Second Quarter 2014 Activity Report

Page 6

2.

R

ESERVES AND

R

ESOURCES

:

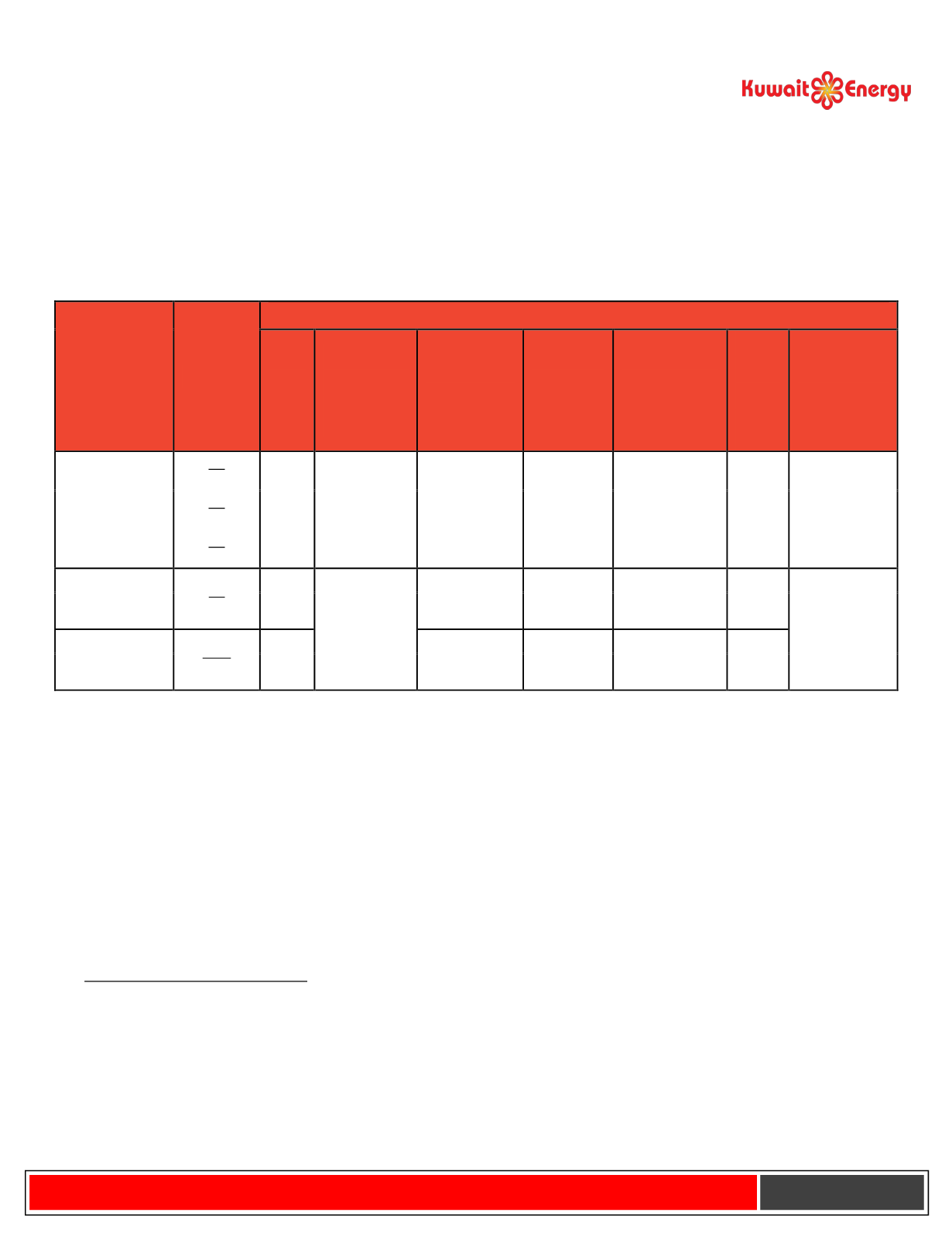

Kuwait Energy engaged GCA, an independent energy consulting firm, to undertake an audit of its MENA reserves

and resources. As at 31 May 2014, Kuwait Energy’s working interest Proven and Probable (2P) reserves are 165.7

mmboe, working interest contingent resources were 850.0 mmboe and the best estimate of risked prospective

resources was 27.3 mmboe. A breakdown of the reserves and resources is shown in the tables below:

Classification Category

Kuwait Energy Reserves and Resources (in mmboe)

YE13

Jan-May

2014

Production

Exploration

adds

Revisions

Acquisitions

and

Divestments

MY14

as at

31

May

MY14-Net

Entitlement

Reserves

1P

90.5

-3.0

0.0

2.7

-0.1

90.2

26.8

2P

213.1

0.1

2.1

-46.6*

165.7

37.3

3P

300.7

0.2

-0.4

-93.5

204.0

47.5

Contingent

resources

2C

853.0

0.0

-2.0

-0.7

850.0

Prospective

resources

Best

37.1

0.0

-1.6

-8.1

27.3

*

Due to divestment of Ukraine and Russia assets

Proven Reserves Replacement Ratio (RRR) = 88%

Proven plus Probable Reserves Replacement Ratio (RRR) = -1503%

Notes

1.

Reserves and resources estimates are Kuwait Energy working interest.

2. Prospective resources are risked.

3. Estimates above exclude Karim Small Fields (Oman) which is covered by a Service Agreement and does not allow external reserves reporting.

4. For MY14, gas and condensate volumes were converted to oil equivalent volumes using conversion factors of 6.0 mscf/boe and 1.0 bbl/boe

respectively.

5. Reserves replacement ratio takes into account acquisition or divestment activities during the year.

6. Contingent Resources do not include Pakistan.

Reserves and Resources Definition

Reserves and resources have been estimated in accordance with the 2007 PRMS – commonly referred to as the SPE PRMS

as approved/endorsed by SPE, WPC, AAPG and SPEE.