KUWAIT ENERGY PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2015

25

13.

INTANGIBLE EXPLORATION AND EVAL

UATION (‘E&E’) ASSET

S

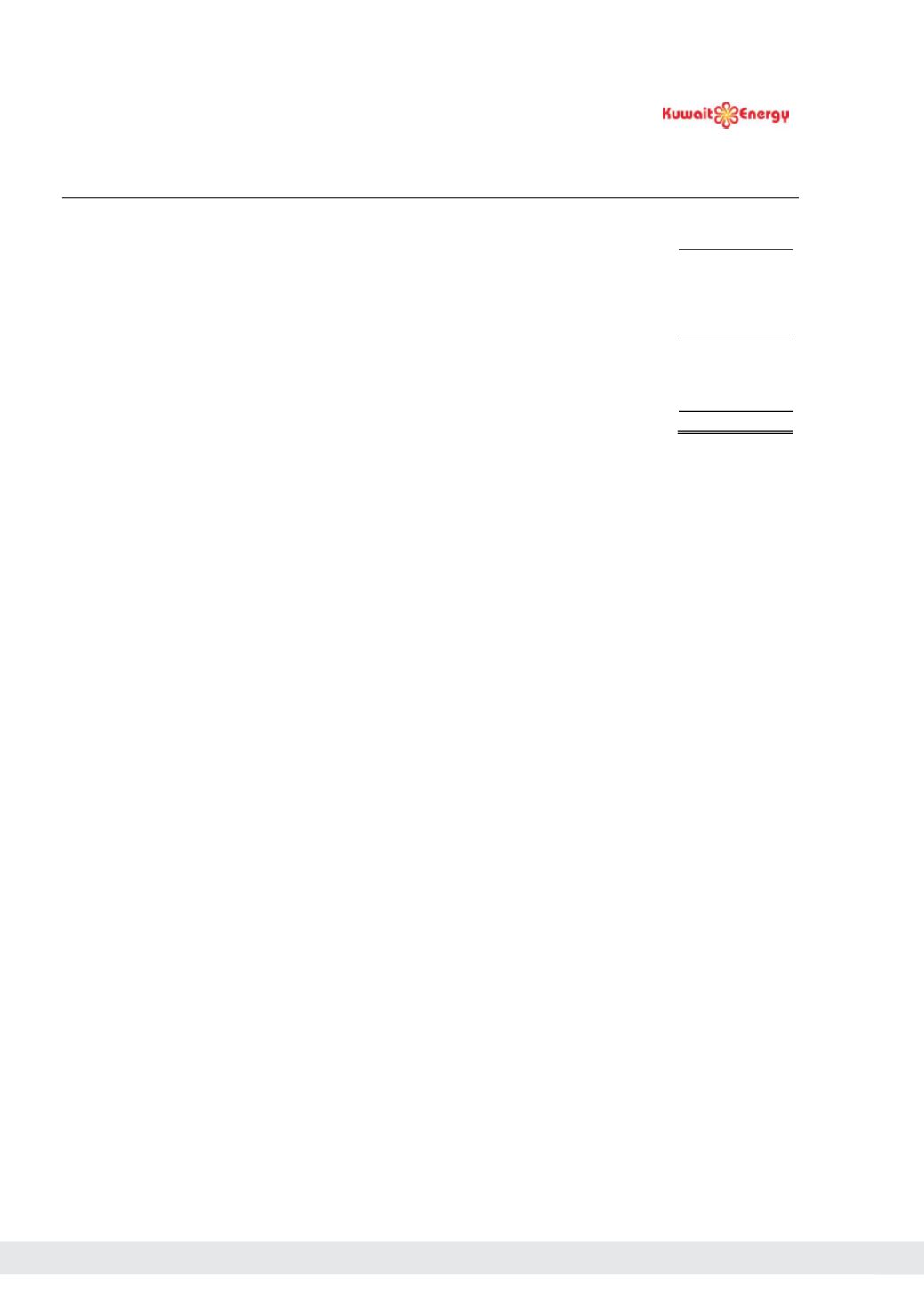

E&E assets

Cost

USD 000’s

At 1 January 2014

58,178

Additions

56,819

Exploration expenditure written off

(1,513)

Transfer to Property, plant and equipment (note 14)

(66,996)

At 31 December 2014

46,488

Additions

10,742

Exploration expenditure written off

(14,218)

Transfer to Property, plant and equipment (note 14)

(10,349)

At 31 December 2015

32,663

As at 31 December 2015, exploration costs of USD 32.7 million (2014: USD 46.4 million) were capitalised pending

further evaluation of whether or not the related oil and gas properties are commercially viable.

As at 31 December 2015, the Group held exploration costs of USD 20.9 million (2014: USD 19.6 million) related to

Block 49 in Yemen where in 2015 the political and security situation has become unstable. The work of operations on

site has been put on hold and force majeure has been declared on Block 49 during the year. There has been no incursion

at the site and control of assets has been maintained. Management have made a significant judgement to continue

capitalising the costs associated with Block 49. In making this judgement, management have considered the existence of

significant contingent resources certified

by the Group’s third party reservoir

engineer, Gaffney Cline & Associates, and

believes that the situation will be resolved so that the Group can continue its exploration and appraisal programme of the

resource discovered to date.

During 2015, exploration cost associated with proven commercial reserves amounting to USD 10.3 million relating to

Abu Sennan in Egypt (2014: USD 56.7 million relating to Block 9 in Iraq and USD 10.3 million relating to Burg El Arab

(BEA) and Abu Sennan in Egypt) were transferred to property, plant and equipment.

Unsuccessful exploration expenditure written off of USD 14.2 million includes USD 11.6 million relating to Block 82 in

Yemen, where the licence has been relinquished due to unsuccessful exploration activities. Further, the Company has

written off unsuccessful exploration expenditure amounting to USD 2.6 million related to Area A in Egypt. Unsuccessful

exploration expenditure written off during 2014 of USD 1.5 million was related to BEA in Egypt.

The additions to exploration and evaluation assets include USD nil (2014: USD 2.4 million) finance costs on qualifying

assets capitalised during the year (see note 9).

72