KUWAIT ENERGY PLC

NOTES TO THE CONDENSED SET OF FINANCIAL STATEMENTS

Nine months ended 30 September 2015

8

4.

PROPERTY PLANT AND EQUIPMENT

The Group completed the acquisition of an additional 25% working interest effective 15 January 2015 in the Burg El Arab

(BEA) field in Egypt from Gharib Oil Fields (‘Gharib’) for a purchase consideration of USD 21,361 thousand. The

purchase was accounted for as an asset acquisition rather than a business combination. The net cash outflow arising on

the acquisition was USD 3,984 thousand, which excludes USD 127 thousand cash acquired. The remaining consideration

was settled with receivables due from Gharib. Property, plant and equipment (PP&E) assets with a gross cost of

USD 22,204 thousand were acquired, however the net PP&E additions from the transaction were USD 16,769 thousand

as USD 5,435 thousand had been capitalised in prior periods under the terms of a carry arrangement with Gharib.

The Board approved an exit from Yemen Block 43 effective 30 June 2015. As at 30 June 2015, the carrying value of

Yemen Block 43 was nil (31 December 2014: nil) and following the disposal the associated costs and accumulated

depreciation have been removed with no income statement impact.

On 30 September 2015 the Group completed the assignment of a 10% participating interest in Block 9 exploration,

development and production service contract in Iraq to Egyptian General Petroleum Corporation (EGPC), with an

effective date of 1 July 2013, resulting in a profit of USD 35,000 thousand. The Group now has a 60% share in Block 9.

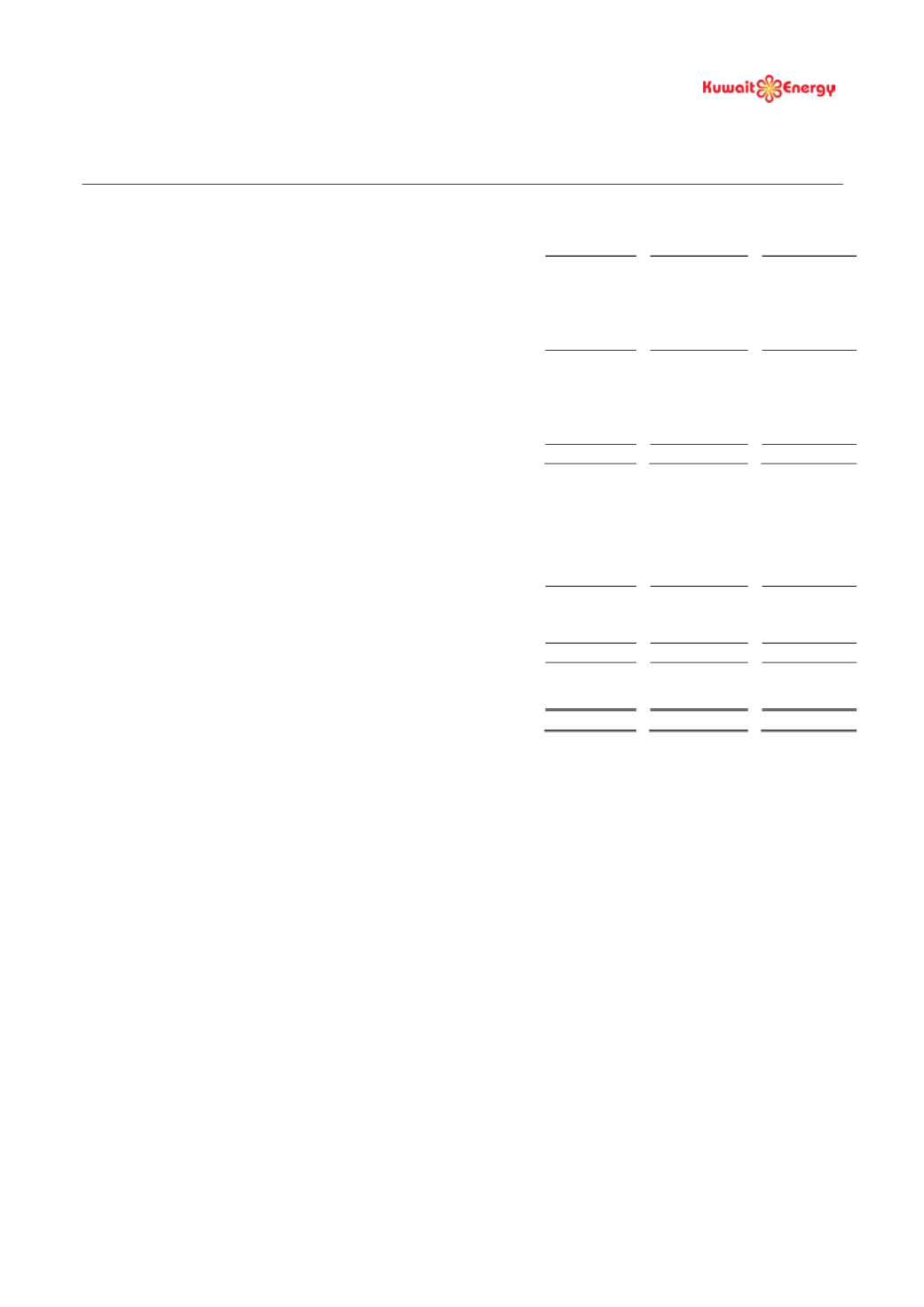

Oil and

gas assets

Other fixed

assets

Total

Cost

USD 000’s USD 000’s USD 000’s

As at 1 January 2014 (audited)

585,008

17,309

602,317

Additions

208,196

1,130

209,326

Disposal

-

(15)

(15)

Transfer from Intangible Exploration and Evaluation

66,996

-

66,996

As at 31 December 2014 (audited)

860,200

18,424

878,624

Additions

142,953

8,352

151,305

Acquisition of asset

16,769

-

16,769

Disposal

(35,942)

-

(35,942)

Transfer from Intangible Exploration and Evaluation

10,499

-

10,499

As at 30 September 2015 (unaudited)

994,479

26,776

1,021,255

Accumulated Depreciation, depletion, amortisation and impairment

As at 1 January 2014 (audited)

246,664

6,686

253,350

Charge for the period

81,853

1,652

83,505

Impairment

19,247

-

19,247

Disposal

-

(15)

(15)

As at 31 December 2014 (audited)

347,764

8,323

356,087

Charge for the period

64,287

723

65,010

Disposal

(24,874)

-

(24,874)

As at 30 September 2015 (unaudited)

387,177

9,046

396,223

Carrying amount

As at 30 September 2015 (unaudited)

607,302

17,730

625,032

As at 31 December 2014 (audited)

512,436

10,101

522,537