KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2014

29

5. SEGMENTAL INFORMATION (CONTINUED)

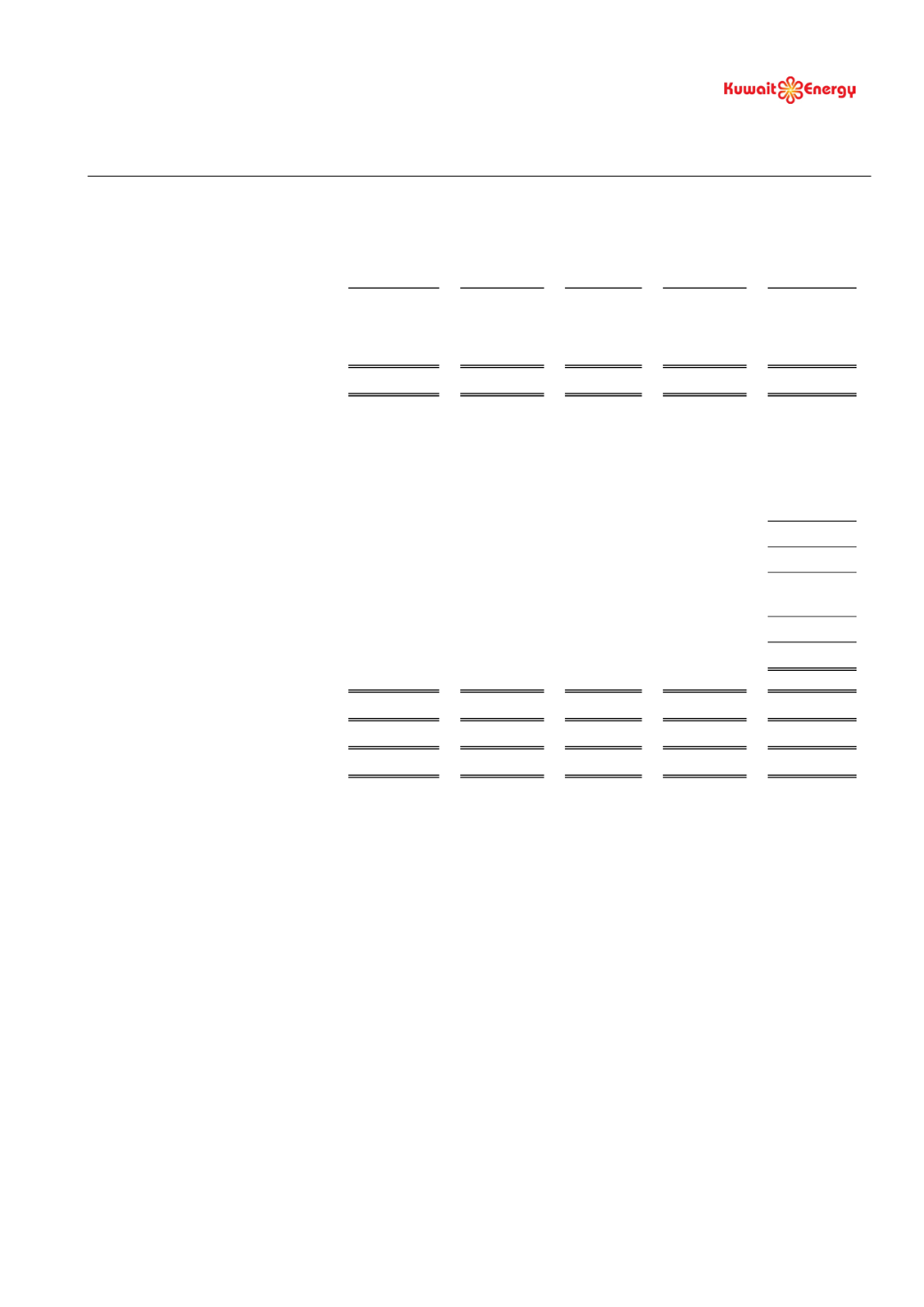

The following is an analysis of the Group’s revenue and results by reportable segments:

Egypt

Yemen

Iraq

Others

Total

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

30 June 2014

Segment revenues

108,888

22,116

-

-

131,004

Segment results

68,007

4,135

-

(8,325)

63,817

Share of results of joint venture

-

-

-

2,571

2,571

Fair value loss on convertible loans

(6,712)

Other income

269

Foreign exchange loss

(41)

Finance costs (net)

(3,552)

Profit before tax

56,352

Taxation

(5,455)

Profit for the period from continuing

operations

50,897

Loss from discontinued operations

(2,600)

Profit for the period

48,297

Segment assets

473,138

150,053

202,932

127,217

953,340

E&E assets

108,214

28,329

39,214

-

175,757

PP&E

185,724

98,408

116,471

3,221

403,824

Segment liabilities

63,392

19,564

69,806

300,769

453,531

Other information

Additions to E&E

13,691

8,805

11,886

-

34,382

Additions to PP&E

29,052

9,895

59,039

510

98,496

Depreciation,

Depletion

and

Amortisation

22,690

15,111

-

683

38,484