Prudent Financial Policy and Risk

Management

Kuwait Energy’s funding policy is targeted at ensuring

that sufficient facilities are available from diverse

funding sources to facilitate execution of business plan

New capital investment projects are evaluated on the

basis of NPV, investment efficiency and payback period

Kuwait Energy maintains a life of field, 3 year plan,

detailed 12 month budgeting, allowing the company to

tailor development capex to cash availability on regular

basis

No commodity price, interest rate or Forex hedging

Sales and majority of expenses are in US$,

hence limited forex exposure

Major portion of funded debt constitutes fixed

interest rate indebtedness

Key Elements of Financial Policy

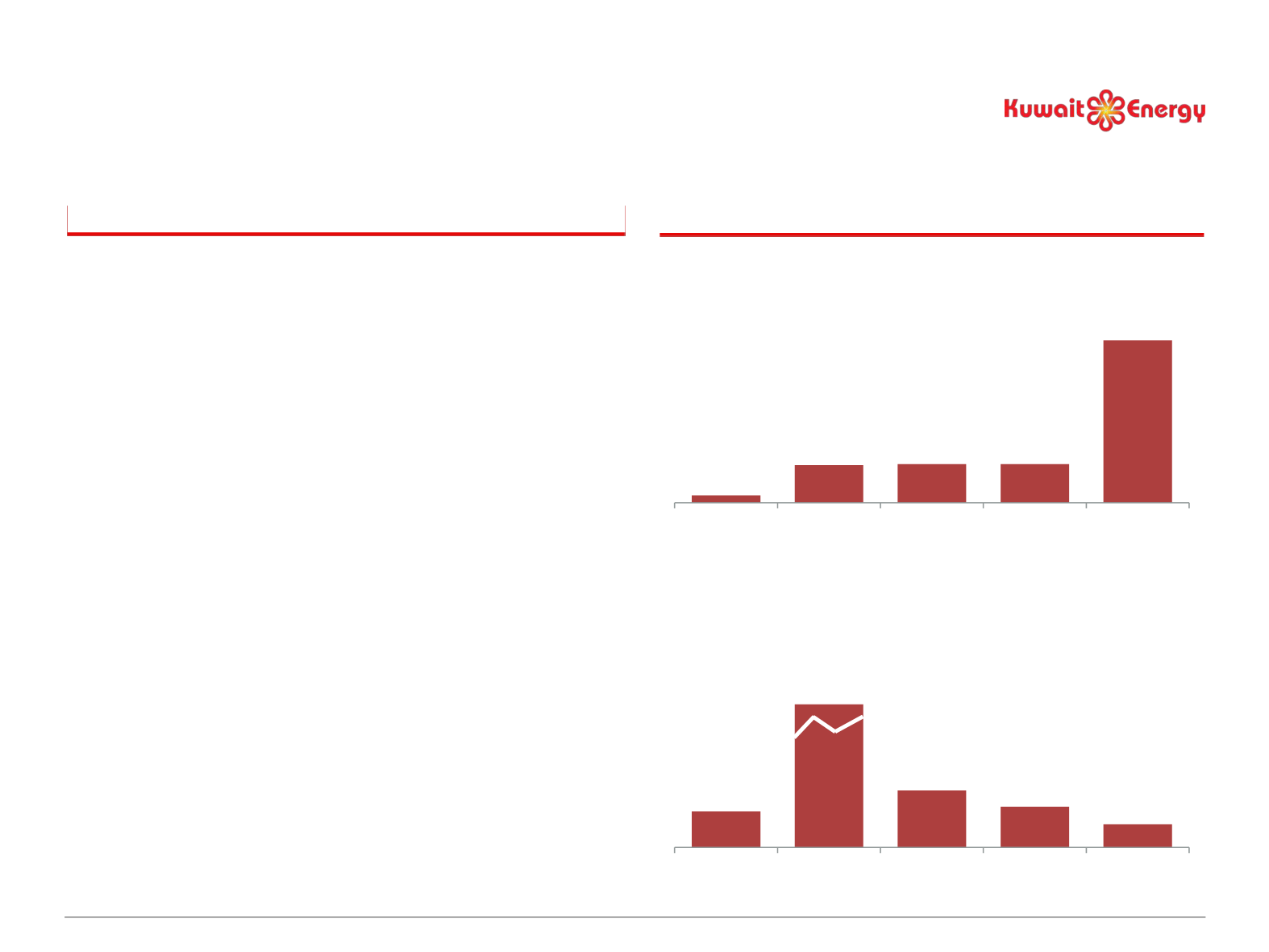

12.6x

128.9x

19.9x

14.2x

8.1x

2011

2012

2013

2014

2015

0.1x

0.8x

0.8x

0.8x

3.3x

2011

2012

2013

2014

2015

OCF

(1)

/ Interest Expense

Net Debt / OCF

(1)

(1) Operating cash flow before working capital adjustments.

Key Leverage Metrics

45