KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2014

35

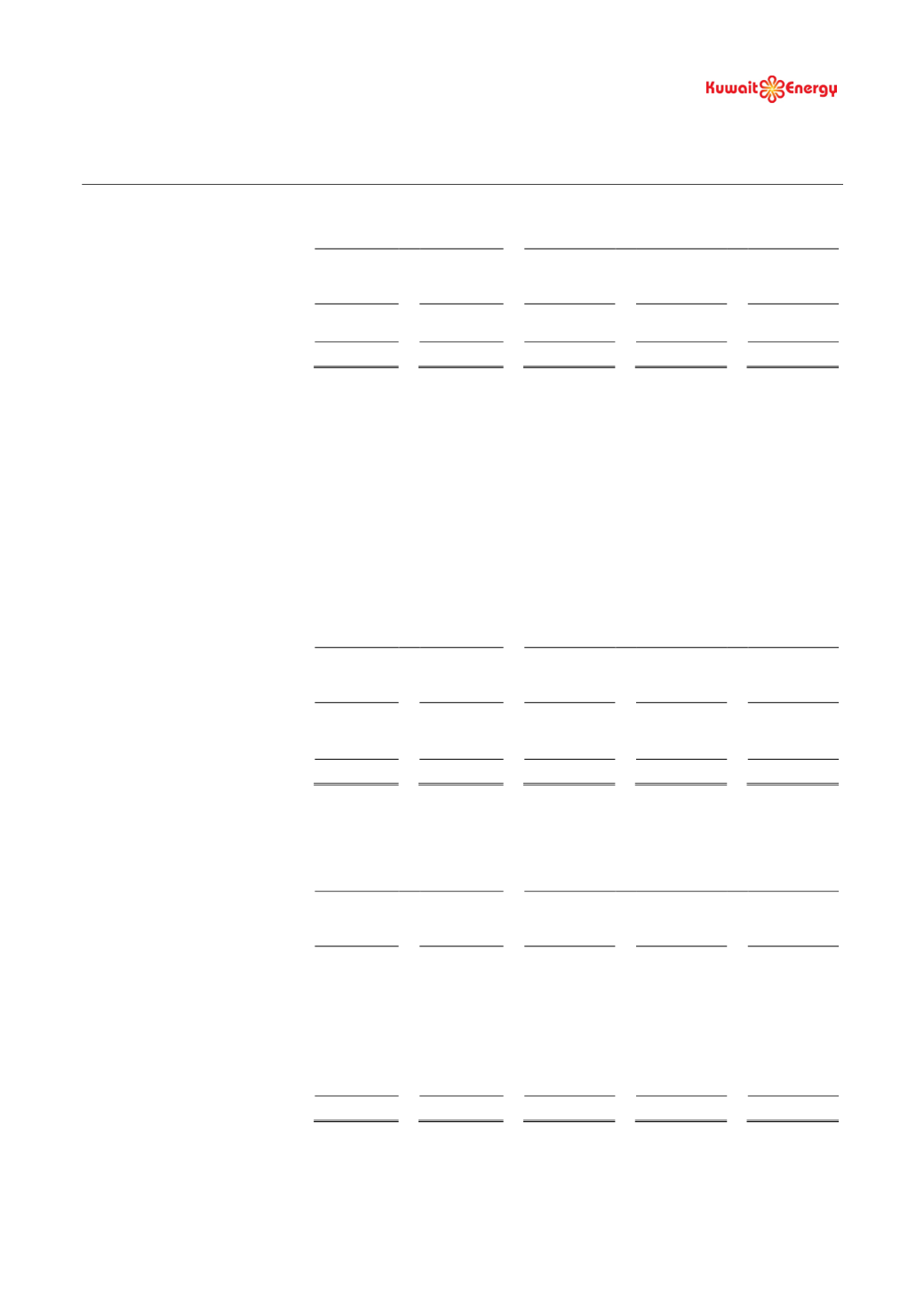

9.

NET IMPAIRMENT LOSS

For the six months

period ended 30 June

For the year ended 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

(Restated)

Audited

(Restated)

Audited

(Restated)

Audited

(Restated)

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

Impairment charges

-

815

1,801

-

-

-

815

1,801

-

-

6 months ended 30 June 2013:

During the period the Company recognised an impairment loss on the block 43 field in Yemen amounting to USD

815 thousand to match the carrying value of the assets to the recoverable value measured on a value in use basis.

12 months ended 31 December 2013:

During the year the Company recognised an impairment loss amounting to USD 1,541 thousand on the block 5 field

in Yemen and USD 260 thousand, net of impairment loss reversal of USD 555 thousand in the second six months of

the year, on the block 43 in Yemen to match the carrying value of the assets to the recoverable value measured on a

value in use basis.

10.

OTHER INCOME

For the six months

period ended 30 June

For the year ended 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

(Restated)

Audited

(Restated)

Audited

(Restated)

Audited

(Restated)

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

Interest income

213

385

528

138

197

Others

56

27

71

85

187

269

412

599

223

384

11.

FINANCE COSTS (NET)

For the six months

period ended 30 June

For the year ended 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

(Restated)

Audited

(Restated)

Audited

(Restated)

Audited

(Restated)

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

Realised hedge loss (see note 28)

-

-

-

-

7,101

Unwinding of decommissioning

provision

101

99

158

121

83

Borrowing costs on bank

overdrafts and loans

6,719

6,421

14,552

3,356

5,464

Less: amount capitalised in cost of

qualifying assets

(3,268)

(1,792)

(4,642)

(2,320)

(5,140)

3,552

4,728

10,068

1,157

7,508