KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the six months ended 30 June 2014

45

19.

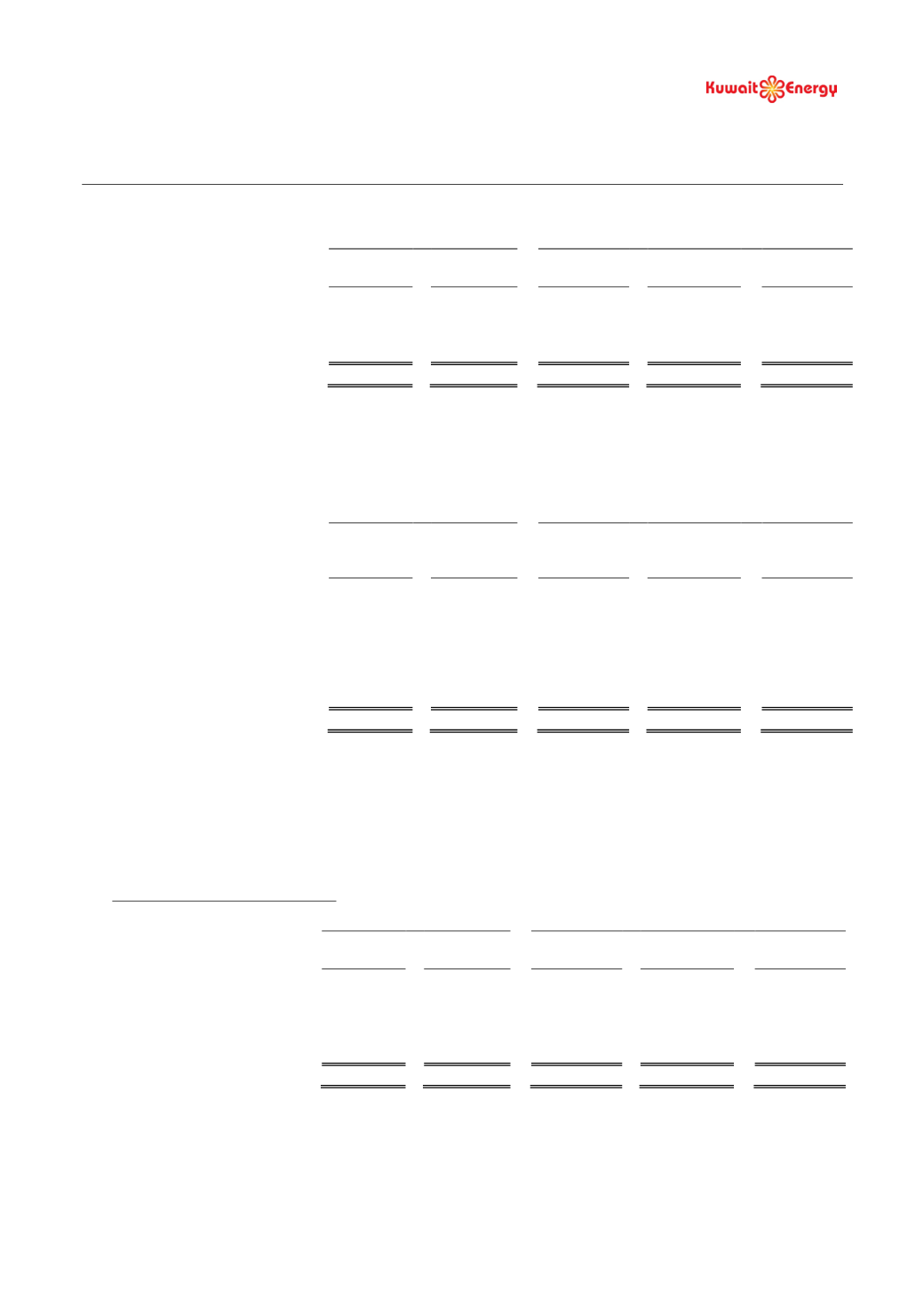

INVENTORIES

As at 30 June

As at 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

Audited

Audited

Audited

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

Crude oil

12,552

8,818

4,656

3,060

2,688

Spare parts, materials and

supplies

20,525

16,290

19,493

16,805

13,552

33,077

25,108

24,149

19,865

16,240

Crude oil is measured at net realisable value. Spare parts, materials and supplies are used in operations and are not held

for re-sale.

20.

TRADE AND OTHER RECEIVABLES

As at 30 June

As at 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

(Restated)

Audited

(Restated)

Audited

(Restated)

Audited

(Restated)

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

Trade receivables

123,085

141,734

124,785

165,540

132,173

Advance to joint ventures

35,991

25,731

17,989

15,230

9,410

Amount due from a related party

1,744

-

-

-

-

Prepayments, deposits and

advances

16,120

10,518

13,458

11,918

6,141

Other receivables

7,149

22,021

7,621

21,148

22,229

184,089

200,004

163,853

213,836

169,953

The average credit period on sales is 60 days. No interest is charged on the overdue trade receivables.

Included in the Group’s trade receivables balance are debtors arising in Egypt which are past due at the reporting date

for which the Group has not provided against as there has not been a significant change in credit quality and the

amounts are still considered recoverable. Further details are provided in the table below. This is a key source of

estimation uncertainty and is discussed in further detail in the “Debtor recoverability” section of note 4.

Ageing of past due but not impaired

As at 30 June

As at 31 December

2014

2013

2013

2012

2011

Audited

Unaudited

Audited

Audited

Audited

USD 000’s USD 000’s

USD 000’s

USD 000’s USD 000’s

61 – 90 days

12,304

11,593

15,858

16,982

9,225

91 – 120 days

-

25,107

-

26,524

20,236

121 – 180 days

13,215

-

-

1,707

24,412

> 180 days

53,791

64,104

73,672

80,014

43,791

Total

79,310

100,804

89,530

125,227

97,664

Amount due from a related party represents the amounts lent to the Chief Operating Officer (COO) of the Group so

that he could meet his obligations under an historical agreement with a third party on behalf of the Group and

purchase a specified number of shares of the Company held by that third party, until such time as the COO is able to

sell the shares and repay the loan to the Company. The Company anticipates that, as and when the COO is required to

purchase shares from the third party, it will purchase them from the COO and hold them as treasury shares.

Subsequent to the period end, the Company obtained shareholder approval to do so in relation to the shares held by

the COO at the period end. Further details are provided in note 30.