KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2014

30

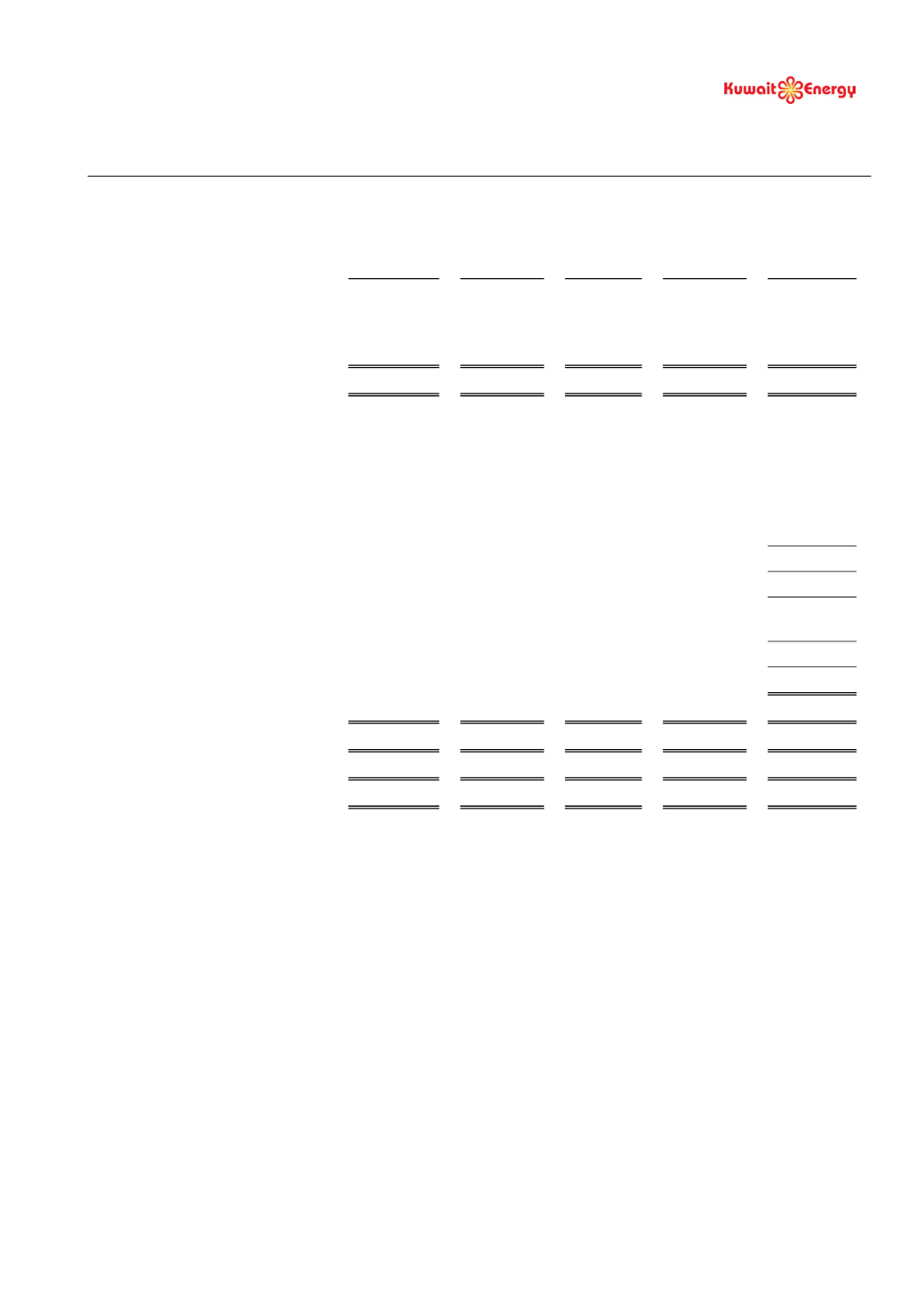

5. SEGMENTAL INFORMATION (CONTINUED)

Egypt

Yemen

Iraq

Others

Total

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

(Restated)

30 June 2013

Segment revenues

85,481

31,621

-

-

117,102

Segment results

33,404

(1,943)

(146)

(37,450)

(6,135)

Share of results of joint venture

-

-

-

728

728

Gain on held for trading derivative

158

Fair value loss on convertible loans

(5,799)

Other income

412

Foreign exchange loss

(3,637)

Finance costs (net)

(4,728)

Loss before tax

(19,001)

Taxation

(3,858)

Loss for the period from continuing

operations

(22,859)

Loss from discontinued operations

(27,681)

Loss for the period

(50,540)

Segment assets

452,475

169,789

60,976

324,820

1,008,060

E&E assets

85,753

24,547

18,003

20,733

149,036

PP&E

180,717

112,731

38,003

247,013

578,464

Segment liabilities

42,199

9,310

8,701

278,840

339,050

Other information

Exploration expenditure written off

14,719

-

-

29,133

43,852

Impairment losses

-

815

-

-

815

Additions to E&E

7,391

3,402

18,003

20,889

49,685

Additions to PP&E

19,771

2,269

14,306

11,211

47,557

Depreciation,

Depletion

and

Amortisation

19,976

21,064

-

851

41,891