Second Quarter 2014 Activity Report

Page 5

Key activities during the period

Financial

Credit Rating:

Kuwait Energy has been issued a B- credit rating from Fitch and Standard & Poor’s and issued

a US$250 million Corporate Bond on 4 August 2014.

Debt:

At the end of Q2 2014, Kuwait Energy had total debt of US$254 million. This consisted of US$104

million under the reserve based lending facility, US$50 million under the Arab Bank facility and US$100

million under its convertibles with Abraaj and Qatar First Bank.

Egypt Receivables

: At the end of Q2 2014, the outstanding receivables from EGPC were US$124 million as a

result of collecting US$70 million in cash during the second quarter of 2014. On 9 July, a US$26 million oil

cargo was received.

Operations

Health, Safety, Sustainability and Environment:

Kuwait Energy classifies its recordable incidents as Lost

Time Incidents – Fatalities and Injuries (LTI), Restricted Work Incidents (RWI) and Medical Treatment

Incidents (MTI).

Kuwait Energy had two recordable incidents during the second quarter of 2014 in its operated areas. One LTI

occurred in Yemen Block 5, where a sub-contractor suffered a hand fracture while moving pipes resulting in

nearly 4 weeks off work; and one RWI occurred in Area A, Egypt from a cut to the hand while cutting wood

in the maintenance workshop.

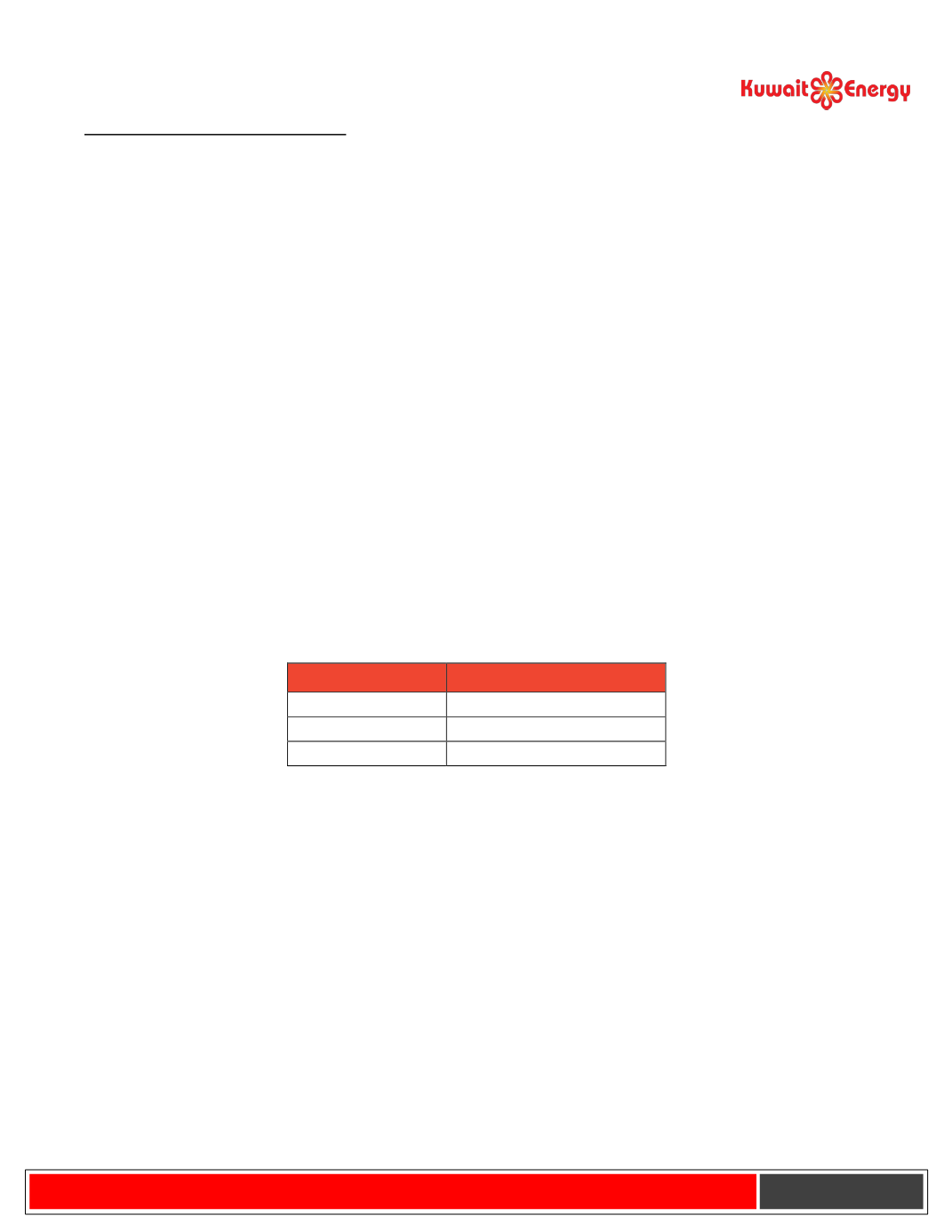

The following table provides days without LTI at the end of second quarter 2014, for the countries in which

Kuwait Energy operates:

Country

Days without LTI

Iraq

856

Egypt

383

Yemen

76

Exploration:

In Q2 2014, one exploration well, BEA SW-1, was spud in BEA, Egypt and was undergoing

testing at the end of the quarter. Two of the exploration wells spud during the first quarter of 2014

underwent testing, with the BEA NW-1X well in Egypt producing at an initial rate of 340 bopd and the Al

Jahraa-2X well in Abu Sennan, Egypt producing at an initial rate of 1,200 bopd. Drilling is continuing on the

Iraq Block 9 exploration well, Faihaa-1, which reached primary target in July.

Development

: In Q2 2014, 11 development wells were spud: 8 in Oman, 2 in Egypt and 1 in Iraq. The

significant contributor to the increase in production from the previous quarter was the Shahd SE-8 well in

ERQ, Egypt which produced at an initial rate of 3,750 boepd (Kuwait Energy WI share 1,856 boepd).

Reserves & Resources

: During Q2 2014, Kuwait Energy had its MENA reserves and resources as at 31 May

2014 audited by Gaffney Cline & Associates (GCA). The proven and probable reserves as at 31 May 2014

were 165.7 mmboe which decreased from the year-end 2013 proven and probable reserves of 213.1

mmboe primarily due to the exclusion of Eurasia.