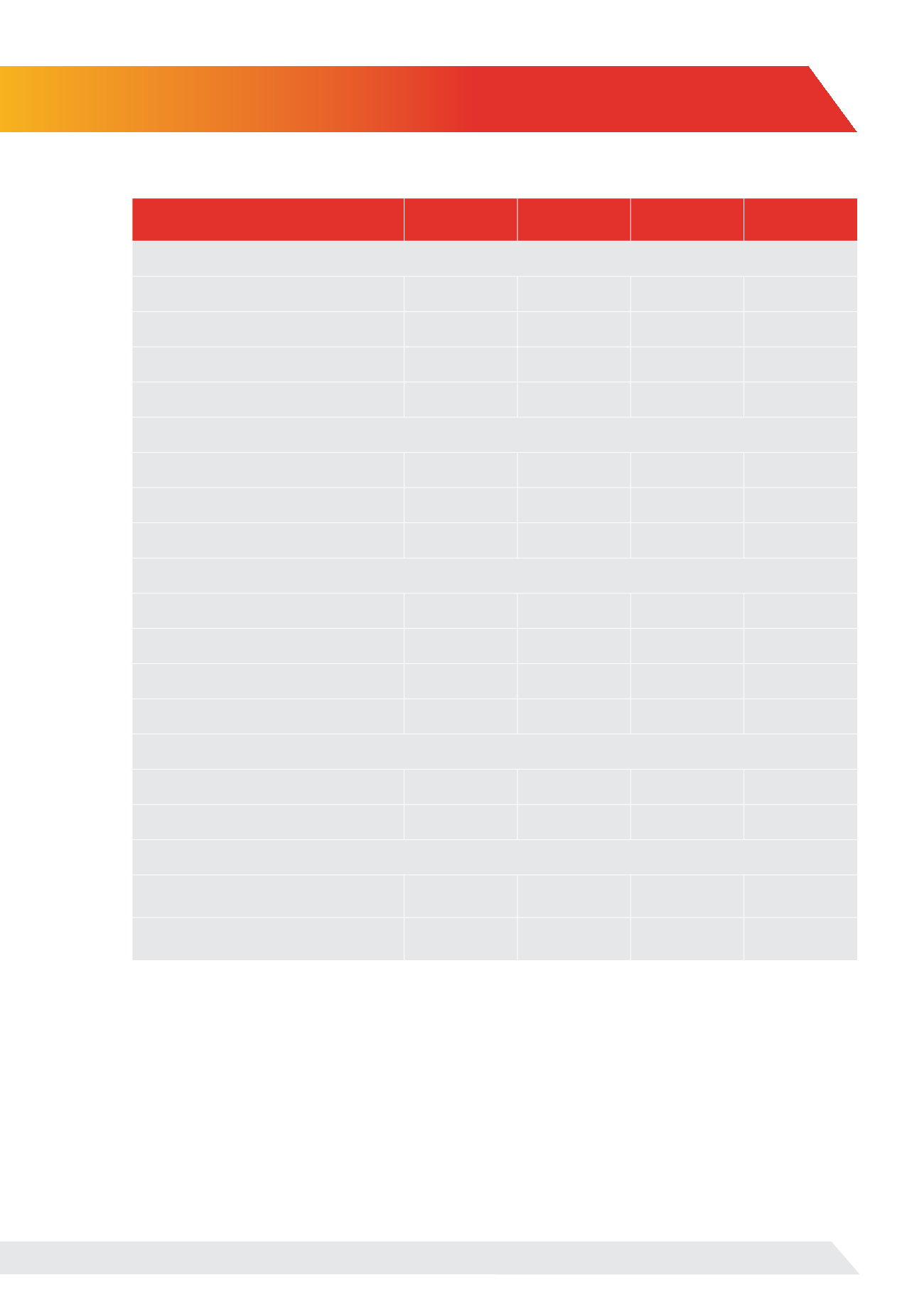

Financial And Operations Highlights

Units

2014

2015

Change

Percentage

Financial Performance

Sales revenue

US$ million

270.8

155.6

-43%

Cost of sales

US$ million

140.5

129.1

-8%

Operating cash flow

US$ million

182.1

79.0

-57%

Net profit/(loss)

US$ million

42.7

(62.4)

-246%

Capital Expenditure

Property, Plant & Equipment

US$ million

209.3

239.0

14%

Exploration & Evaluation Assets

(1)

US$ million

56.8

10.8

-81%

Total Capital Expenditures

US$ million

266.1

249.8

-6%

Financial Position

Total Assets

US$ million

935.5

860.4

-8%

Total Debt

US$ million

360.3

368.4

2%

Shareholder Equity

US$ million

407.7

349.3

-14%

Earnings / (loss) per Share

US cents

13.0

(19.1)

-247%

Reserves and Production

Average Daily WI Production

boepd

25,252

25,000

-1%

Proven & Probable WI Reserves

(2)

mmboe

671

818

22%

Total Wells Drilled

Exploration

Number of

wells

6

2

-67%

Development & Appraisal

Number of

wells

48

47

-2%

1. Exploration & Evaluation Assets included Iraq Block 9 in 2014. In 2015 it has moved to Property, Plant & Equipment.

2. Reserves are audited by GCA.

19