In Kuwait Energy, we believe that the development of a risk management plan and a risk appetite statement (RAS)

are critical elements of an effective risk management strategy. We also believe that risk strategies and mitigation

plans need to be aligned with the Group’s strategies, scorecard and business objectives.

In line with these beliefs, in 2015 we embarked on establishing the foundations for the Group’s Enterprise Risk

Management (ERM) framework. The framework allows for the elevation of risk and compliance management to

a strategic level. This best practice framework mitigates risk from all tangible and non-tangible assets. It is also

intended to set the foundation for Risk Management and Compliance for Kuwait Energy.

Our goal is to link our Company’s strategy and scorecard to our risk management plan and risk appetite. This is in

order to create metrics that enable us to better quantify and relate risks to the achievement of business goals and

hence create a higher chance of business success. We have also established risk management as a responsibility at

every departmental level in the Group.

Looking forward, we will be enhancing our key ERM capabilities with a stronger risk management framework.

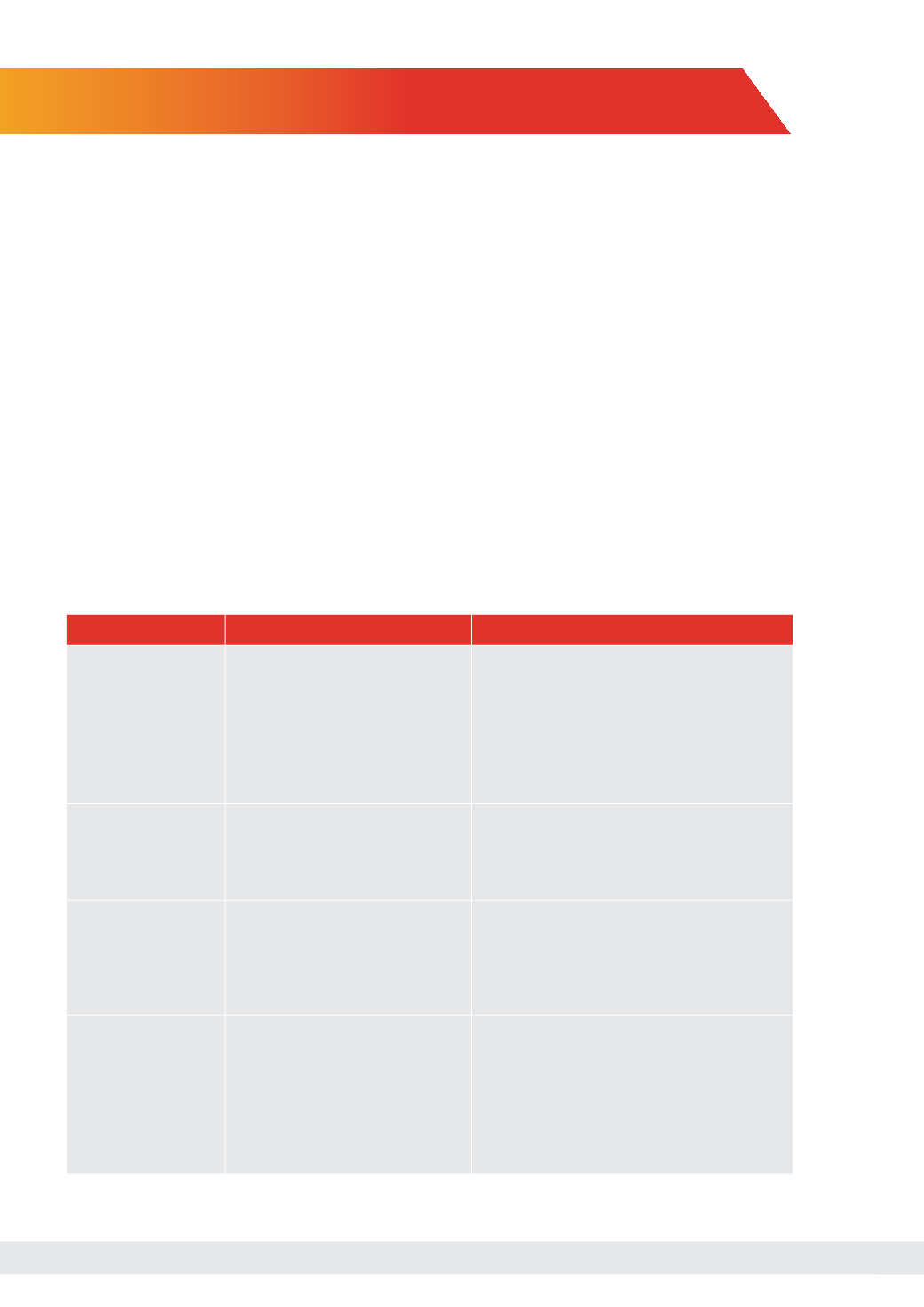

Risks, Detailed Risks and Mitigation

For each risk we identified, we have placed detailed mitigation plans.

Strategic risks

Risks with the potential to impact the Group’s ability to create value for shareholders and meet their expectations include:

Identifed Risk Factor

Detailed Risk

Mitigation

Portfolio Balance

A risk would exist when there

is a lack of diversification in the

Company’s portfolio: Oil vs Gas

projects; geographic diversity;

service vs other contract types; big

projects vs small projects; and being

an operator vs non-operator.

Diversify investments geographically. Explore

opportunities in Iran. Put in place a business

plan that balances capital needs with technical

risk and access. Network and establish solid

partnerships and relations within the business

region.

Replacement Reserves

Inability to replace reserves in the

existing concessions.

Iran opportunities, balanced exploration

program in Egypt and increased subsurface

understanding, application of new technologies.

Acquisitions and partnerships where prudent.

Economic Concerns

Lack of sufficient due diligence in

the planning and evaluation for

new investments and inadequate

management of current assets.

Increased emphasis on higher return margins

and greater balance in economic metrics.

Portfolio must be economically as well as

technically balanced.Optimize capital on best

projects.

Geopolitical Instability

Conflicts in Yemen, growing concerns

with regional countries, the Group’s

Portfolio consists of assets in most

volatile region in the world. Growing

Security issues. Terrorism.

Being an indigenous MENA based company

allows for better understanding and cooperation

and acceptance, protect assets, ease of

communication; appropriate security programs.

Additionally, further portfolio geo-balance

and maintaining a pivotal role in regional

relationships via alliances and CSR programs.

Risk Management Report

46