KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2014

31

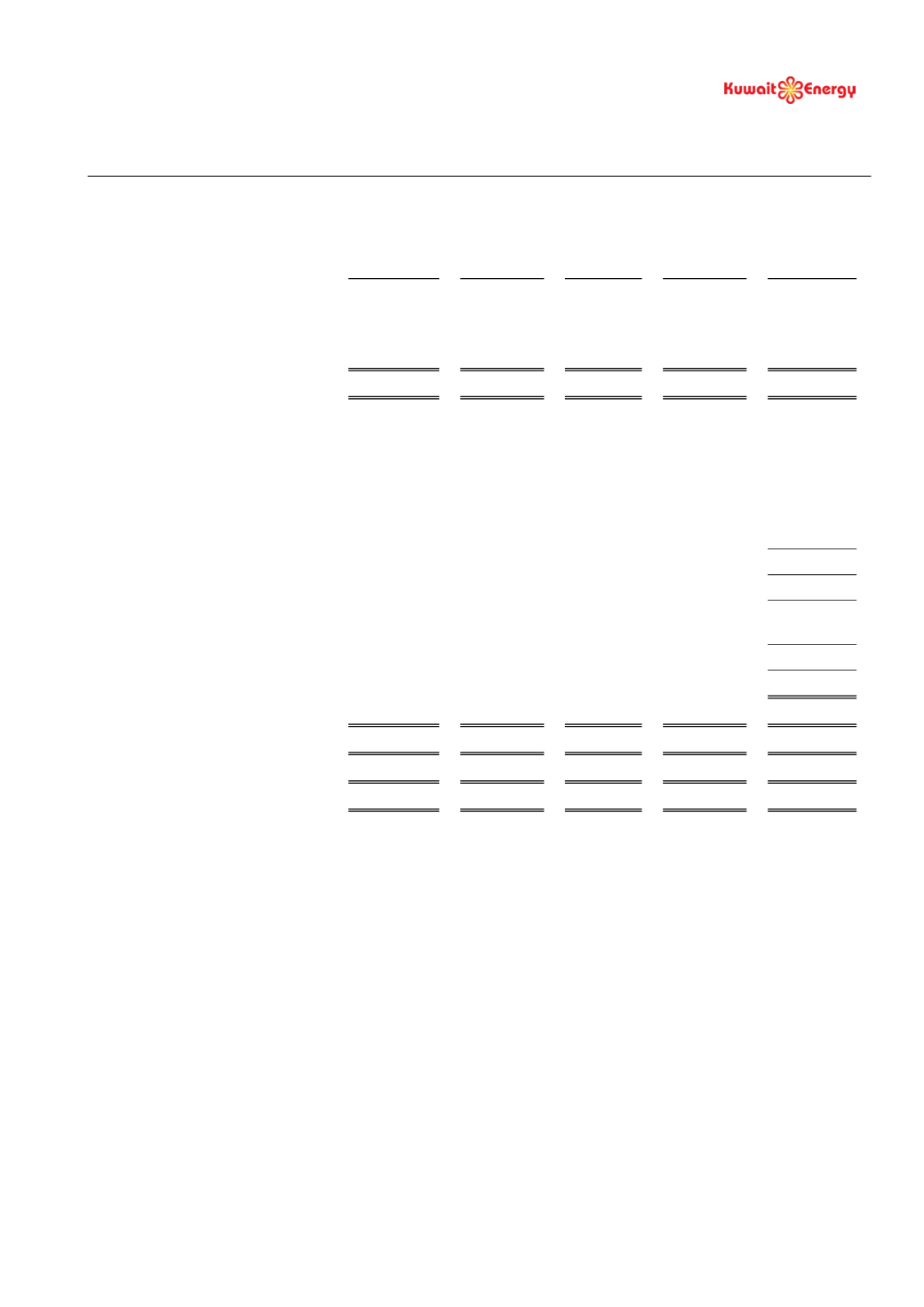

5. SEGMENTAL INFORMATION (CONTINUED)

Egypt

Yemen

Iraq

Others

Total

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

(Restated)

31 December 2013

Segment revenues

193,487

69,007

-

-

262,494

Segment results

98,496

(5,407)

(146)

(63,992)

28,951

Share of results of joint venture

-

-

-

1,543

1,543

Gain on held for trading derivative

322

Fair value loss on convertible loans

(12,071)

Other income

599

Foreign exchange loss

(3,762)

Finance costs (net)

(10,068)

Profit before tax

5,514

Taxation

(8,097)

Profit for the year from continuing

operations

(2,583)

Loss from discontinued operations

(278,787)

Loss for the year

(281,370)

Segment assets

448,554

150,322

94,494

175,740

869,110

E&E assets

94,522

19,524

27,329

-

141,375

PP&E

178,873

103,624

57,411

3,904

343,812

Segment liabilities

45,770

13,523

30,183

331,382

420,858

Other information

Exploration expenditure written off

16,855

11,205

-

45,195

73,255

Impairment losses

-

1,801

-

-

1,801

Additions to E&E

18,297

9,584

27,329

23,718

78,928

Additions to PP&E

39,969

5,822

33,704

21,313

100,808

Depreciation, Depletion and

Amortisation

43,995

34,352

-

1,616

79,963