KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2014

44

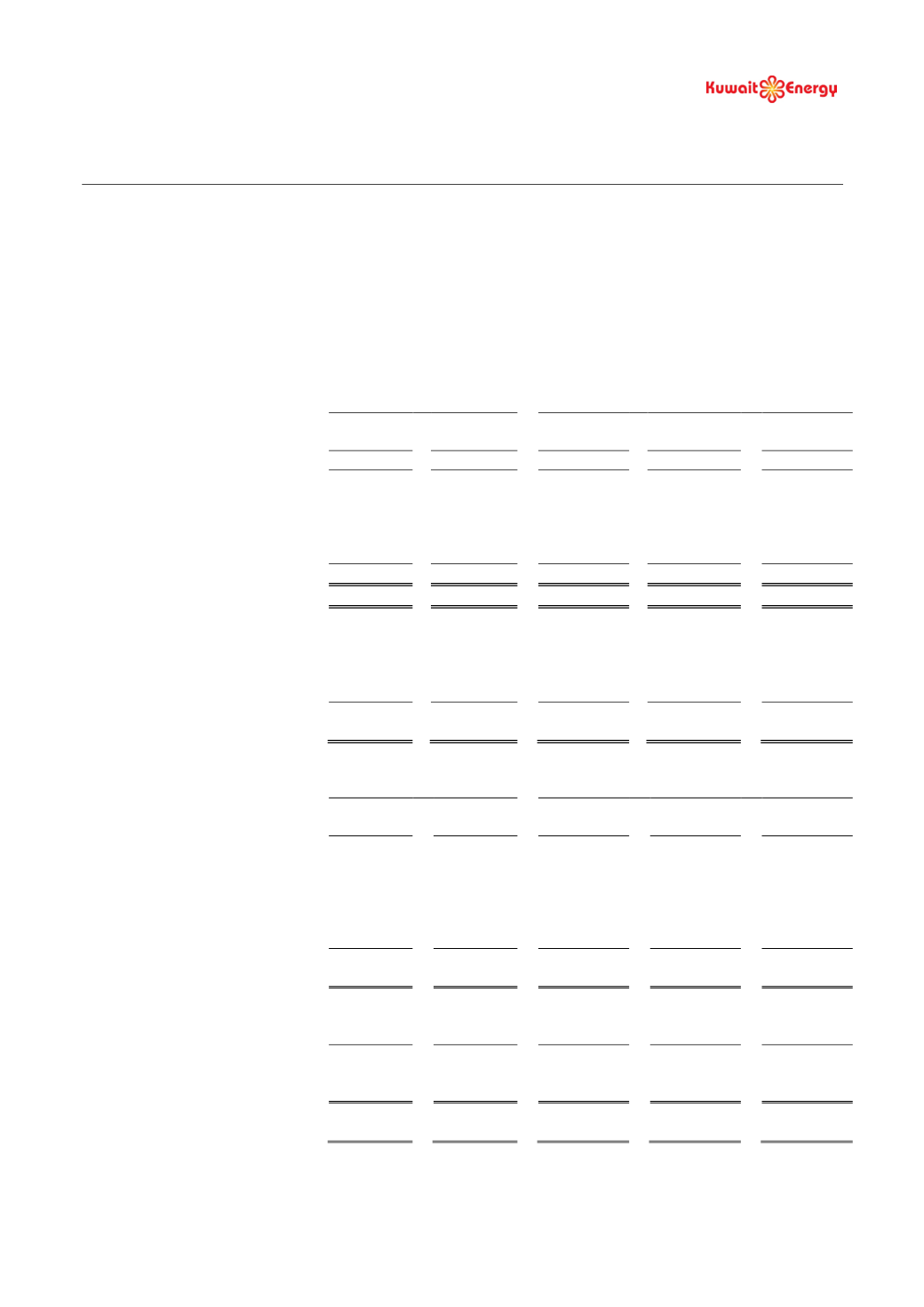

18.

INVESTMENT IN JOINT VENTURE

The Group owns a 20% equity interest in Medco L.L.C. (“Medco”), a jointly controlled entity incorporated in Oman,

engaged as operator for Karim Small fields in Oman. In accordance with IFRS 11, the Group has determined its

interest in Medco to be a joint venture and accordingly accounts for it using the equity accounting method (see note

2).

Summarised financial statement information (100%) of Medco, based on its IFRS financial statements adjusted to

bring the accounting policies of Medco in line with those of the Group, and reconciliation with the carrying amount of

the investment in the Group’s consolidated financial statements are set out below:

As at 30 June

As at 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

Audited

Audited

Audited

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

Cash and bank balances

8,845

12,236

19,849

8,089

8,580

Other current assets

27,062

27,019

32,087

30,919

30,509

Non-current assets

7,197

10,334

8,672

11,997

15,321

Current liabilities

(15,901)

(15,944)

(24,227)

(25,171)

(19,346)

Non-current liabilities

(376)

(643)

(295)

(357)

(352)

Equity

26,827

33,002

36,086

25,477

34,712

Group’s equity interest in Medco

20%

20%

20%

20%

20%

Proportion of the Group's

ownership interest in Medco

5,365

6,600

7,217

5,095

6,942

Adjustments made to bring the

accounting policies of Medco in

line with those of the Group

4,304

3,183

3,381

3,960

4,061

Carrying amount of the Group’s

interest in Medco

9,669

9,783

10,598

9,055

11,003

For the six months

period ended 30 June

For the year ended 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

Audited

Audited

Audited

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

Revenue

51,165

49,503

109,490

103,035

100,148

Amortization

1,662

1,662

3,325

3,325

3,325

Taxation charges

1,113

1,016

1,452

2,139

1,051

Profit and total comprehensive

income for the period/year

8,242

7,526

10,610

15,764

7,788

Group’s share of profit for the

period/year

1,648

1,505

2,122

3,153

1,558

Adjustments made to bring the

accounting policies of Medco in

line with those of the Group

923

(777)

(579)

(101)

(439)

Share of results from joint venture

recognised in consolidated

income statement

2,571

728

1,543

3,052

1,119

Dividend received from the joint

venture during the period/year

3,500

-

-

5,000

-