KUWAIT ENERGY PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2015

20

5.

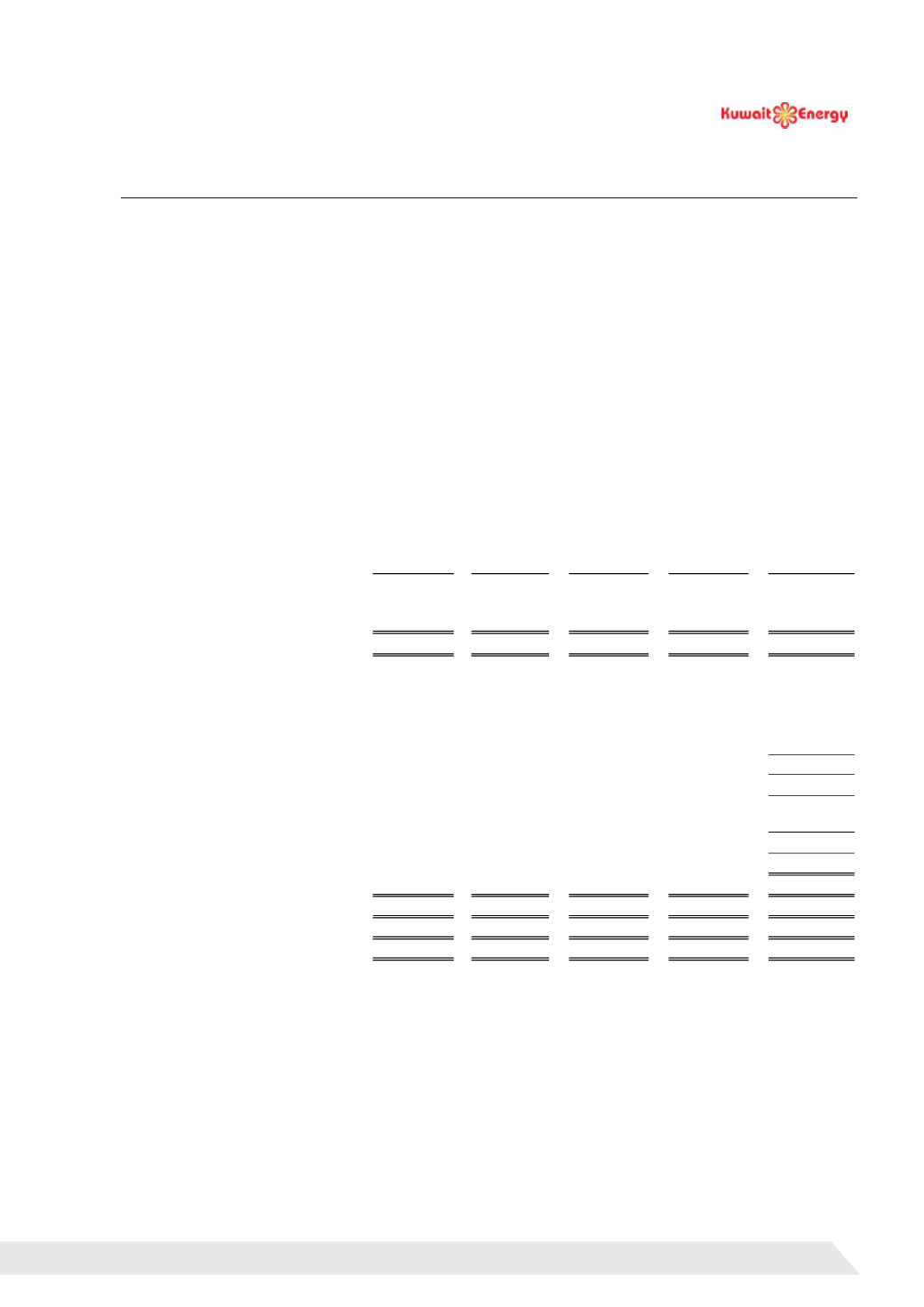

SEGMENTAL INFORMATION

The information reported to the Group’s chief operati

ng decision maker for the purposes of resource allocation and

assignment of segment performance is specifically focused on the geographical area (country), namely Egypt, Yemen,

Iraq and rest of the world (included in Others).

The Group’s revenues

are only from oil and gas sales, therefore all information is being presented for geographical

segments. All of the segment revenue reported below is from external customers. No revenue or assets arose in or relate

to Jersey, the Company’s country of domicile

, in either year.

Other operations include discontinued operations, unallocated expenditure and net liabilities of a corporate nature. The

liabilities comprise the Company’s external debt and other non

-attributable corporate liabilities. The unallocated capital

expenditure for the year comprises the acquisition of non-attributable corporate assets.

Information about major customers

The

Group’s largest customer is

EGPC. Revenue for the year from EGPC, which all arises in the Egypt segment, was

approximately USD 146.8 million (2014: USD 213.6 million). The Group

’s

other major customer is Exxon Mobil in

Yemen and the revenue for the year from Exxon Mobil was USD 8.9 million (2014: USD 48.0 million), all of which

arose in the Yemen segment.

The

following is an analysis of the Group’s revenue and results by reportable segments:

Egypt

Yemen

Iraq

Others

Total

USD

000’s

USD

000’s

USD

000’s

USD

000’s

USD

000’s

31 December 2015

Segment revenues

146,774

8,868

-

-

155,642

Segment operating profit/(loss)

(5,498)

(34,338)

8,533

(9,715)

(41,018)

Share of results of Joint Venture

-

-

-

445

445

Fair value loss on convertible loans

(9,261)

Other income

1,231

Foreign exchange loss

(1,851)

Finance costs

(9,654)

Loss before tax

(60,108)

Taxation charges

(2,259)

Loss for the year from continuing

operations

(62,367)

Loss from discontinued operations

-

Loss for the year

(62,367)

Segment assets

288,959

86,198

401,718

83,547

860,422

E&E assets

11,792

20,871

-

-

32,663

PP&E

202,805

45,764

371,467

1,535

621,571

Segment liabilities

48,210

22,828

52,878

381,585

505,501

Other information

Exploration expenditure written off

2,590

11,628

-

-

14,218

Impairment of oil and gas assets

35,810

8,544

24,656

-

69,010

Additions to E&E

8,037

2,705

-

-

10,742

Additions to PP&E

59,532

(410)

163,113

30

222,265

Depreciation, Depletion and

Amortisation

62,869

5,213

-

1,065

69,147

67