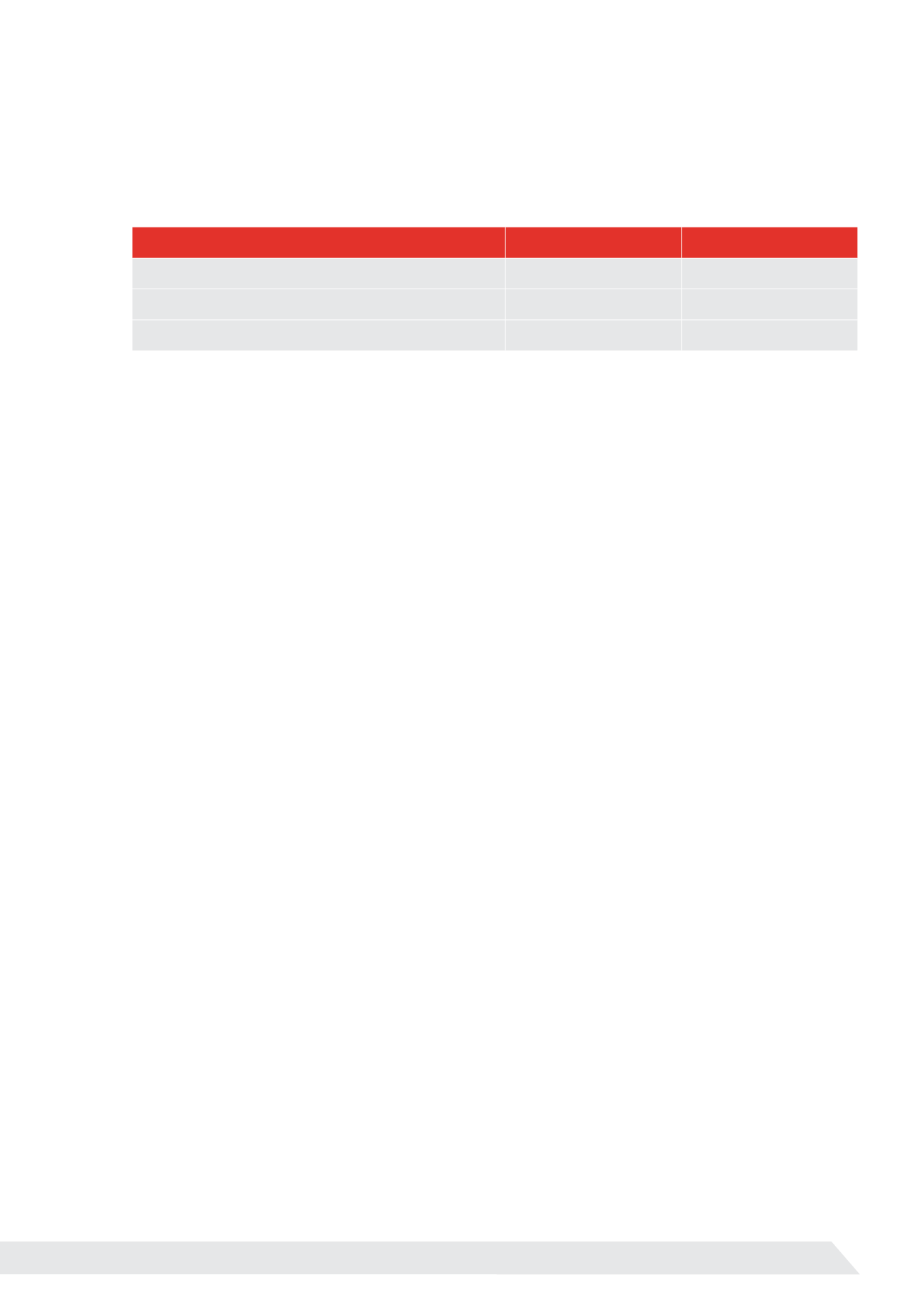

Capital Expenditure – signifcant reduction in exploration

Capex

2014 US$ million

2015 US$ million

Development and production

209.3

239.0

Exploration

56.8

10.8

Total Capex

266.1

249.8

Note

: Exploration & Evaluation Assets included Iraq Block 9 in 2014. In 2015 it has moved to Property, Plant & Equipment.

During 2015, the Company incurred US$239.0 million on development and production capital costs mainly on

development of Siba and Block 9 in Iraq and production wells and facilities in Abu Sennan, Burg El Arab, ERQ and

Area A in Egypt.

Exploration expenditure of US$10.8 million of was incurred mainly on Abu Sennan, Egypt.

Liquidity risk management

The Group closely monitors and manages its liquidity risk. Cash forecasts are regularly produced and sensitivities run

for different scenarios including, but not limited to, changes in oil prices, different production rates from the Group’s

producing assets and delays to development projects. In addition to the Group’s operating cash flows, portfolio

management opportunities are reviewed to potentially enhance the financial capability and flexibility of the Group.

In the current low oil price environment, the Group has taken appropriate action to reduce its cost base (both

quantum and timing of payments) and had US$105.3 million in cash at the end of 2015.

The Group has significant levels of committed capital expenditure during the next 12 months primarily on field

development expenditures in Iraq. The Group has received a letter of conditional approval from EGPC confirming

their executive approval of EGPC’s acquisition of a 20% paying (15% revenue) interest in one of the Group’s key

oil & gas fields conditional on obtaining the approval of the EGPC board of directors and concerned authorities

and finalizing the related farm-out agreement. Under the terms of the proposed farm-out agreement, EGPC will

settle the consideration owed for the farm-out by paying the Group’s share of costs of a major related contract with

any balance being payable from cost recovery allocation received when the production commences from this field.

This agreement, which is also subject to a pre-emption process once finalised, will materially reduce the Group’s

contractual payment commitments during 2016 and 2017.

Therefore, after making enquiries and on the assumption the farm-out outlined above proceeds to completion,

the Directors have a reasonable expectation the Group will have adequate resources to continue in operational

existence for the foreseeable future, being at least the next 12 months from the date of approval of the 2015 financial

statements. Accordingly, the Directors continue to adopt the going concern basis of accounting in preparing these

consolidated financial statements.

21