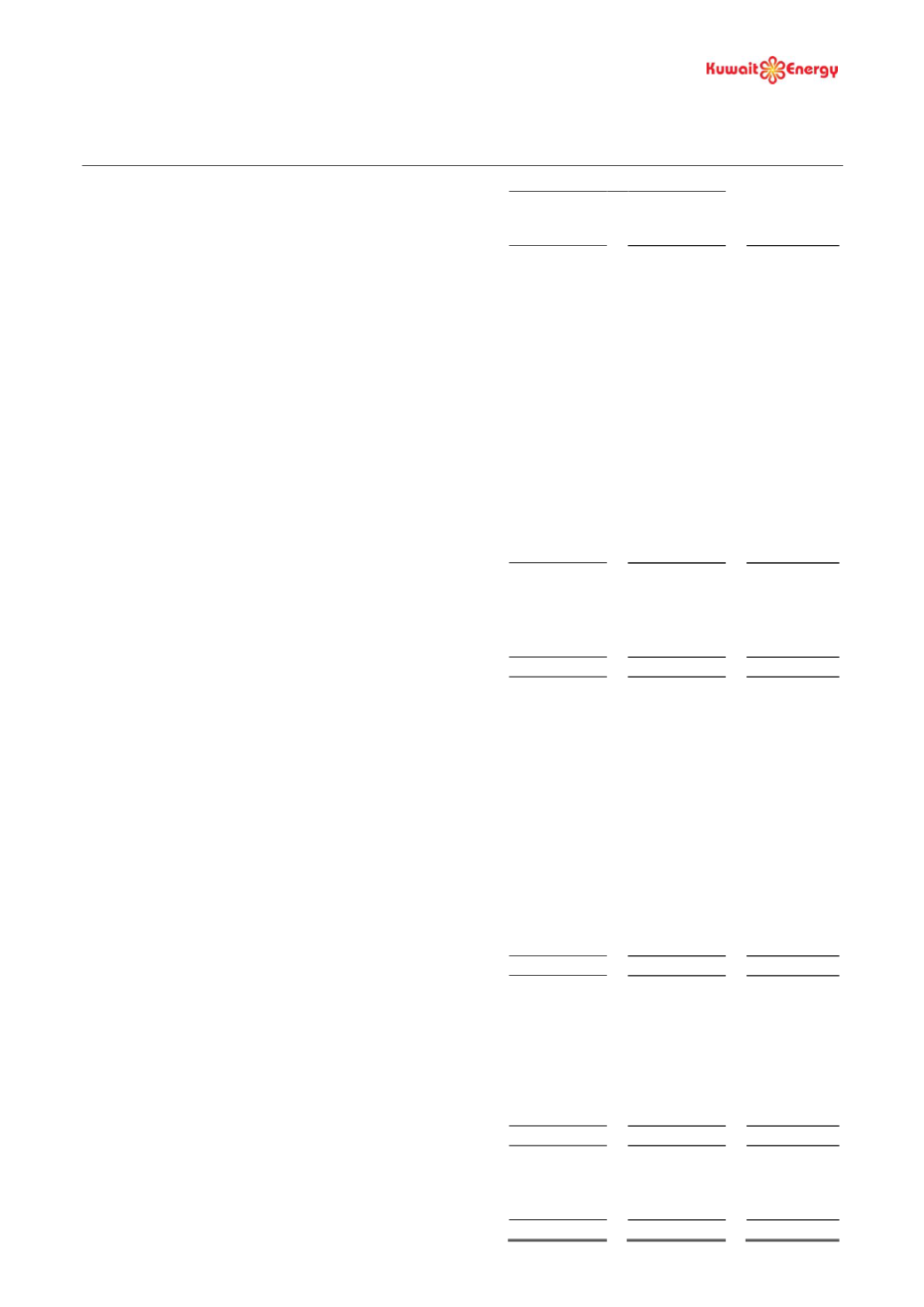

KUWAIT ENERGY PLC

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Nine months ended 30 September 2015

6

Nine months ended 30 September Year ended

31 December

2014

Audited

Note

2015

Unaudited

2014

Unaudited

(Restated)

USD 000’s

USD 000’s

USD 000’s

OPERATING ACTIVITIES

Profit for the period

15,477

60,117

42,703

Adjustments for:

Share of results of Joint Venture

(2,071)

(2,900)

(1,040)

Depreciation, depletion and amortisation

65,010

59,540

83,505

Exploration expenditure written off

2,519

1,611

1,513

Impairment of oil and gas assets

-

-

19,247

Impairment charge on discontinued operations

-

1,700

3,126

Profit on farm-out of working-interest

(35,000)

-

-

Tax charges

1,768

8,212

8,800

Share based expense

-

-

1,066

Foreign exchange loss

1,789

-

Fair value loss on convertible loans

12,296

9,100

9,931

Finance costs

7,004

14,516

12,773

Interest income

(967)

(412)

(568)

Provision for retirement benefit obligation

505

717

1,066

Operating cash flow before movement in working capital

68,330

152,201

182,122

Decrease/(increase) in trade and other receivables

32,995

(44,828)

48,277

(Decrease)/increase in trade and other payables

(31,912)

33,684

29,954

Decrease/(increase) in inventories

1,290

(1,625)

1,223

Tax paid

(9,624)

(8,521)

(8,521)

Net cash generated by operating activities

61,079

130,911

253,055

INVESTING ACTIVITIES

Purchase of intangible exploration and evaluation assets

(9,213)

(45,400)

(49,797)

Purchase of property, plant and equipment

(111,195)

(130,228)

(186,093)

Purchase of other fixed assets

(7,625)

(811)

(1,110)

(Increase)/decrease in capital inventory stores

(5,310)

126

1,284

Proceeds from farm-out of working interests

43,190

-

-

Proceeds from disposal of assets classified as held for sale

-

5,000

13,300

Withdrawal from/(additions to) decommission and

retirement benefit obligation fund

1,050

-

(5,141)

Net cash (outflow)/inflow from acquisition of

assets/subsidiary

(3,857)

499

451

Increase in liquid investments

(50,000)

-

-

Dividend received from Joint Venture

2,000

3,500

3,500

Interest received

743

213

568

Net cash used in investing activities

(140,217)

(167,101)

(223,038)

FINANCING ACTIVITIES

Proceeds from borrowings

-

127,054

127,054

Repayment of borrowings

-

(48,735)

(48,735)

Proceeds from finance lease

5,902

-

-

Purchase of treasury shares

-

-

(1,749)

Finance costs paid

(31,274)

(13,578)

(18,189)

Net cash (used)/generated by financing activities

(25,372)

64,741

58,381

Net (decrease)/increase in cash and cash equivalents

(104,510)

28,551

88,398

Cash and cash equivalents at beginning of the period

215,992

127,594

127,594

Effect of foreign exchange rate changes on cash and cash

equivalents

(1,513)

-

-

Cash and cash equivalents at end of the period

7

109,969

156,145

215,992