KUWAIT ENERGY PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2017

44

26.

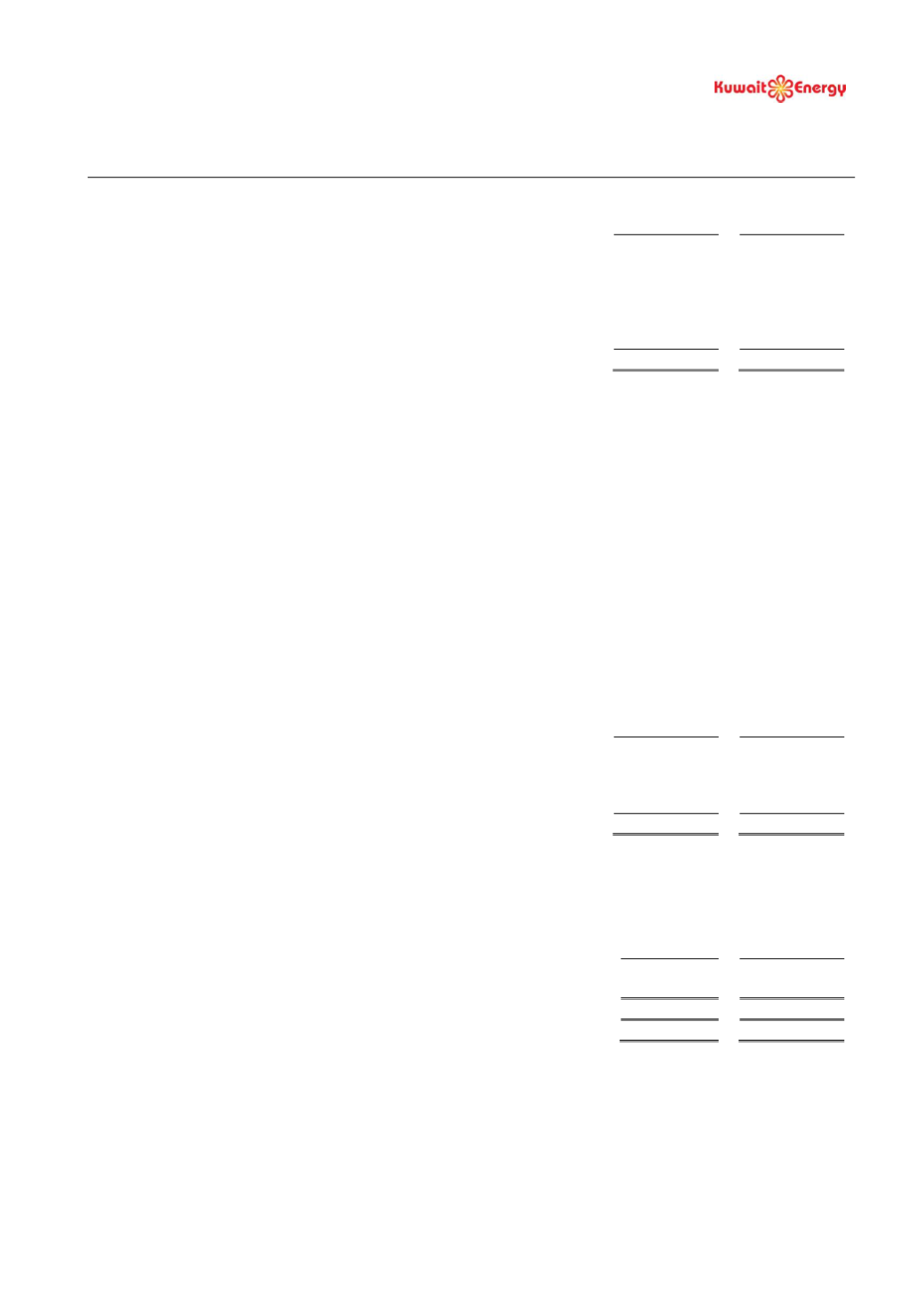

TRADE AND OTHER PAYABLES

2017

2016

US$ 000’s

US$ 000’s

Trade payables and accruals

108,303

118,514

Advance against farm-out of working interest (note 13)

-

3,500

Joint venture partners payables

2,963

7,568

Accrued interest payable

10,477

10,313

Salaries and bonus payables

2,315

4,473

124,058

144,368

Trade creditors and accruals principally comprise amounts outstanding for trade purchases and ongoing costs. The credit

period for trade purchases ranges between 30 and 150 days. No interest is charged on the overdue trade payables. The

Group has financial risk management policies in place to ensure that all payables are paid within the pre-agreed credit

terms.

The directors consider that the carrying amount of trade payables approximates to their fair value due to their short

term nature

.

27.

CRUDE OIL PREPAYMENT

In December 2016, the Group signed an agreement for a secured crude oil prepayment facility of up to US$ 100 million

(the “Prepayment Agreement”), repayable principally by the delivery of the Group’s crude oil entitlement from Block 9,

Iraq. As of 31 December 2017, the Group had drawn-down US$ 80 million (2016; US$ 40 million) from the facility

classified as a short-term prepayment. Under the terms of the agreement interest is accrued and settled on semi-

annually basis.

Movement in Crude oil prepayment is as below:

2017

2016

US$ 000’s

US$ 000’s

As at 1 January

40,000

-

Received

40,000

40,000

Settled

(42,531)

-

As at 31 December

37,469

40,000

The agreement stipulates a pricing calculation with reference to the terms of Block 9 export oil sales agreement, and

prepayments are settled through physical deliveries of crude oil.

28.

CONTINGENT LIABILITIES AND CAPITAL COMMITMENTS

2017

2016

US$ 000’s

US$ 000’s

a)

Contingent liabilities - letters of guarantee

-

4,000

b)

Capital commitments

26,015

43,106

c)

Agreement to purchase shares (note 33b)

5,362

6,176

Capital commitments include committed seismic expenditures, exploration and development well drilling as specified

in the exploration and development licenses.