KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2014

51

25.

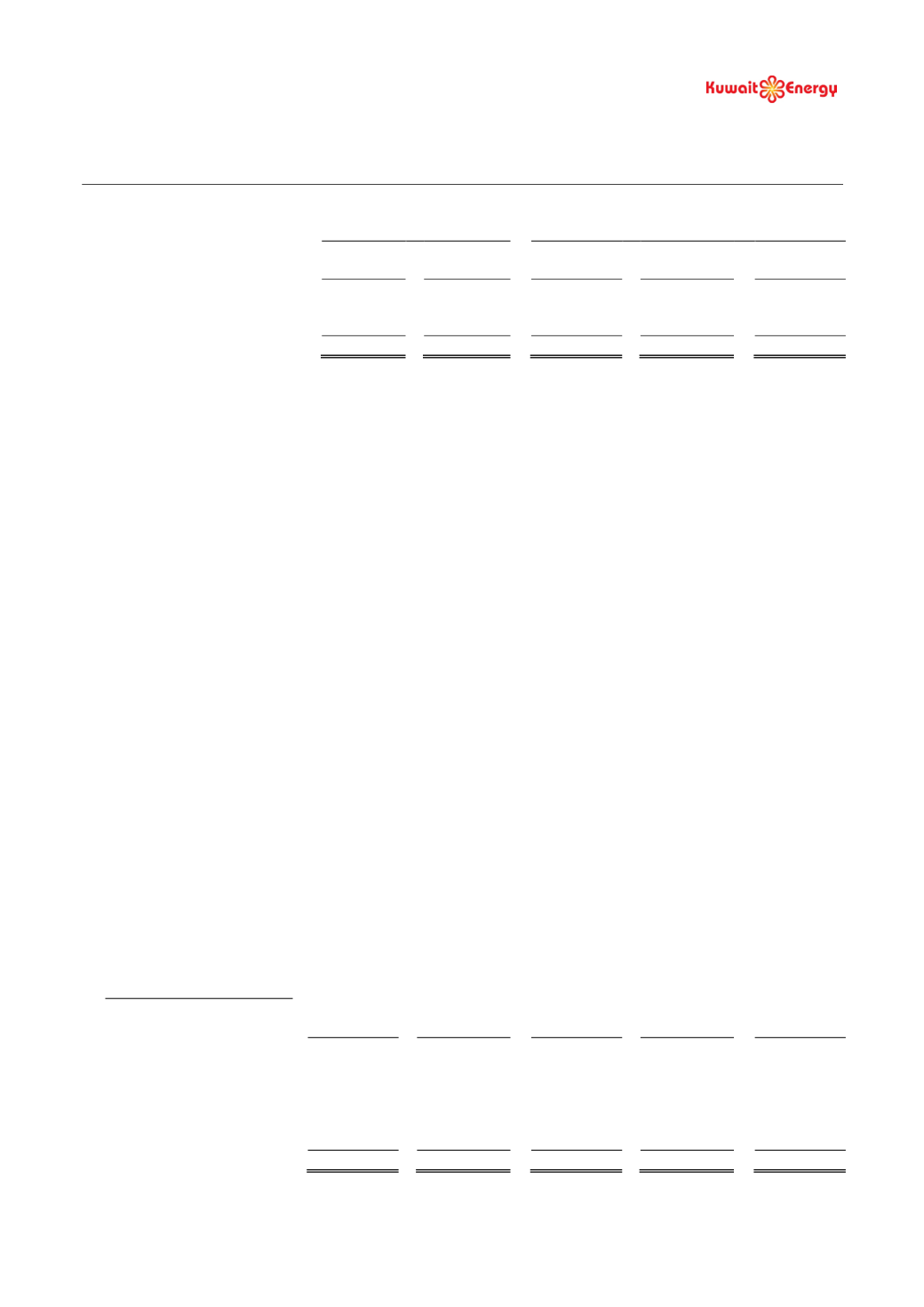

CONVERTIBLE LOANS

As at 30 June

As at 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

Audited

Audited

Audited

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

Non-current portion

114,400

101,786

105,807

83,213

-

Current portion

2,722

6,756

6,744

4,031

-

117,122

108,542

112,551

87,244

-

During 2012, the Group entered into unsecured financing arrangements with Abraaj Capital and Qatar First Bank for

USD 150 million each (total value of USD 300 million). Under the arrangements, the group has drawn down an

amount of USD 100 million, of which USD 83 million was drawn down in 2012 and USD 17 million was drawn

down in 2013. Of the USD 200 million remaining undrawn on the loans USD 50 million has expired and the residual

USD 150 million is subject to certain additional conditions precedent. The loans are repayable in three equal

instalments payable at every six month interval starting from 66

th

month from the first draw down date.

A variety of conversion options exist: if the Group undertakes a public offering of shares raising at least $150 million

of equity (a “Qualifying IPO”), there is mandatory conversion; if no such offering has occurred in the 36 month

period following the first draw down of each loan, the lenders or the company may request early repayment;

alternatively the loans may run to term.

The loans carry a coupon interest of 8% and if the options are not exercised, the outstanding loans, without additional

interest, are repaid in cash as per the repayment schedule.

Should a conversion option be exercised, the outstanding loans, the coupon interest and an additional interest uplift

will be converted into the equity shares of the Company. The additional interest uplift is 8% if conversion is within

36 months of the first draw down and 12% if conversion is after this time (total effective interest rate of 16% / 20%

respectively).

If the conversion options are exercised, the outstanding loans, together with the additional interest uplift outlined

above, are convertible into shares of the Company based on the fair value of the shares on the conversion date. These

embedded options are in the nature of embedded derivatives which have been determined not to be closely related to

the loan arrangements. The group has opted to recognise the convertible loans as financial liabilities at fair value

through the income statement based on the Company’s best estimate at the balance sheet date of the relative

likelihood of the occurrence of each conversion or prepayment option. The fair value at 30 June 2014 assumed a

Qualifying IPO in the second half of 2014 which, at the date of approval of these financial statements, is now not

considered likely to happen.

If a Qualifying IPO had instead been assumed to happen on the first day following the 36 month drawdown

anniversary, which is May 2015 and August 2015 for the Abraaj and QFIB loans respectively, this would have

increased the fair value of the loans at 30 June 2014 by USD 6,688 thousand. If the loans had been assumed to run to

term this would have reduced their fair value at 30 June 2014 by USD 15,586 thousand.

Movement in convertible loan

30.06.2014 30.06.2013 31.12.2013 31.12.2012 31.12.2011

Audited

Unaudited

Audited

Audited

Audited

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

As at 1 January

112,551

87,244

87,244

-

-

Amount drawdown

-

17,000

17,000

83,000

-

Loss due to change in fair

value*

8,593

7,639

15,683

7,113

-

Payment of coupon interest

(4,022)

(3,341)

(7,376)

(2,869)

-

As at end of the period/year

117,122

108,542

112,551

87,244

-

*Change in fair value since the prior period as a result of changes in the forecasted cash flows. Of this amount USD

1,881 thousand (30 June 2013: USD 1,840 thousand, 31 December 2013: USD 3,612 thousand, 31 December 2012: