KUWAIT ENERGY PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2015

22

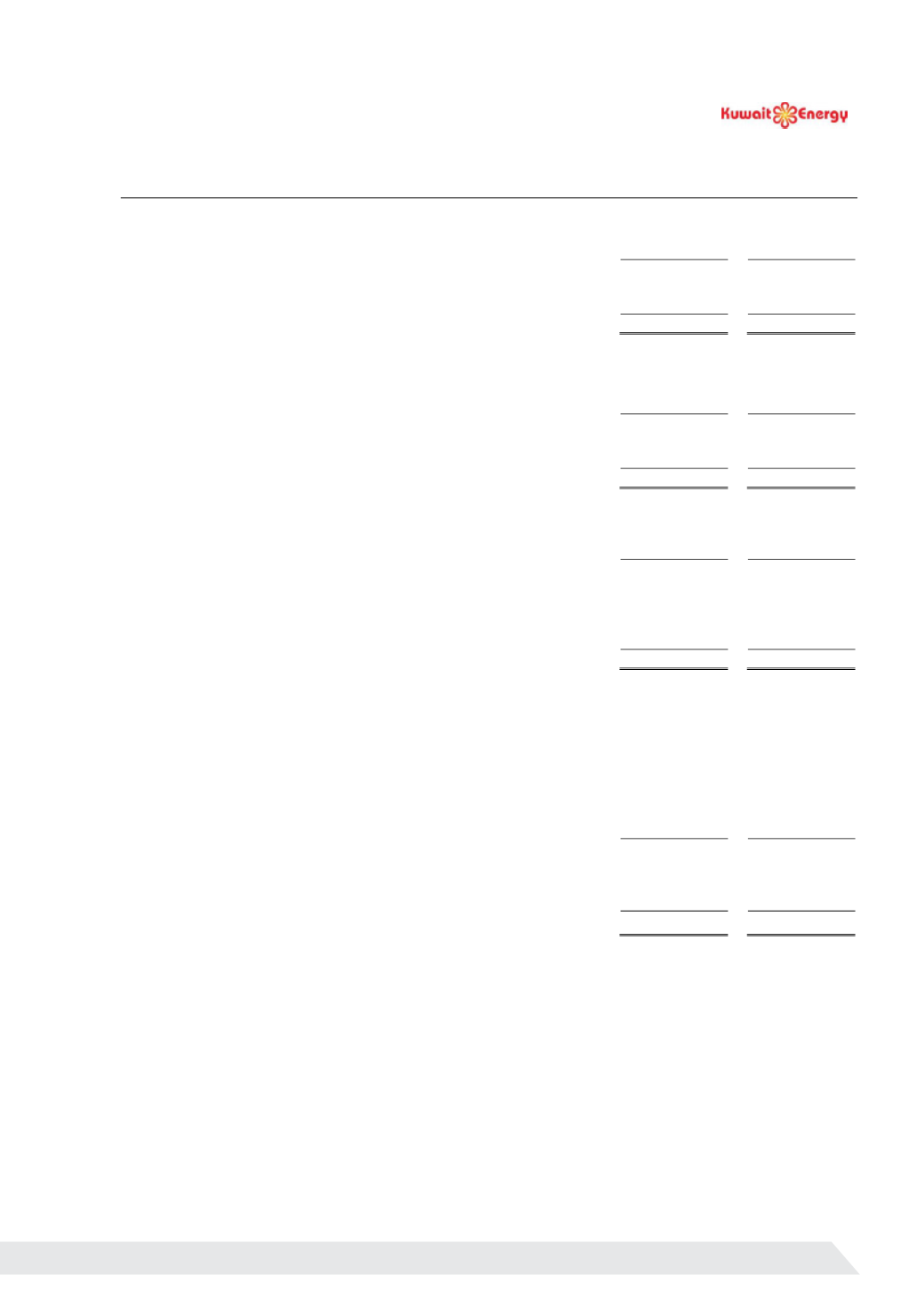

6.

REVENUE

Year ended

2015

Year ended

2014

USD 000’s

USD 000’s

Oil sales

153,844

270,759

Gas sales

1,798

-

155,642

270,759

7.

COST OF SALES

Year ended

2015

Year ended

2014

USD 000’s

USD 000’s

Operating costs

61,330

58,651

Depletion and amortisation of oil and gas assets (note 14)

67,757

81,853

129,087

140,504

8.

GENERAL AND ADMINISTRATIVE EXPENSES

Year ended

2015

Year ended

2014

USD 000’s

USD 000’s

Staff costs charged to administrative expenses

5,048

10,953

Professional and consultancy fees

3,331

11,233

Depreciation of other assets (note 14)

1,390

1,652

Other expenses

8,452

8,831

18,221

32,669

A proportion of the

Group’s staff cost

s

are recharged to the Group’s joint venture partners, a proportion is allocated to

operating costs and a proportion is capitalised into the cost of fixed assets under the Group’s accounting policy for

exploration, evaluation and production assets, with the remainder classified as an administrative overhead cost in the

income statement, as shown above.

9.

FINANCE COSTS

Year ended

2015

Year ended

2014

USD 000’s

USD 000’s

Borrowing costs on senior guaranteed notes and bank loans

25,669

22,409

Other finance costs

452

104

Less: amount capitalised in cost of qualifying assets

(16,467)

(9,740)

9,654

12,773

Finance cost of USD 16.5 million (2014: USD 7.3 million) have been capitalised to property, plant and equipment during

the year and USD nil (2014: USD 2.4 million) have been capitalised to intangible exploration and evaluation assets using

a weighted average interest rate of 10.6% (2014: 8.45%).

69