Key Elements of Financial Policy

Source: Company filing.

(1) Farm-out completion subject to pre-emption rights and government approvals. (2) Represents operating cash flow before change in working capital.

Low Cost Operator with Prudent Capital

Structure

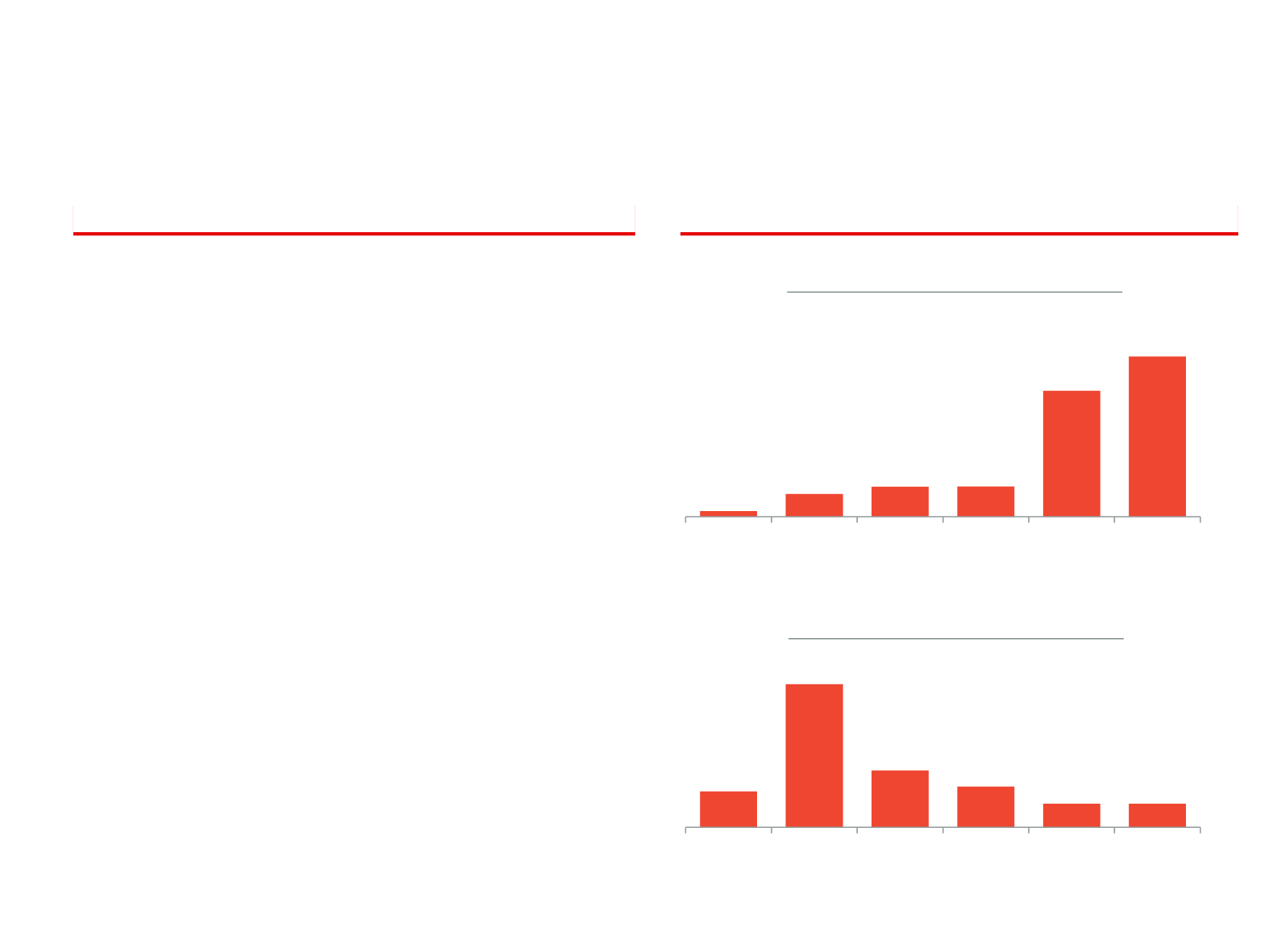

Key Leverage Metrics

OCF

(2)

/ Interest Expense

Net Debt / OCF

(2)

Funding policy aimed at ensuring that sufficient

facilities are available to support business plan

3-year plan and 12-month budgeting process

Active portfolio management to optimise cash flows

Sale of 10% interest in Block 9 in 2015

Sale of 15% revenue WI / 20% cost WI in Siba in

2017

Sale of 25% interest in Abu Sennan in 2016

(1)

Investment opportunities evaluated based on NPV,

investment efficiency and payback period

Targeting primarily operated assets, allowing

control of pace and quantum of spending

No commodity price hedging or borrowings at floating

interest rates

Revenue is typically priced in USD, the

company’s functional

and presentational

currency

Large portion of funded debt carries a fixed

interest rate

25

12.6x

1

28.9x

19.9x

14.2x

8.2x

8.2x

2011 2012 2013 2014 2015 2016

0.1x

0.6x

0.8x

0.8x

3.3x

4.2x

2011 2012 2013 2014 2015 2016