KUWAIT ENERGY PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2015

32

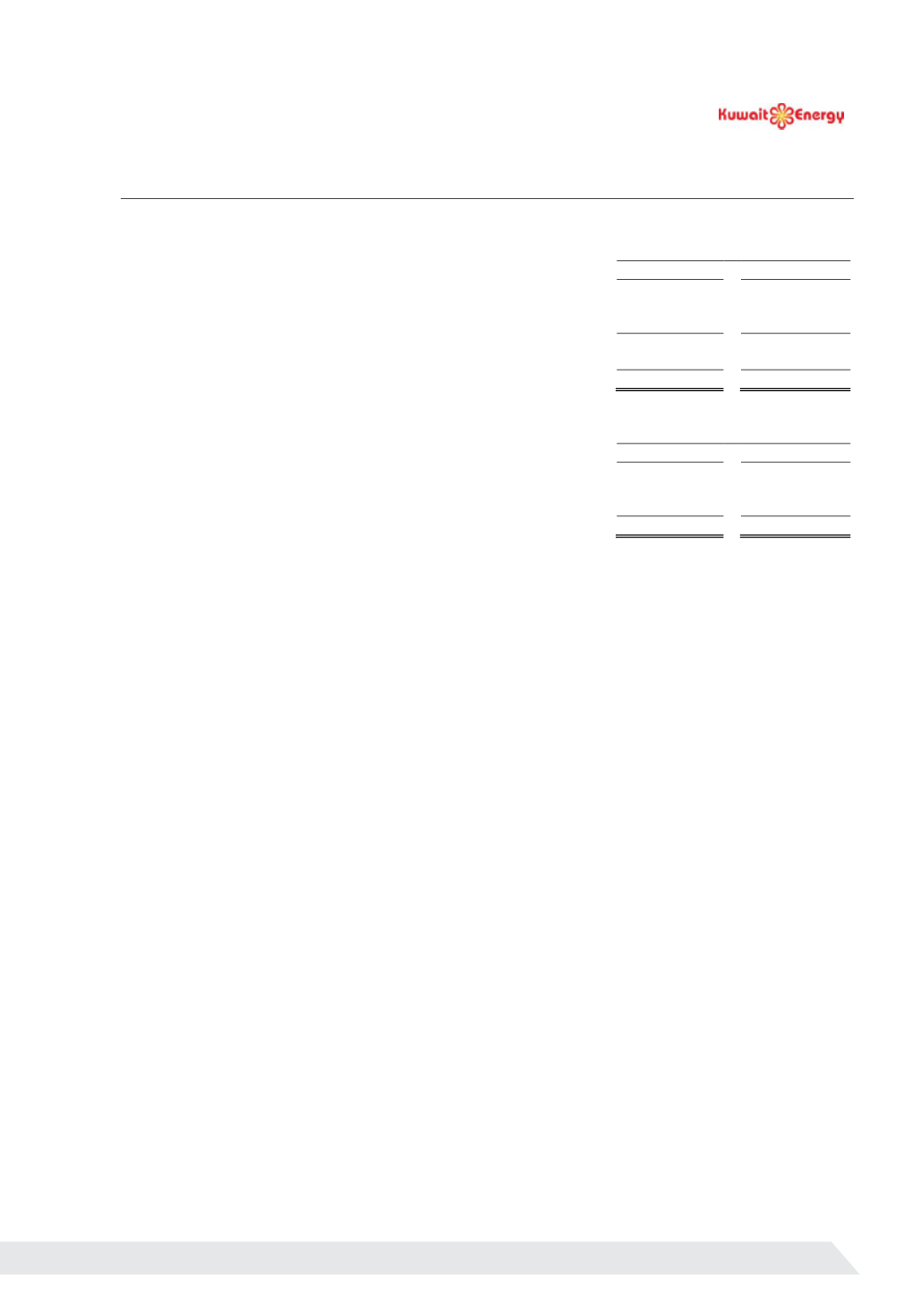

24.

OBLIGATIONS UNDER FINANCE LEASES

Minimum lease payments

2015

2014

Amounts payable under finance leases:

USD 000’s

USD 000’s

Within one year

1,766

-

In the second to fifth years inclusive

4,469

-

6,235

-

Less: future finance charges

(589)

-

Present value of lease obligation

5,646

-

Present value of minimum lease

payments

2015

2014

Amounts payable under finance leases:

USD 000’s

USD 000’s

Within one year (shown under current liabilities)

1,735

-

In the second to fifth years inclusive

3,911

-

Present value of lease obligation

5,646

-

During 2015, the Group sold its new office building in Egypt with a carrying value of USD 7.1 million for a sales

consideration of USD 7.5 million. The Group leased back the sold building under a finance lease for a total lease value

of USD 8.2 million which was settled by USD 1.5 million down payment and the remaining lease payments to be paid

over a lease term of 5 years. The Group has the right to buy the leased building at the end of lease period for an agreed

nominal sale price of USD 1 only. The leased building is recognised as an asset in the consolidated balance sheet at

USD 7.5 million equal to the present value of the minimum lease payments discounted at an implicit interest rate of 5%.

USD 0.4 million excess of sales consideration over the original carrying amount of building has been deferred and

amortised over the lease term.

T

he Group’s obligations under finance leases are secured by the lessor’s rights over the

leased asset. The lease is on a fixed repayment basis and no arrangements have been entered into for contingent rental

payments.

The fair value of the Group’s lease obligation is approximately equal to their carrying value.

79