KUWAIT ENERGY PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2015

30

21.

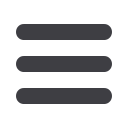

OTHER RESERVES

Treasury

shares

Merger

reserve

Retirement

benefit

obligation

reserve

Share based

compensation

reserve

Total

USD 000’s

USD 000’s

USD 000’s

USD 000’s

USD 000’s

At 1 January 2014

-

(36,140)

137

-

(36,003)

Other comprehensive income for the year

-

-

812

-

812

Acquisition of subsidiary (note 31)

(72,000)

2,331

-

-

(69,669)

Purchase of treasury shares (note 31)

(1,749)

-

-

-

(1,749)

At 31 December 2014

(73,749)

(33,809)

949

- (106,609)

Other comprehensive income for the year

-

-

445

-

445

Acquisition of minority interest

-

220

-

-

220

Share-based payments charges

-

-

-

331

331

At 31 December 2015

(73,749) (33,589)

1,394

331 (105,613)

22.

BORROWINGS

During 2014, the Group issued USD 250 million of 9.5% Senior guaranteed unsecured notes maturing in 2019 (the

“Notes”). Interest on the Notes

are being paid semi-annually in arrears on 4 February and 4 August. The Notes have

been admitted by the Irish Stock Exchange for listing and trade on the Global Exchange Market. The proceeds from the

Notes were received net of amounts used to fully repay the Reserve Based Facilities and the Arab Bank Facility. The

remaining proceeds, after fees, are being used to fund capital expenditure of the Group, particularly in respect of the

Group’s assets in Iraq and for general corporate purposes.

The Notes are callable in whole, or, in part, at the option of the Group prior to maturity (subject to certain conditions

being satisfied).

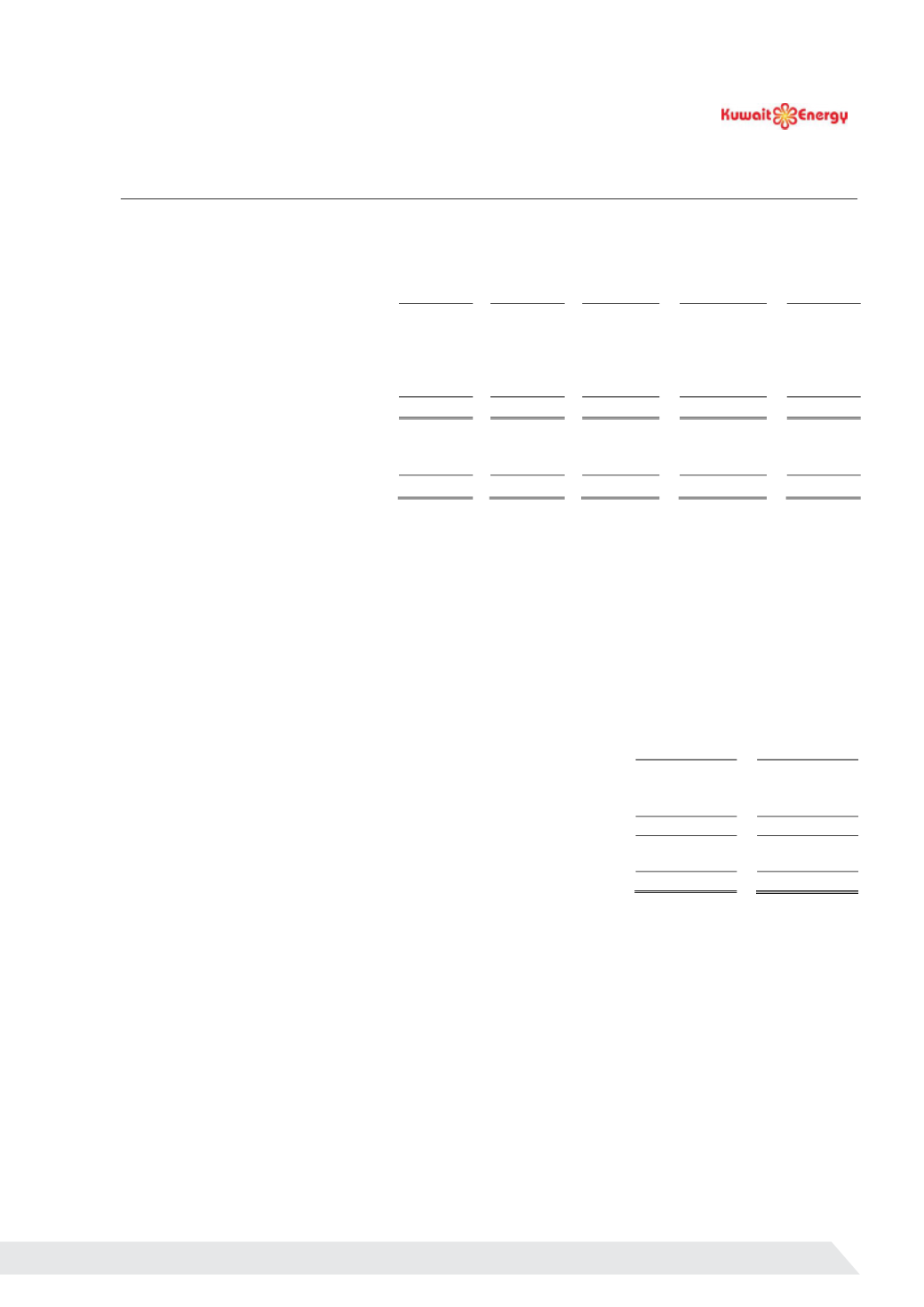

Movement in carrying value of the Notes measured at amortised cost:

2015

2014

USD 000’s

USD 000’s

Par value payable on maturity

250,000

250,000

Unamortised initial transaction fees

(6,674)

(7,541)

Non-current portion of Senior guaranteed notes

243,326

242,459

Interest accrued and payable within 12 months

(included in trade and other payables)

9,896

9,896

Carrying value as at 31 December

253,222

252,355

As at 31 December 2015, the fair value of the Notes measured at an ask price was USD 230.2 million (2014: USD 234.4

million).

77