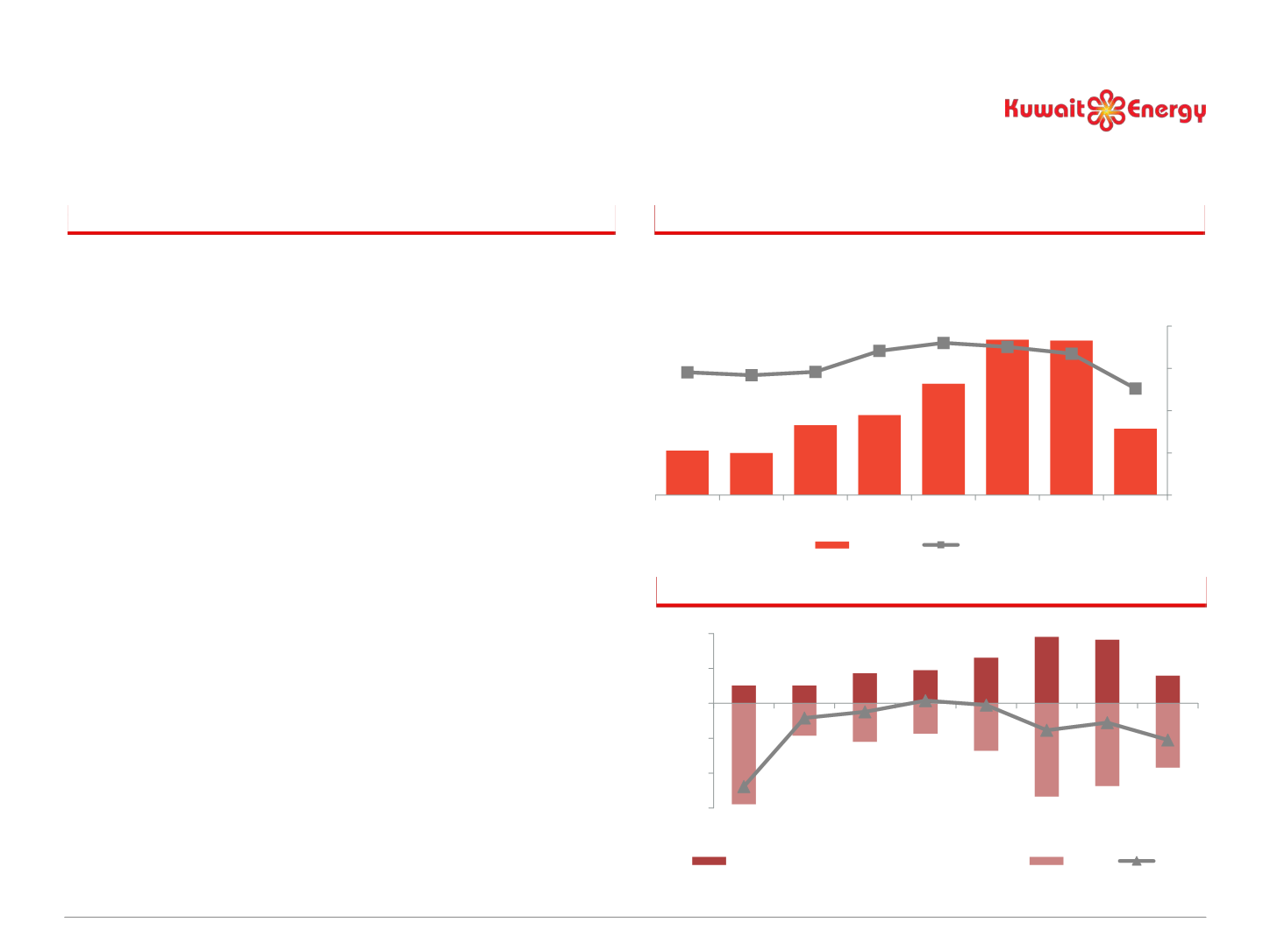

53

50

83

95

132

184 183

79

0%

20%

40%

60%

80%

2008 2009 2010 2011 2012 2013 2014 2015

EBITDA

EBITDA Margin

Strong Financial Position Supported by

Solid Cash Flow Generation

Solid Financial Position

EBITDA Evolution ($m)

Strong cash balance of $105m at year end 2015 as a result

of increasing production and collection of EGPC

receivables, partly offset by the lower realised product

price

51% EBITDA margin achieved in 2015 in a decreasing crude

oil price environment

Future revenues largely independent from oil price

movements due to fiscal structure of existing licensing

agreements

Significant remaining debt headroom and minimum work

commitments satisfied across entire license portfolio

Supportive shareholders contributed to injecting over

$1.25bn equity since company inception in 2005

43

(238)

(42)

(24)

8

(5)

(77)

(55)

(105)

-300

-200

-100

0

100

200

2008 2009 2010 2011 2012 2013 2014 2015

OCF (before working capital adjustments)

Capex

FCF

Free Cash Flow Evolution ($m)