KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2014

38

13.

DISCONTINUED OPERATIONS (CONTINUED)

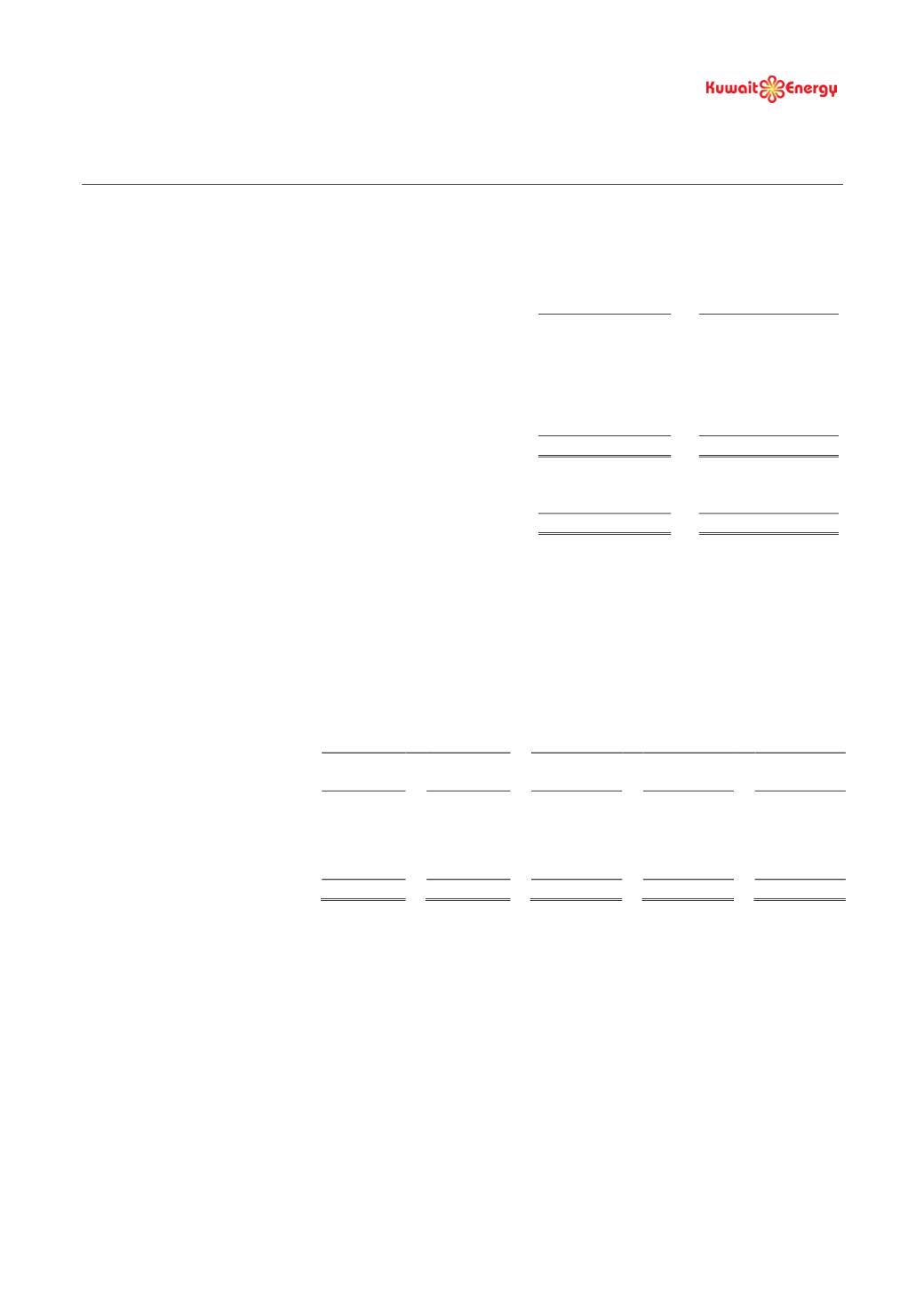

The major classes of assets and liabilities of discontinued operations classified as held for sale are as follows.

Russia

Russia and Ukraine

30 June 2014

31 December 2013

USD 000’s

USD 000’s

Property, plant and equipment

4,351

32,236

Deferred tax assets

9,994

11,103

Inventories

709

1,094

Trade and other receivables

270

5,900

Cash and bank balances

790

941

Total assets classified as held for sale

16,114

51,274

Trade and other payables

4,590

15,611

Deferred tax liabilities

3,224

20,663

Total liabilities classified as held for sale

7,814

36,274

Net assets of operations classified as held for sale

8,300

15,000

The deferred tax asset shown above primarily arises in Russia, where losses have been incurred in 2011, 2012, 2013

and 2014. Management believes it is appropriate to recognize a deferred tax asset, as based on an independent

assessment of its commercial reserves, it expects to generate taxable profits in future years in Russia.

The cash flows associated with Russia and Ukraine operations classified as held for sale are as follows

For the six months

period ended 30 June

For the year ended 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

Audited

Audited

Audited

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

Operating cash flows

(900)

(891)

(2,440)

(3,634)

4,591

Investing cash flows

5,000

(9,529)

(18,450)

(30,384)

(20,883)

Financing cash flows

-

-

-

-

-

Total cash flows

4,100

(10,420)

(20,890)

(34,018)

(16,292)