KUWAIT ENERGY PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2017

41

22.

BORROWINGS

In 2014, the Group issued US$ 250 million of 9.5% senior guaranteed unsecured notes maturing in August 2019 (the

“Notes”). Interest on the Notes is paid semi-annually in arrears on 4 February and 4 August. The Notes are listed on

the Global Exchange Market of the Irish Stock Exchange. The Notes are callable in whole, or, in part, at the option of

the Group prior to maturity, subject to certain conditions being satisfied.

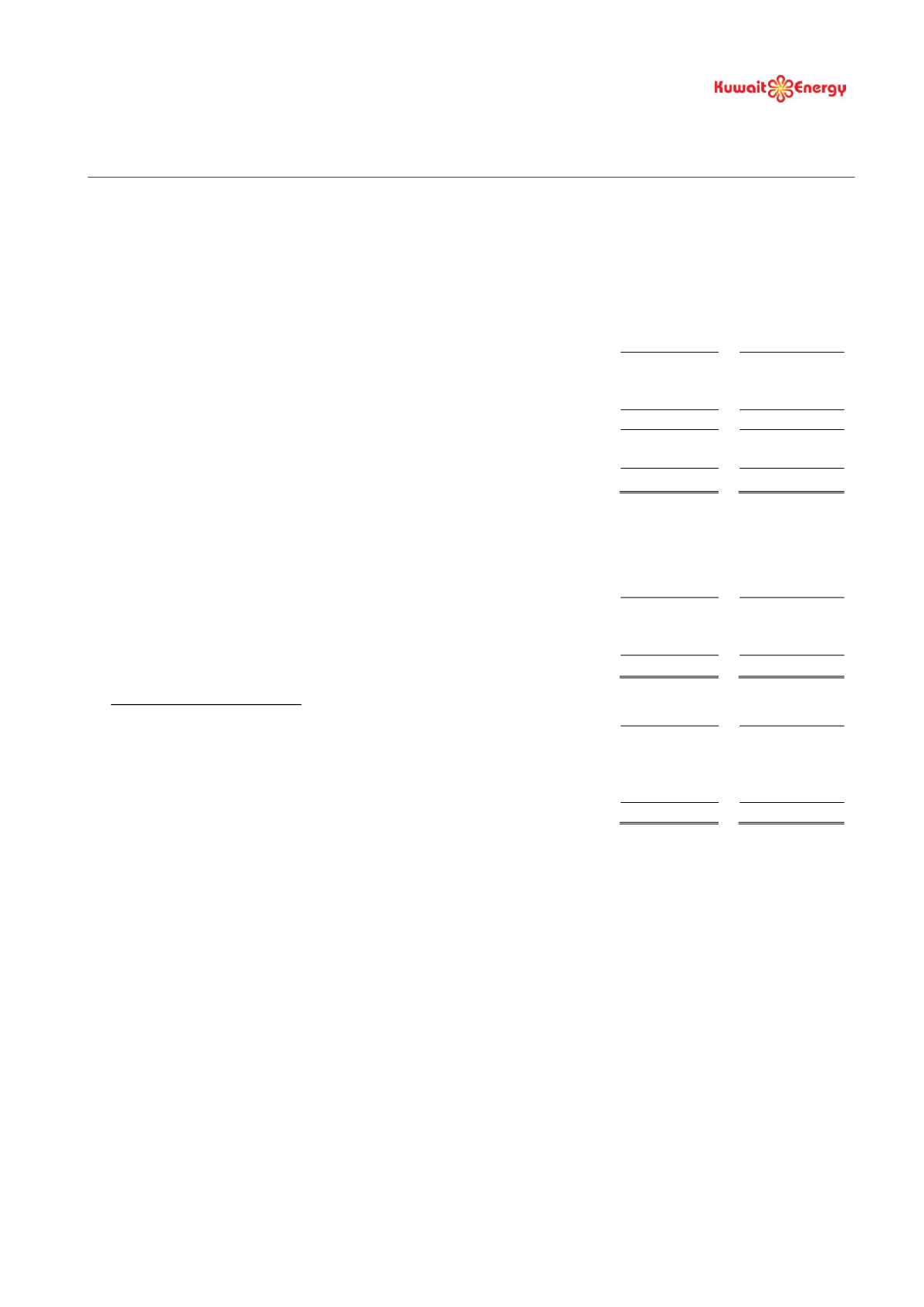

Movement in carrying value of the Notes measured at amortised cost:

2017

2016

US$ 000’s

US$ 000’s

Par value payable on maturity

250,000

250,000

Unamortised initial transaction fees

(3,443)

(5,140)

Non-current portion

246,557

244,860

Interest accrued and payable within 12 months

(included in trade and other payables)

9,896

9,896

Carrying value as at end of the year

256,453

254,756

As at 31 December 2017, the fair value of the Notes was US$ 216.3 million (2016: US$ 232.8 million).

23.

CONVERTIBLE LOANS

2017

2016

US$ 000’s

US$ 000’s

Non-current portion

-

117,198

Current portion

158,204

19,075

158,204

136,273

Movement in convertible loan

2017

2016

US$ 000’s

US$ 000’s

As at 1 January

136,273

119,400

Change in fair value*

32,255

27,211

Payment

(10,324)

(10,338)

As at 31 December

158,204

136,273

*Of this amount US$ 3.5 million (2016: US$ 2.4 million) has been capitalised to qualifying assets in the period, see note 13, resulting in a net charge

to the consolidated income statement of US$ 28.7 million (2016: US$ 24.8 million).

During 2012, the Group entered into unsecured financing arrangements with Abraaj Capital and Qatar First Bank for

US$ 150 million each (total value of US$ 300 million). Under the arrangements, the Group has drawn down an amount

of US$ 100 million. There is no remaining availability to draw down additional amounts.

If the Group undertakes a public offering of shares raising at least US$ 150 million of equity, there is mandatory

conversion; if no such public offering has occurred by the 36 month following the first draw down of each convertible

loan, a period which elapsed in 2015 and 2016, the Company has the option for early repayment together with a

prepayment premium.

During 2017, the Group and KEC SPV 1 (an entity managed and controlled by Abraaj Investment Management Limited)

holding 50% of the convertible loans principal amended certain terms of the convertible loan agreement to defer the

first repayment date to mid-2018. The loans are repayable in three instalments within six months starting from first

repayment date. The lender have option to request conversion of loan into ordinary shares of the Company prior to

the first repayment date in certain circumstances as set out in the loan agreement. Subsequent to 31 December 2017

(see note 34), the Group has received an irrevocable notice of conversion from Qatar First Bank holding other 50% of

the convertible loan principal, to convert the principal and part of the premium amount outstanding into ordinary

shares of the Company under terms of the convertible Murabaha.