Second Quarter 2014 Activity Report

Page 10

5.

E

XPLORATION

A

CTIVITY

:

Exploration expenditure during the Q2 2014 was US$23.0million, which was primarily spent on exploration

drilling in Egypt and Iraq. The table below provides the status of the wells drilled during 2014:

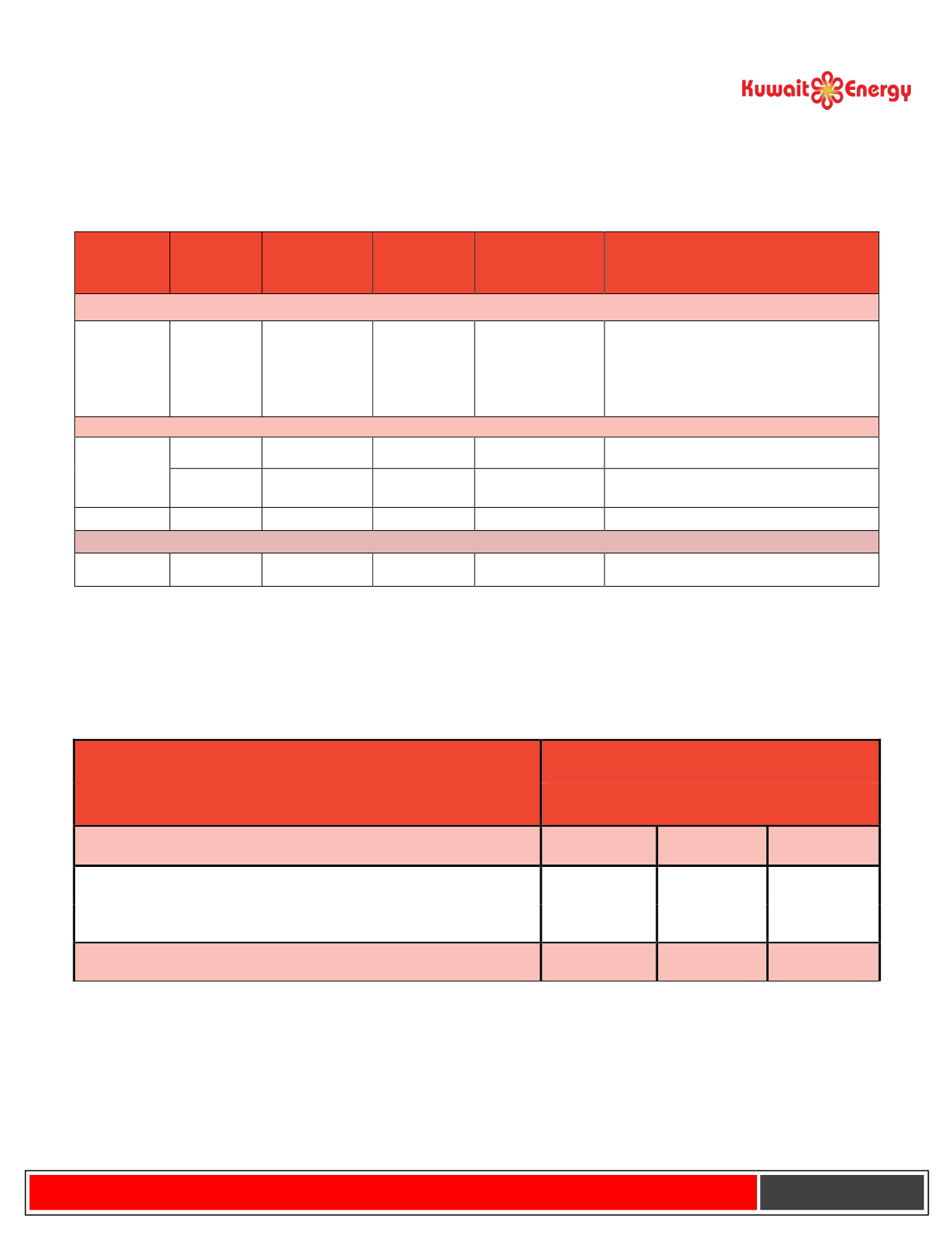

Country

Basin/

Area

Well

Target

Kuwait Energy

Cost Interest

Well Status at end Q2 2014

2013 Carry-over wells

Egypt

ERQ

Diaa-2

Oil

49.5%

Exploration target encountered no

hydrocarbon shows, however producing

from the already discovered Upper

Bahariya formation with an initial gross

rate of 100 bopd

Q1 2014

Egypt

BEA

BEA NW-1X

Oil

75.0%

Producer with an initial rate of 340 bopd

Abu

Sennan

Al Jahraa-2

Oil

78.0%

Producer with an initial rate of 1,200

bopd

Iraq

Block 9

Faihaa-1

Oil

70.0% *

Drilling

Q2 2014

Egypt

BEA

BEA SW-1

Oil

75%

Testing

* Pursuant to a farm out arrangement entered into with EGPC for a 10% working interest share in Block 9, Kuwait Energy’s cost

interest in Block 9 will be reduced to 60% upon the fulfilment of certain conditions precedent, including written approval from

the Iraqi government

6.

