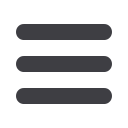

Abraaj

50

12%

QFB

(1)

50

12%

HY Notes

250

60%

Vitol

60

15%

Building Loan

4

1%

Capital Structure and Debt Profile

Debt Outstanding as at March 2017

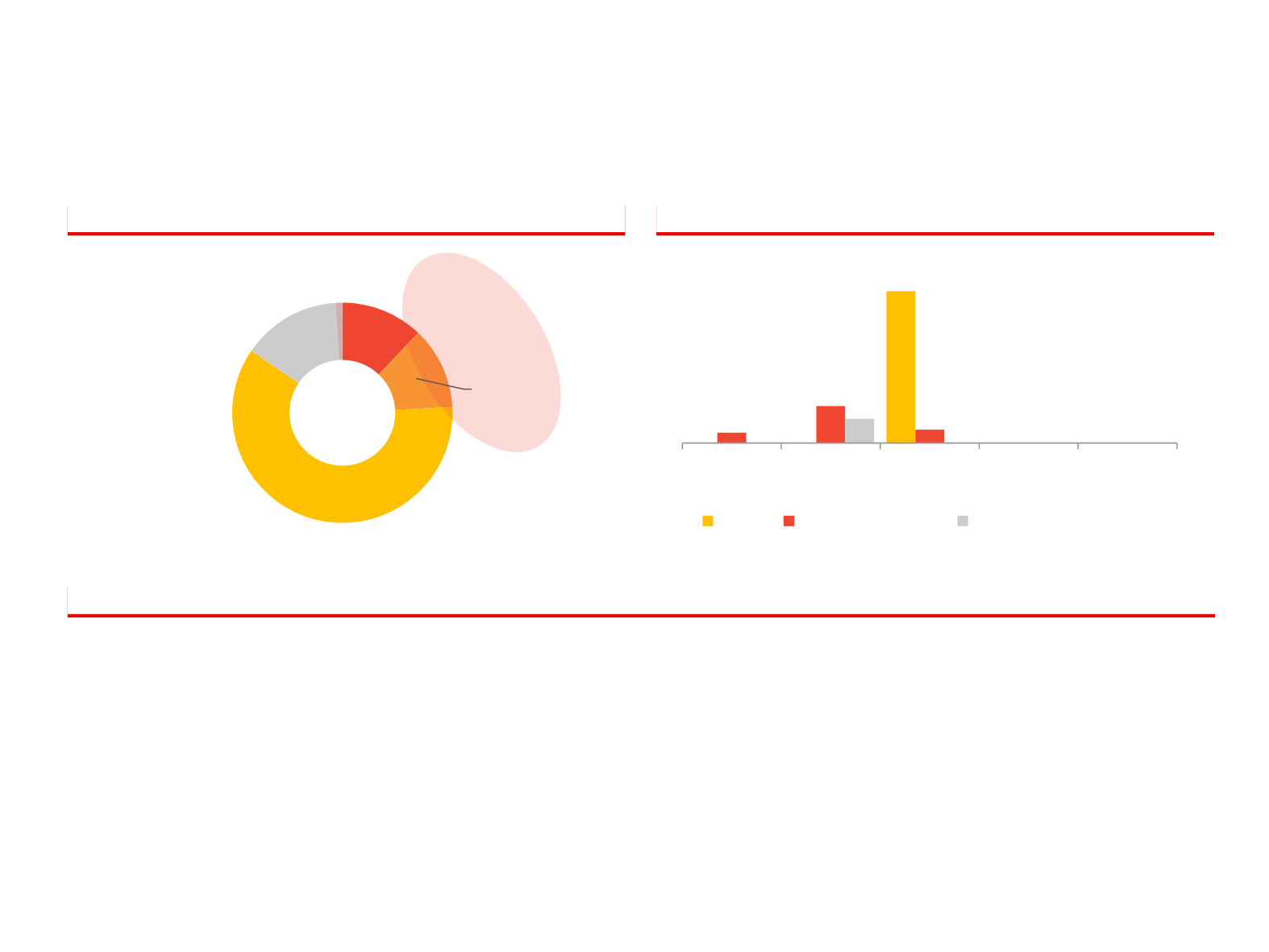

Debt Maturities for Existing Facilities ($m)

Credit Facilities Update

$394m

250

17

61

22

40

2017

2018

2019

2020

2021

Bond Convertible Debt

Vitol prepayment facility

Convertible

Debt

Bond

Agreement signed with Vitol in December 2016 for a pre-payment facility of up to $100m

$40m was drawn down in December 2016

Further $20m drawn down in May 2017

$250m bond issued in August 2014 at 9.5% coupon rate, maturing in 2019

$50m Abraaj and $50m QBF convertible loans

Source: Company filing, loan agreements.

(1) Agreement reached with QBF to convert debt into equity

26