In 2015, despite a very low oil price environment, Kuwait Energy has delivered solid revenue and operating cash flow

of US$155.6 million and US$79.0 million respectively while maintaining a strong balance sheet with US$105.3 million

in cash and no 2016 maturities for any of its external debt.

Financial performance – structurally low operating cost environment

Oil sales accounted for 99 per cent of the Group revenue (2014: 100 percent). Realised price of oil was US$49.6 per

barrel compared to Brent oil price average for the year of US$53.9 per barrel.

Kuwait Energy delivered sales revenue of US$155.6 million (2014: US$270.8 million), 43% lower than 2014 mainly due

to the decrease in average realised price of crude oil. Kuwait Energy is a low operating cost per barrel oil independent

due to its on-shore Middle Eastern oil focus. Group’s underlying operating cost per barrel is US$7.8 per barrel (2014:

US$7.3 per barrel). Depletion and amortisation was 17% lower at US$67.8 million (2014: US$81.9 million) mainly due

to lower production in Block 5, Yemen and an increase in reserves in Abu Sennan, Egypt.

In 2015, US$14.2 million was written off due to unsuccessful exploration expenditure on Area A, Egypt and the

relinquishment of Block 82, Yemen.

Due to significantly lower oil prices during 2015 and the projected oil prices for the foreseeable future, an impairment

charge of US$69.0millionwas recognised. This relates to Block 5 in Yemen, Burg El Arab and Abu Sennan areas in Egypt,

Siba andMansuriya in Iraq. Operations in Yemen are currently suspended due to regional unrest. We continue to take

steps to protect our license interest, as described further in note 13 and 14 to the consolidated financial statements.

General and administrative costs were significantly lower at US$18.2 million compared to US$32.7 million as the

Company went through a cost rationalisation process. As a result of the decline in oil prices, which created challenges

for the entire oil industry, Kuwait Energy worked due diligently to manage its costs.

During 2015, the Group completed the assignment of a 10% participating interest in Block 9 exploration,

development and production service contract in Iraq to EGPC, with an effective date of 1 July 2013, resulting in

a profit of US$33.9 million.

Finance costs post capitalisation, fair valuation for convertible debt and exchange losses amounted to US$20.8

million compared to US$23.0 million in 2014.

The above resulted in a net loss after tax of US$62.4 million for 2015 (2014: net profit US$42.7 million).

Cash flows - solid operating cash flow in low oil prices

Kuwait Energy generated an operating cash flow before working capital movements of US$79.0 million in 2015 (2014:

US$182.1 million) with US$105.3 million in cash and cash equivalents as at 31 December 2015 (2014: US$216.0

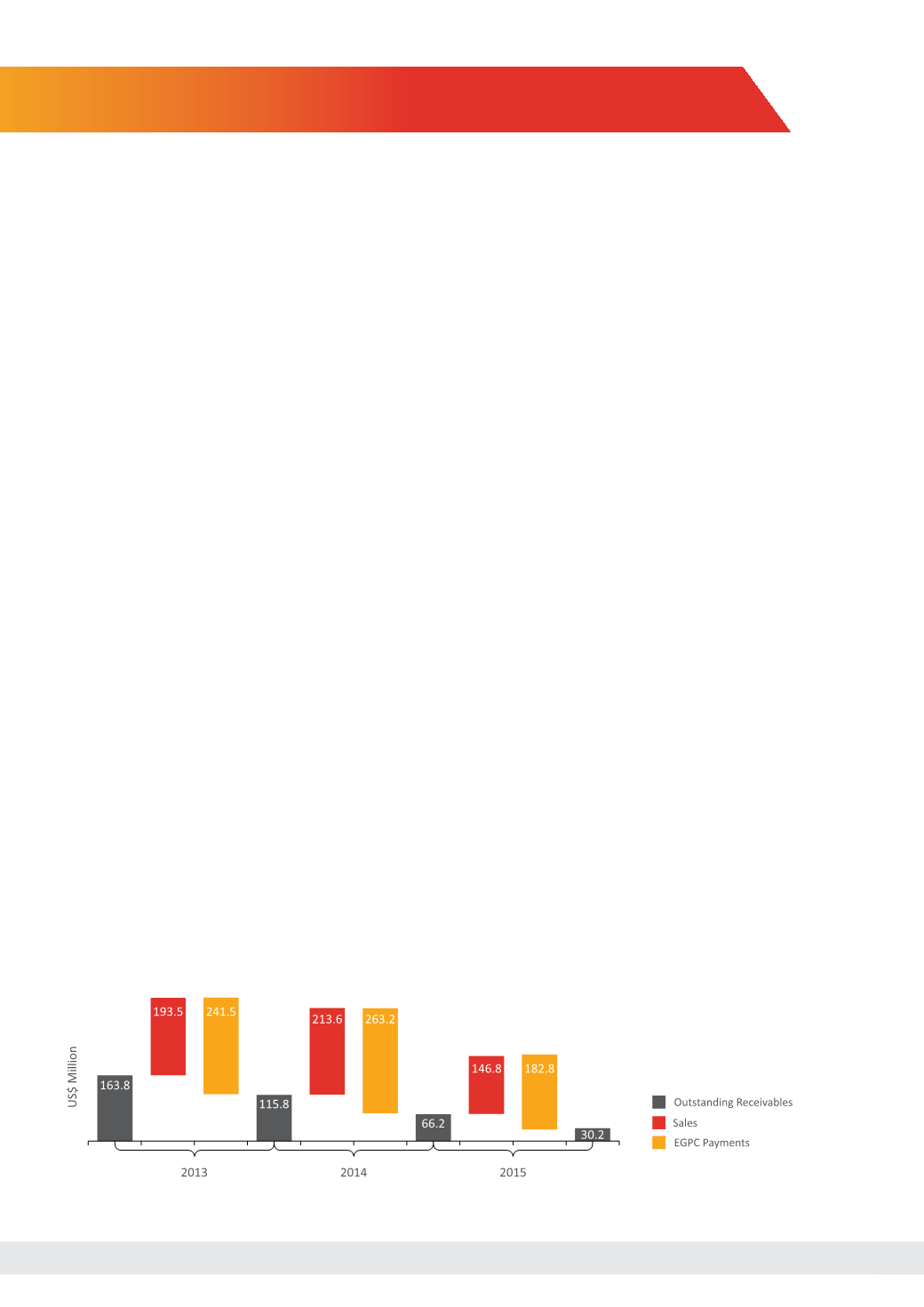

million). Kuwait Energy continued to focus on collecting money owed by its major customer in Egypt, EGPC, as

evidenced by the significant amounts collected during the last three years.

The chart below presents movements in Kuwait Energy’s receivables from EGPC from 2013 to 2015.

Financial Performance

2013 to 2015 EGPC Sales and Receipt

20