Q2 2014 F

INANCIALS

:

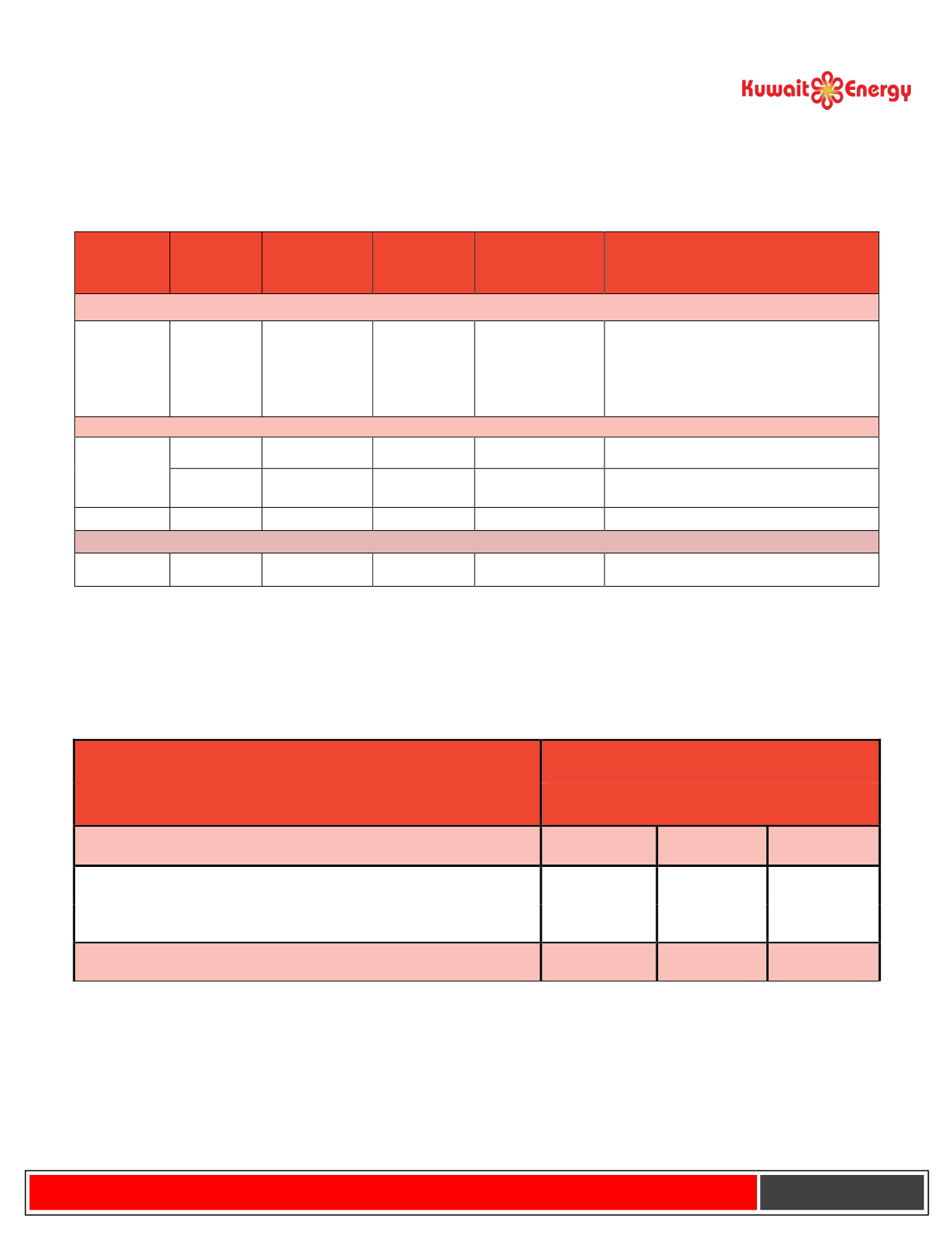

Unaudited Consolidated Statement of Income:

Consolidated Statement of Income

Actual

US$ Million

Q2 2014

Q1 2014

Q2 2013

Revenue (Net Sales)

72.3

67.3

64.2

Operating & General and Administrative Expenses

(19.5)

(21.0)

(22.6)

Operating Profit*

52.8

46.3

41.6

Notes:

All financial numbers are based on management accounts and are unaudited. Revenue reported is net of government

take and is based on management accounts which are unaudited.

The financial numbers for 2013 are restated on account of (a) Eurasia assets being classified as ‘held for sale’ as per

2013 audited accounts (b) Oman numbers being excluded due to application of IFRS 11 applicable from 1 Jan 2014.

*Operating profit is operating profit before depletion, impairment and exploration write-off