KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2014

33

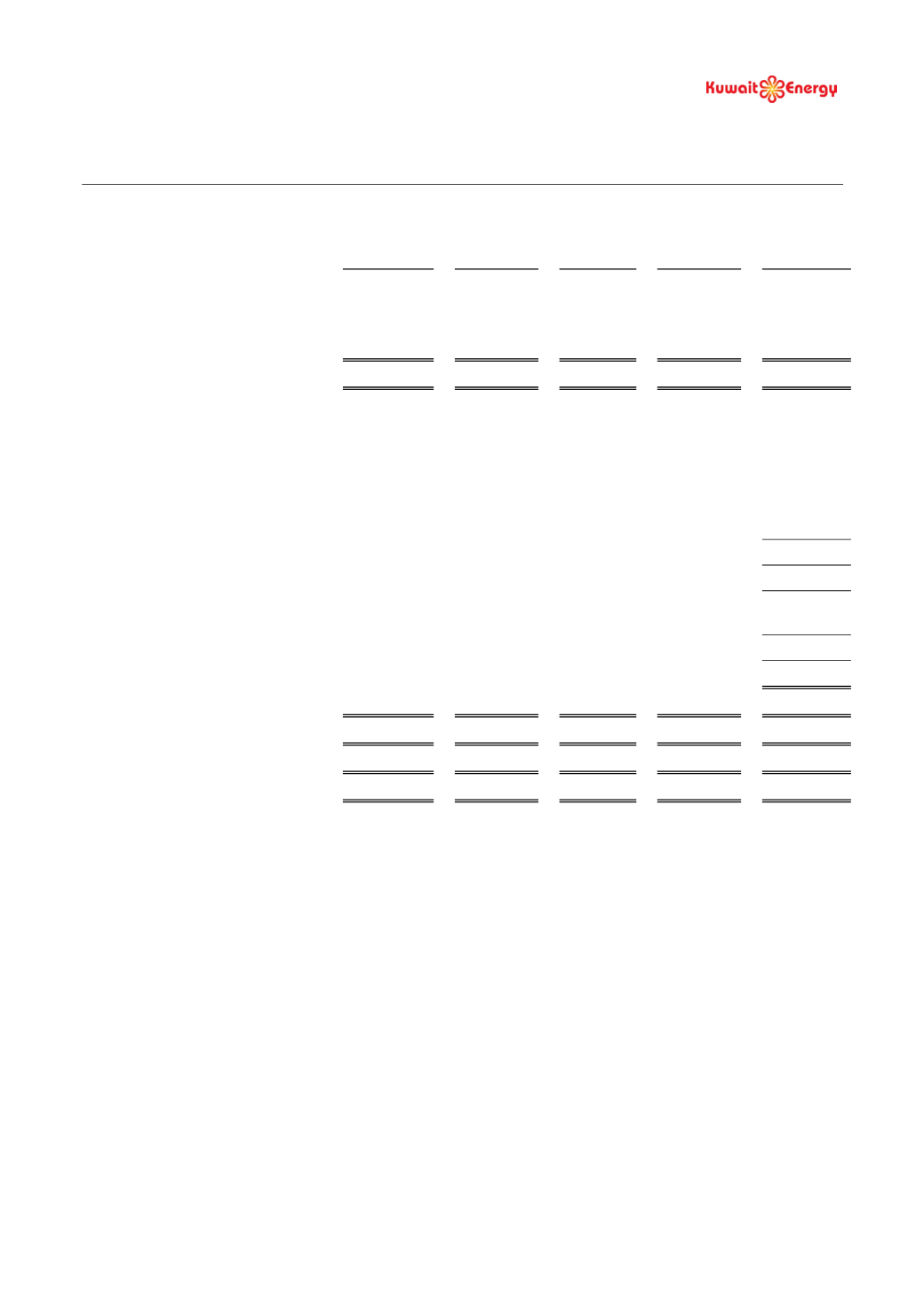

5. SEGMENTAL INFORMATION (CONTINUED)

Egypt

Yemen

Iraq

Others

Total

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

(Restated)

31 December 2011

Segment revenues

120,245

18,273

-

-

138,518

Segment results

71,579

(9,325)

(12,681)

49,573

Share of results of joint venture

-

-

-

1,119

1,119

Gain on held for trading derivative

(75)

Fair value loss on convertible loans

-

Other income

384

Foreign exchange loss

683

Finance costs (net)

(7,508)

Profit before tax

44,176

Taxation

(8,731)

Profit for the year from continuing

operations

35,445

Loss from discontinued operations

(16,960)

Profit for the year

18,485

Segment assets

448,004

28,560

4,646

367,316

848,526

E&E assets

73,867

20,930

-

36,384

131,181

PP&E

207,689

3,585

4,484

256,659

472,417

Segment liabilities

32,780

6,129

1,115

105,815

145,839

Other information

Exploration expenditure written off

3,459

14,594

-

-

18,053

Additions to E&E

24,795

7,627

-

3,851

36,273

Additions to PP&E

46,319

3,025

3,801

40,933

94,078

Depreciation, Depletion and

Amortisation

24,038

2,517

-

1,011

27,566