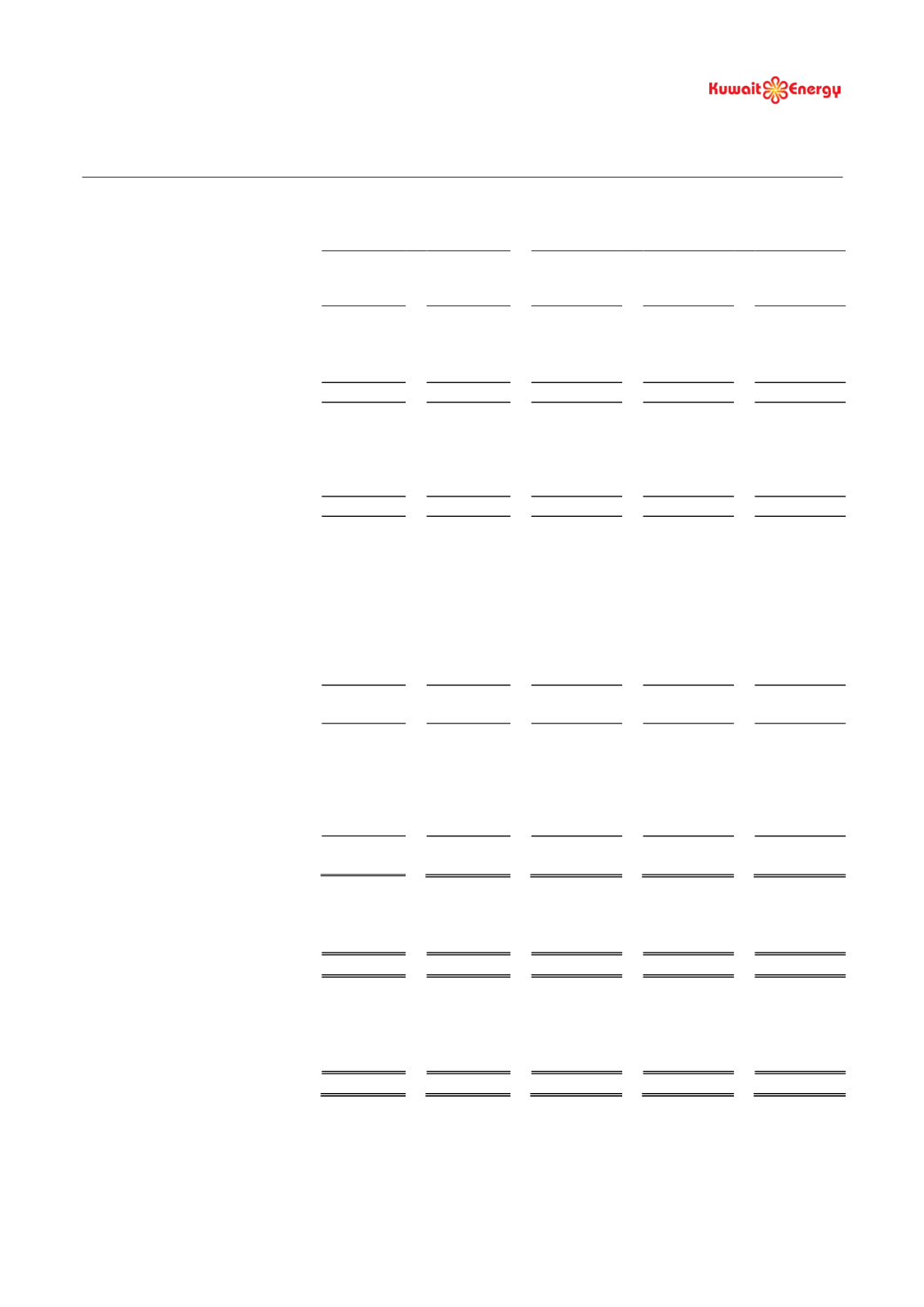

KUWAIT ENERGY plc

CONSOLIDATED INCOME STATEMENT

For the six months ended 30 June 2014

5

For the six months

period ended 30 June

For the year ended 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

(Restated)

(1)

Audited

(Restated)

(1)

Audited

(Restated)

(1)

Audited

(Restated)

(1)

Notes USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

Continuing Operations

Revenue

6

131,004

117,102

262,494

182,976

138,518

Cost of sales

8

(55,304)

(64,632)

(132,226)

(75,816)

(52,989)

Gross profit

75,700

52,470

130,268

107,160

85,529

Exploration expenditure

written off

16

-

(43,852)

(73,255)

(14,304)

(18,053)

Net impairment losses

9

-

(815)

(1,801)

-

-

General and administrative

expenses

(11,883)

(13,938)

(26,261)

(20,791)

(17,903)

Operating profit/(loss)

63,817

(6,135)

28,951

72,065

49,573

Share in results of joint

venture

18

2,571

728

1,543

3,052

1,119

Gain/(loss) on held for

trading derivative

28

-

158

322

266

(75)

Fair value loss on convertible

loans

25

(6,712)

(5,799)

(12,071)

(4,528)

-

Other income

10

269

412

599

223

384

Foreign exchange (loss)/gain

(41)

(3,637)

(3,762)

320

683

Finance costs (net)

11

(3,552)

(4,728)

(10,068)

(1,157)

(7,508)

Profit/(loss) before tax

56,352

(19,001)

5,514

70,241

44,176

Taxation charge

12

(5,455)

(3,858)

(8,097)

(8,272)

(8,731)

Profit/(loss) for the

period/year from

continuing operations

50,897

(22,859)

(2,583)

61,969

35,445

Discontinued operations

Loss for the period/year from

discontinued operations

13

(2,600)

(27,681)

(278,787)

(24,401)

(16,960)

Profit /(loss) for the

period/year

48,297

(50,540)

(281,370)

37,568

18,485

Earnings/(loss) per share

from continuing operations

-

Basic (cents)

14

15.5

(7.1)

(0.8)

19.4

11.3

-

Diluted (cents)

14

15.5

(7.1)

(0.8)

19.4

11.3

Earnings/(loss) per share

from continuing and

discontinued operations

-

Basic (cents)

14

14.7

(15.6)

(86.6)

11.8

5.9

-

Diluted (cents)

14

14.7

(15.6)

(86.6)

11.8

5.9

(1)

Restated to show the investment and results from the Group’s joint venture in Oman using the equity method

following adoption of IFRS 11 on 1 January 2014 and to reflect the Group changing its accounting policy for oil and

gas exploration and evaluation expenditure from the “modified full cost method” to the “successful efforts” method.

Further details are provided in note 2. Equivalent restatements have also been made to the consolidated balance

sheet, consolidated cash flow statement and related supporting notes.