KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2014

41

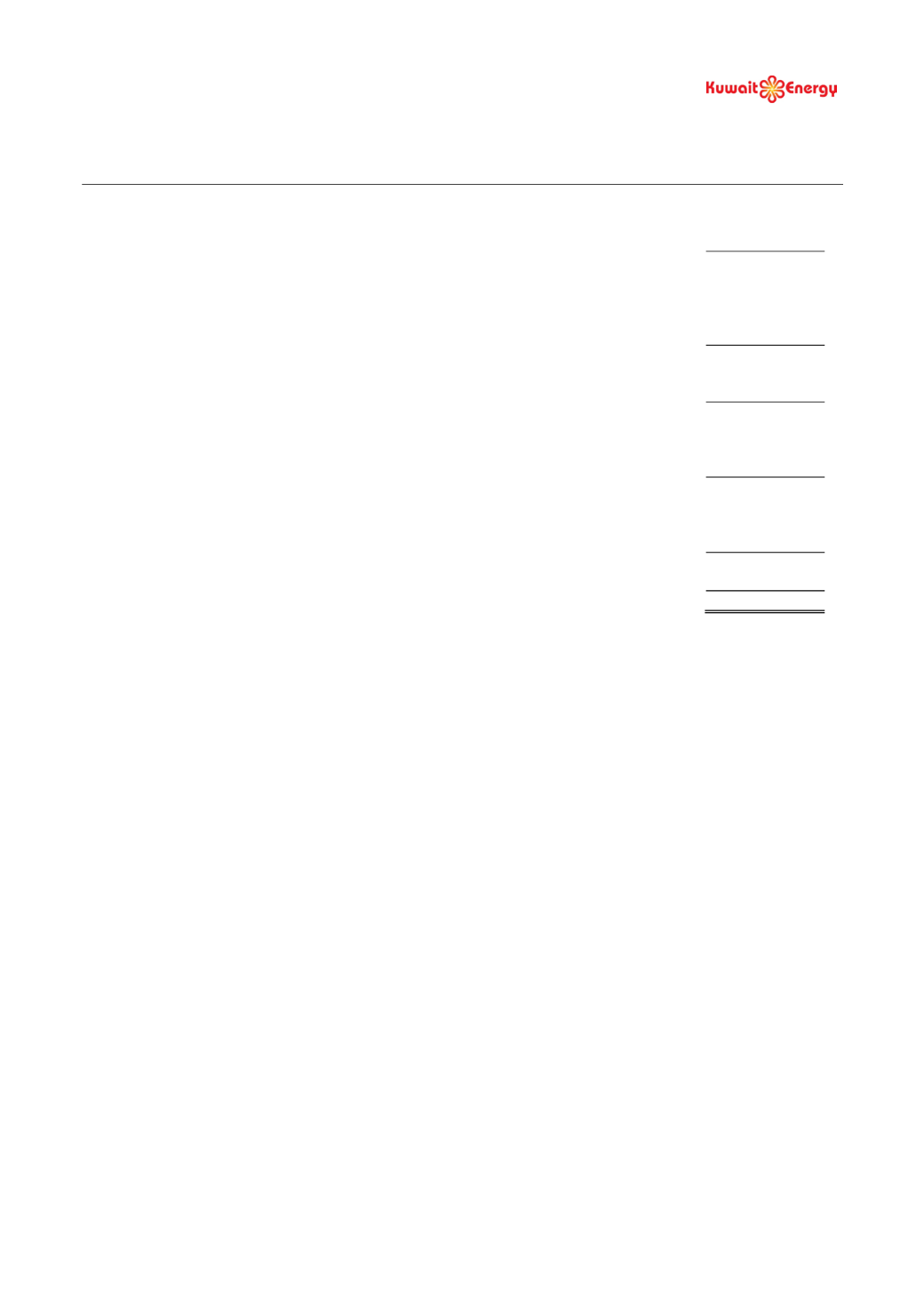

16.

INTANGIBLE EXPLORATION AND EVALUATION (‘E&E’) ASSETS

E&E assets

(Restated)

Cost

USD 000’s

As at 1 January 2011

228,636

Additions

36,273

Exploration expenditure written off

(18,053)

Transfer to Property, plant and equipment

(115,675)

As at 31 December 2011

131,181

Additions

37,447

Exploration expenditure written off

(14,304)

As at 31 December 2012

154,324

Additions

49,685

Exploration expenditure written off in relation to discontinued operations (see note 13)

(11,121)

Other exploration expenditure written off

(43,852)

As at 30 June 2013

149,036

Additions

29,243

Exploration expenditure written off in relation to discontinued operations (see note 13)

(7,501)

Other exploration expenditure written off

(29,403)

As at 31 December 2013

141,375

Additions

34,382

As at 30 June 2014

175,757

6 months ended 30 June 2014

As at 30 June 2014, exploration costs of USD 175,757 thousand (30 June 2013: USD 149,036) were capitalised

pending further evaluation of whether or not the related oil and gas properties are commercially viable.

12 months ended 31 December 2013

As at 31 December 2013, exploration costs of USD 141,375 thousand were capitalised pending further evaluation of

whether or not the related oil and gas properties are commercially viable. Exploration expenditure written off of USD

73,255 thousand includes USD 29,181 thousand relating to Licence 1 in Latvia where, due to unsuccessful

exploration well results, the Group has decided to exit the country. Further the Company has written off exploration

expenditure amounting to USD 16,856 thousand related to Abu Sennan, Area A and B6 fields in Egypt, USD 11,204

thousand related to block 83 in Yemen, USD 14,919 thousand in Pakistan Jherruk and Kunri fields and USD 1,095

thousand in Somalia due to unsuccessful exploration well results.

Of the total write off outlined above, USD 43,852 thousand was recorded in the first six months of the year, which

includes USD 29,133 thousand relating to Licence 1 in Latvia where, due to unsuccessful exploration well results, the

Group has decided to exit the country. Further in the first six months of the year, the Company has written off

exploration expenditure amounting to USD 14,719 thousand related to Area A and Abu Sennan fields in Egypt due to

unsuccessful exploration well results.

12 months ended 31 December 2012

As at 31 December 2012, exploration costs of USD 154,324 thousand were capitalised pending further evaluation of

whether or not the related oil and gas properties are commercially viable. Exploration expenditure written off of

USD 14,304 thousand includes USD 9,136 thousand relates to block 74 in Yemen, where the licence was surrendered

during the year due to unsuccessful exploration well results. Further the Company has written off exploration

expenditure amounting to USD 5,168 thousand related to Abu Sennan, Area A and block 6 fields in Egypt due to

unsuccessful exploration well results.

12 months ended 31 December 2011

As at 31 December 2011, exploration costs of USD 131,181 thousand were capitalised pending further evaluation of

whether or not the related oil and gas properties are commercially viable. The transfer during the year to property,

plant and equipment reflects assets for which commercial reserves have been discovered during the year. Exploration

expenditure written off of USD 18,053 thousand includes USD 14,594 thousand related to block 15, 35 and 49 fields

in Yemen, USD 3,459 thousand related to East Ras Qattara and Area A fields in Egypt, due to unsuccessful

exploration well results.