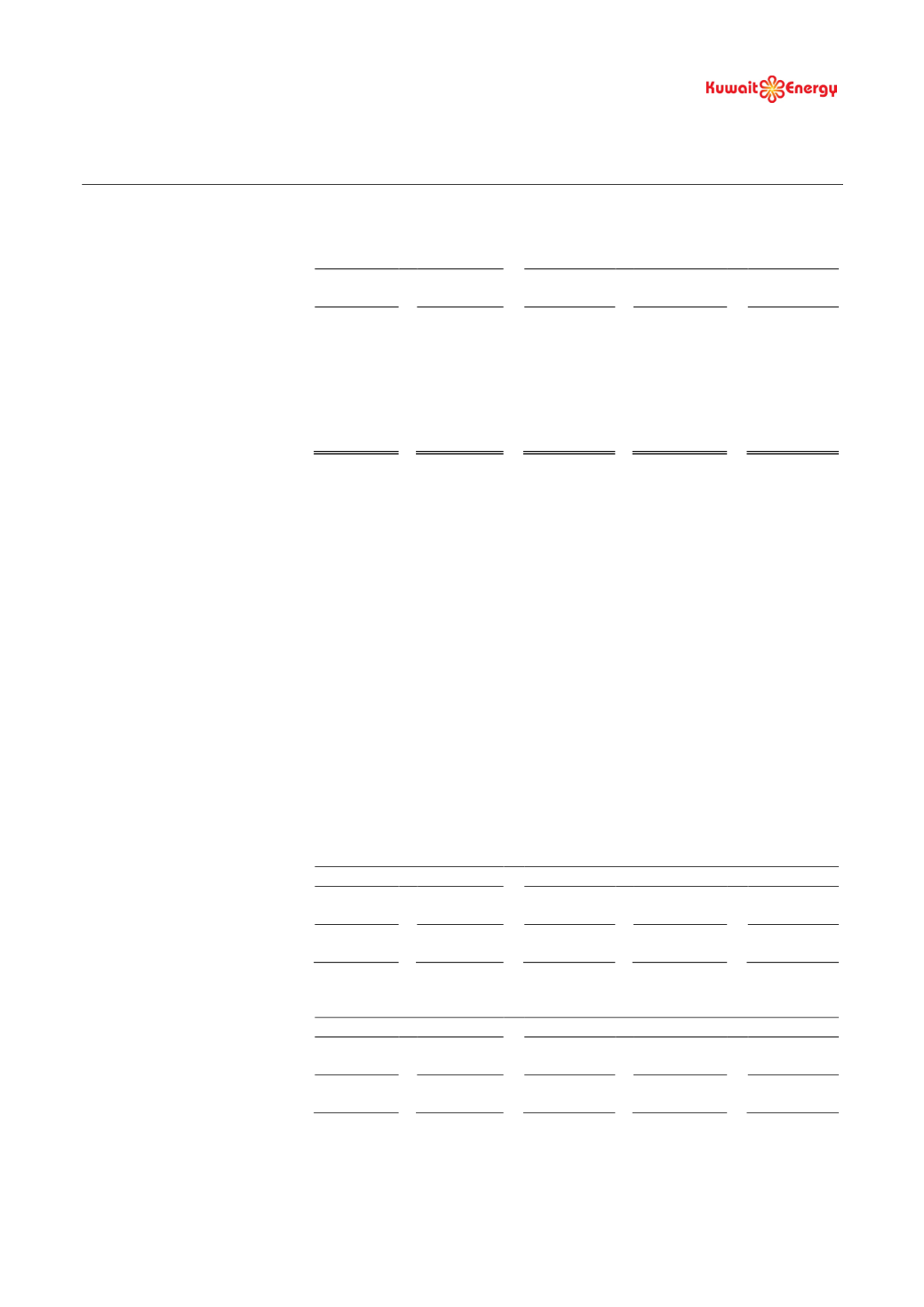

28.

DERIVATIVE FINANCIAL INSTRUMENTS

As at 30 June

As at 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

Audited

Audited

Audited

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

Financial liabilities carried

at fair value through profit

or loss

Held for trading derivatives

not designated in hedge

accounting relationships

(interest rate cap - see below)

-

327

162

484

750

The Group’s derivative financial instruments are all classified as Level 2 in all years. Level 2 fair value measurements

are those derived from inputs other than quoted prices that are observable for the asset or liability either directly (i.e.

as prices) or indirectly (i.e. derived from prices). The reduction in the fair value amounting to USD nil for the period

ended 30 June 2014 (30 June 2013: USD 158 thousand, year ended 31 December 2013: USD 322 thousand, 31

December 2012: USD 266 thousand, 31 December 2011: USD 75 thousand loss) was recognised in the consolidated

income statement.

During 2011 & 2010 the group had an oil put option designated as a cash flow hedge in order to reduce the Group’s

exposure to fluctuations in oil prices. The change in the fair value of oil put option amounting to USD 3,662 thousand

was recognised in the 2011 consolidated statement of comprehensive income and a realised hedge loss of USD 7,101

thousand was recognised in the 2011 consolidated income statement. The oil options were settled in full in 2011 and

no further commodity instruments were entered into.

Derivatives used for hedging purposes but which do not meet the qualifying criteria for hedge accounting are

classified as ‘Held for trading derivatives’.

Interest rate cap is an agreement to cap the interest rate on facilities at 2 % when the LIBOR is more than 2 % and

equal to or less than 5 %. The interest rate cap matured on 30 June 2014.

The notional amounts of interest rate cap together with the fair value is summarised as follows:

Held for trading Derivatives

Notional principal value

As at 30 June

As at 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

Audited

Audited

Audited

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

-Interest rate cap

-

50,000

50,000

50,000

50,000

Fair value (Negative)/ Positive

As at 30 June

As at 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

Audited

Audited

Audited

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

-Interest rate cap

-

(327)

(162)

(484)

(750)

.